- EUR/USD fades Thursday’s pullback and regains 1.1850.

- German, EMU advanced manufacturing PMIs surprised to the upside.

- US flash manufacturing/services PMI next on tap in the calendar.

The single currency regains the smile at the end of the week and pushes EUR/USD back to the mid-1.1800s, or new daily highs.

EUR/USD meets support near 1.1790

Following Thursday’s moderate pullback, EUR/USD resumes the upside on Friday and manages to re-visit the mid-1.1800s in response to better-than-expected flash prints from PMIs.

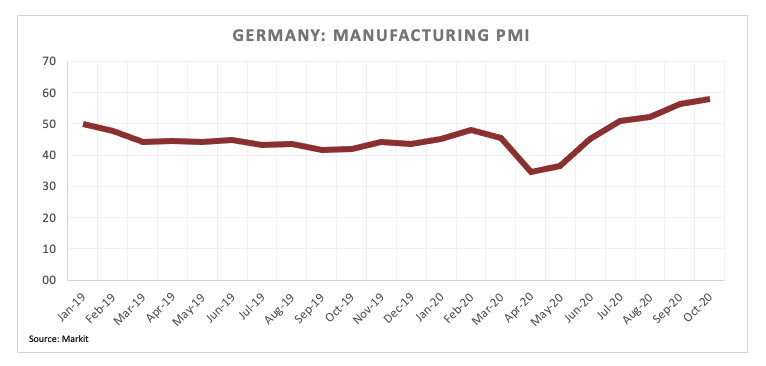

In fact, advanced manufacturing PMIs in Euroland and Germany came in above estimates for the current month at 54.4 and 58.0, respectively, alleviating some concerns over the impact of the second wave of the coronavirus pandemic on the incipient recovery in the region.

On the other hand, the greenback found extra legs after an extra stimulus bill is unlikely to be discussed further before the presidential elections in November, as per latest comments by House Speaker Nancy Pelosi.

In the US docket, Markit will also release its flash manufacturing and services gauges later in the NA session.

What to look for around EUR

EUR/USD fades Thursday’s retracement and regains the positive momentum well above 1.1800 the figure. The outlook on EUR/USD remains positive and bearish moves are deemed as corrective only. Further out, the positive bias in the euro remains underpinned by auspicious results from domestic fundamentals (despite momentum appears somewhat mitigated in several regions), the so far cautious stance from the ECB and the solid position of the EMU’s current account. In addition, the probable “blue wave” following the US elections is deemed as a negative driver for the greenback and carries the potential to lend extra legs to the pair in the longer run.

EUR/USD levels to watch

At the moment, the pair is gaining 0.18% at 1.1839 and a breakout of 1.1880 (monthly high Oct.21) would target 1.1917 (high Sep.10) en route to 1.1965 (monthly high Aug.18). On the flip side, the next support emerges at 1.1688 (monthly low Oct.15) followed by 1.1612 (monthly low Sep.25) and finally 1.1495 (monthly high Mar.9).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.