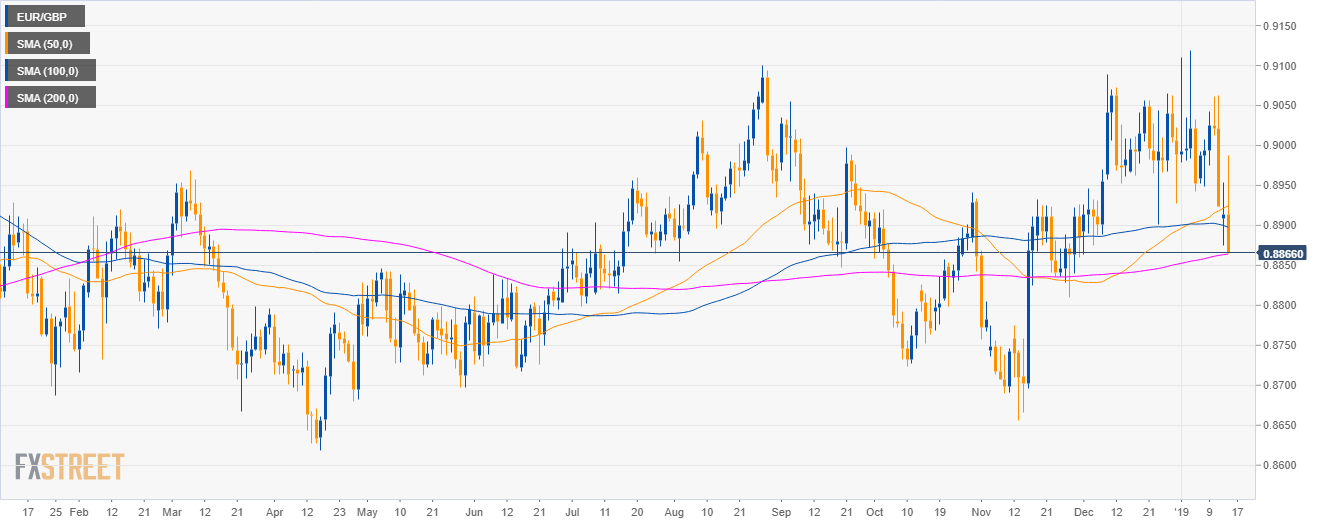

EUR/GBP daily chart

- EUR/GBP is trading in a sideways trend below the 50 and 100 simple moving averages (SMAs).

- Parliament voted down PM May's Brexit deal.

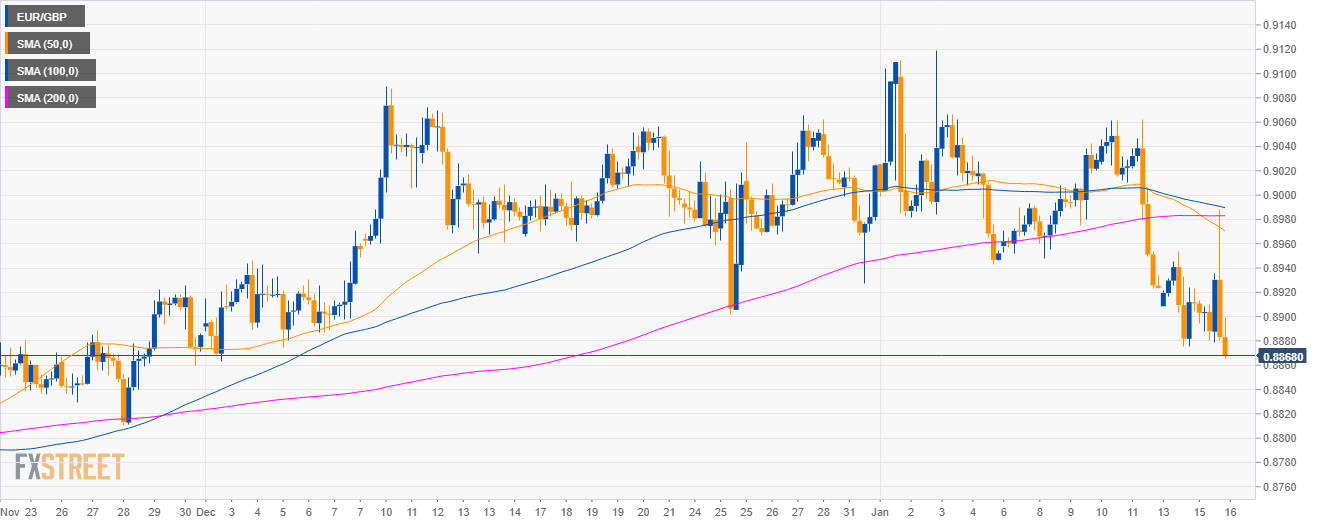

EUR/GBP 4-hour chart

- EUR/GBP is trading below its main SMAs.

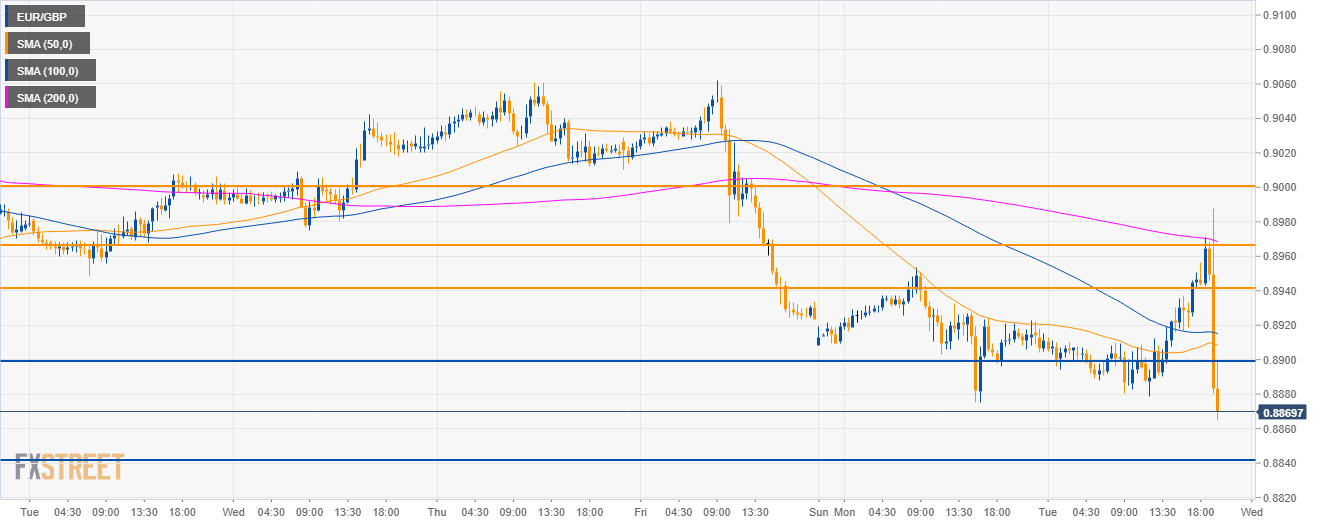

GBP/USD 30-minute chart

- EUR/GBP bears are now breaking below the 0.8800 level.

- The bear target to the downside is seen at the 0.8840 level.

Additional key levels

EUR/GBP

Overview:

Today Last Price: 0.8887

Today Daily change: -26 pips

Today Daily change %: -0.292%

Today Daily Open: 0.8913

Trends:

Previous Daily SMA20: 0.8994

Previous Daily SMA50: 0.8922

Previous Daily SMA100: 0.89

Previous Daily SMA200: 0.8863

Levels:

Previous Daily High: 0.8954

Previous Daily Low: 0.8875

Previous Weekly High: 0.9062

Previous Weekly Low: 0.8923

Previous Monthly High: 0.9089

Previous Monthly Low: 0.8863

Previous Daily Fibonacci 38.2%: 0.8924

Previous Daily Fibonacci 61.8%: 0.8905

Previous Daily Pivot Point S1: 0.8874

Previous Daily Pivot Point S2: 0.8836

Previous Daily Pivot Point S3: 0.8796

Previous Daily Pivot Point R1: 0.8953

Previous Daily Pivot Point R2: 0.8992

Previous Daily Pivot Point R3: 0.9031

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.