- EUR/USD fades Tuesday’s pullback and retests 1.2170.

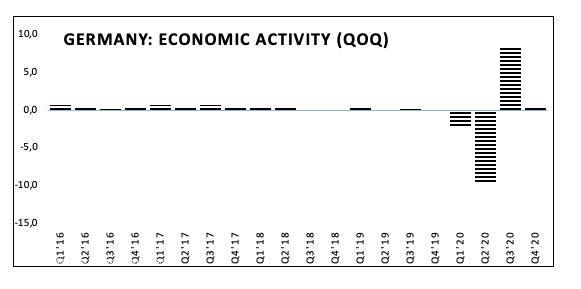

- German Q4 GDP came in at -3.7%, above consensus.

- Chief Powell will testify again before Congress later on Wednesday.

The single currency regains some composure and lifts EUR/USD to the 1.2170 region once again, where it met some decent resistance (once again…).

EUR/USD bid on risk-on mood

EUR/USD quickly leaves behind Tuesday’s small downtick and regains the 1.2170 region, although a break of this area still remains elusive for EUR-bulls.

The positive performance of EUR/USD comes in response to the sour sentiment in the dollar, particularly after Chief Powell reinforced the continuation of the current dovish stance from the Federal Reserve. Powell’s semiannual Monetary Policy Report reiterated that both inflation and the labour market run well below the Fed’s target and support further the view that an interest rate hike is still far away.

In the euro docket, German final GDP figures noted the economy expanded 0.3% QoQ during the October-December period, surpassing initial estimates. Still in the euro area, France’s Business Confidence improved a tad to 97 for the current month, albeit below the 99 expected.

Across the pond, MBA will publish its weekly figures for Mortgage Applications seconded by New Home Sales and the EIA’s weekly report on crude oil inventories.

In addition, Fed’s Powell will once again take centre stage following another testimony, this time before the House Financial Services Committee. Furthermore, FOMC’s L.Brainard (permanent voter, dovish) is due to speak, while Vice Chair R.Clarida (permanent voter, dovish) will speak on “US Monetary Outlook and Monetary Policy”.

What to look for around EUR

EUR/USD manages well to keep business above the 1.2100 mark so far, facing usual resistance near the critical 1.2200 mark. The constructive outlook for the pair, however, is expected to remain unchanged in the longer run, always supported by the reflation/vaccine trade and hopes of a strong recovery in the region. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

Key events in Euroland this week: European Council meeting (Thursday and Friday). ECB’s Lagarde will participate in the G20 meeting of central bank governors and finance ministers on Friday

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention, always on inflation issues. EU Recovery Fund. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is gaining 0.03% at 1.2152 and a breakout of 1.2180 (weekly high Feb.23) would target 1.2189 (weekly high Jan.22) en route to 1.2349 (2021 high Jan.6). On the downside, the next support at 1.2023 (weekly low Feb.17) followed by 1.2008 (100-day SMA) and finally 1.1952 (2021 low Feb.5).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.