- EUR/JPY came within a whisker of November highs at 125.14 and has since reversed sharply back below the 125.00 level.

- The pair still trades with reasonable gains on the day, however, as JPY broadly ends a bad month with a whimper.

EUR/JPY came within 1 pip of matching monthly highs set on 9 November in the immediate aftermath of the Pfizer/BioNtech announcement at 125.14. However, in the build-up to a choppy final 16:00GMT London fixing of the month, the pair sharply reversed and has now dropped back below 125.00 to trade in the 124.60s.

Month-end flows dominate, but economic fundamentals to take over as the week progresses

Difficult to predict month-end flows have been dominant in financial markets today; many banks were suggesting USD selling, which was initially seen before being unwound prior to the 16:00GMT London Fix. Meanwhile, US equities dumped shortly after the open, amid a number of high-profile institutions touting sell signals. The S&P 500 currently trades 0.8% lower on the day, but still holds onto gains of more than 10% on the month.

The euro and yen have also been buffeted by month-end flows. But with this short-lived phenomenon now largely over, focus ought to return to the usual themes driving the two currencies; risk appetite, central banks and economic fundamentals.

In particular, JPY traders will be watching for any hints that US states are moving further into lockdown, something which could support JPY vs its G10 peers including EUR. Moreover, Japanese November manufacturing and services PMIs are released on Tuesday and Thursday respectively, which ought to garner some attention, as should speeches from BoJ’s Amamiya and Suzuki.

Meanwhile, EUR traders very much expect a hefty dose of easing from the ECB on 16 December and will be looking for further confirmation of as much from ECB President Christine Lagarde (speaking on Tuesday) and ECB Chief Economist Lane (speaking on Wednesday). Meanwhile, November Consumer Price Inflation is likely to be very soft and is released on Wednesday, while traders will also be watching Eurozone retail sales on Thursday.

EUR/JPY double top?

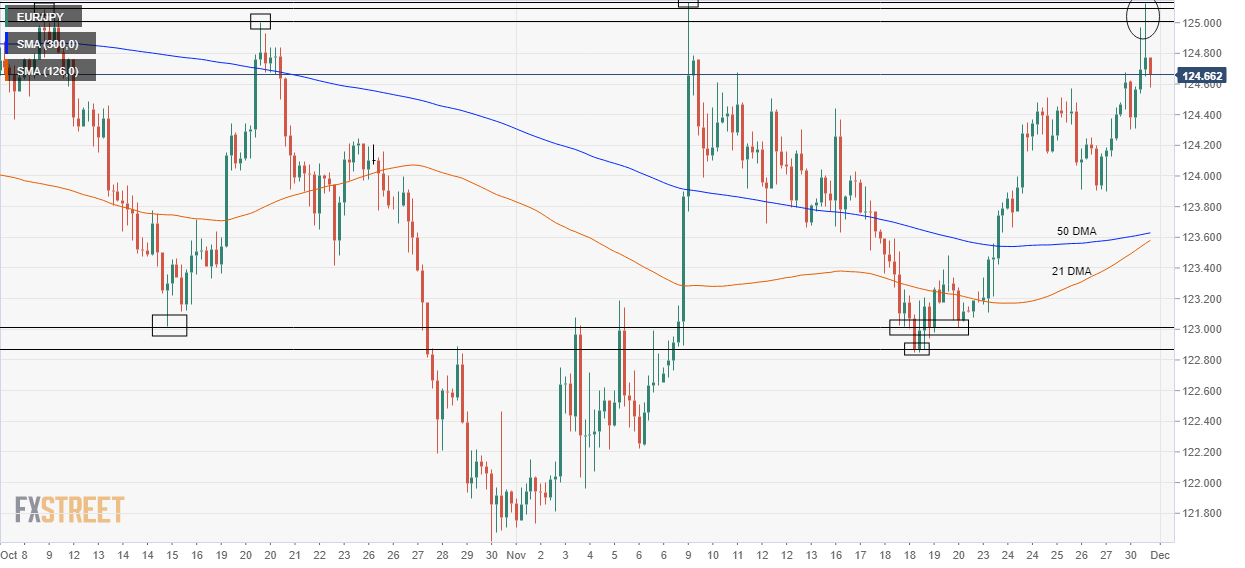

With EUR/JPY strongly rejecting resistance at the previous monthly high at 125.14, a double top has been put in. If this does turn out to be a meaningful double top, eyes will be on support just below the 124.00 level (26 November lows) and then the pair’s 21 and 50-day moving averages just above 123.50. Below that at the 123.00 level, there is also strong support (2 and 15 October lows and 18, 19 and 20 November lows).

However, it might not be current to argue that EUR/JPY is a double top given that is has actually tested this region four times over the past two months; in mid-October, the pair rejected the 125.00 level twice. Thus, this might signal that a convincing upside break of the 125.00 level is coming imminently, which would open the door for a move to the upside and towards Summer highs between 126.50-127.00.

EUR/JPY four hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.