- EUR/USD met decent support in the 1.0730/25 band.

- German IFO survey surprised to the upside in April.

- Eurogroup will meet again in early May after Thursday’s fiasco.

The single currency remains on the defensive for yet another session at the end of the week, forcing EUR/USD to recede further and clinch weekly lows in the vicinity of 1.0720.

EUR/USD offered on dollar buying, poor data

EUR/USD has been posting losses since Monday without being interrupted, coming under extra selling pressure amidst increased dollar buying, safe haven demand and disappointing figures in the domestic calendar.

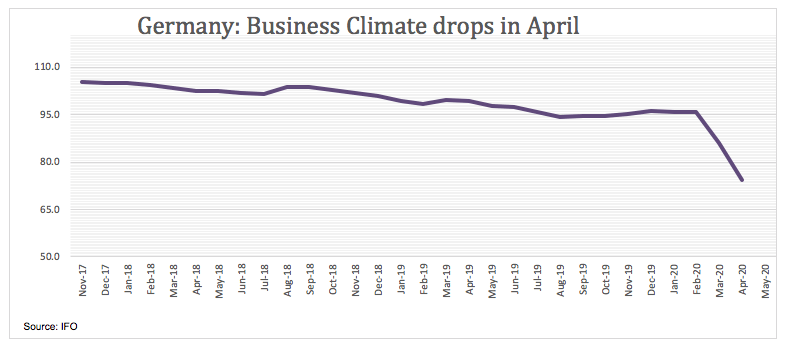

In fact, another drop of suffering fell on the euro on Friday after the German IFO survey came in short of expectations in all of its components for the month of April, adding to Thursday’s negative surprise from PMIs in core Euroland.

Data wise across the pond, Durable Goods Orders for the month of March is coming up next seconded by the final gauge of the Consumer Sentiment for the current month tracked by the U-Mich index.

Adding to the sour atmosphere surrounding the single currency, another fiasco at the Eurogroup meeting showed consensus among EU leaders that further action is much needed to counter the devastating (albeit asymmetrical) impact of the coronavirus in the region, although, once again, no decision has been made on the subject. The leaders will meet again on May 6th.

What to look for around EUR

The euro remains on a bearish note so far this week, always looking to developments from the coronavirus and its impact on the economy and dollar dynamics as the main drivers of both sentiment and price action. On the more macro view, the single currency is expected to remain under scrutiny in the next periods in light of the forecasted contraction in the economy of the region in the first half of the year, relegating hopes of a strong recovery to Q3 and/or Q4.

EUR/USD levels to watch

At the moment, the pair is losing 0.12% at 1.0763 and faces immediate contention at 1.0727 (weekly low Apr.24) followed by 1.0635 (2020 low Mar.23) and finally 1.0569 (monthly low Apr.10 2017). On the upside, a breakout of 1.0814 (78.6% Fibo of the 2017-2018 rally) would target 1.0990 (weekly/monthly high Apr.15) en route to 1.1041 (200-day SMA).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.