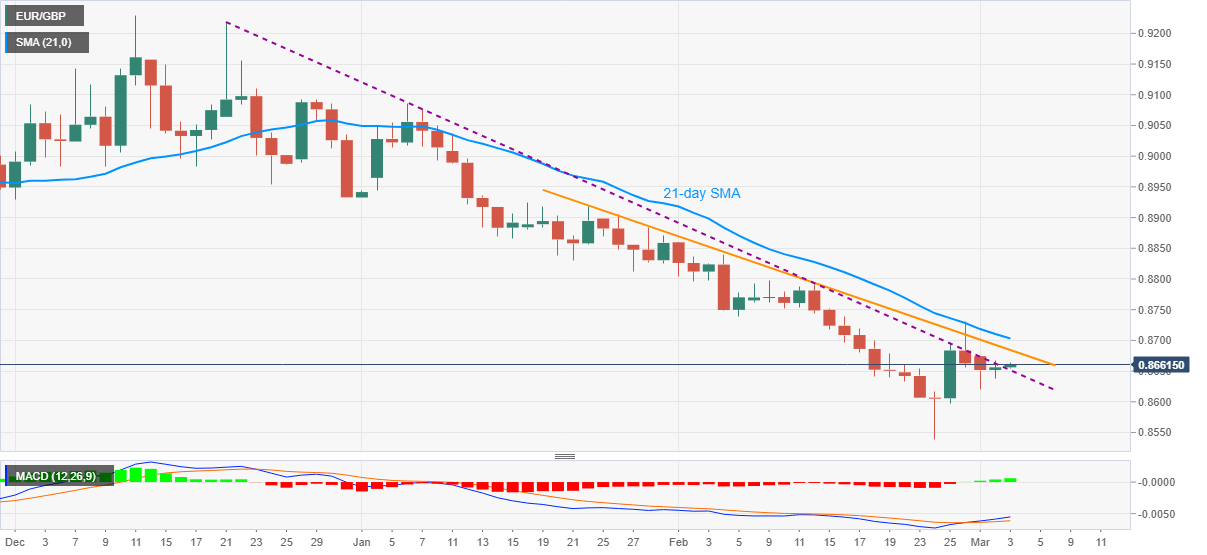

- EUR/GBP wavers around intraday top after breaking 10-week-old resistance the previous day.

- Short-term resistance line, 21-day SMA stands tall to test the bulls amid upbeat MACD.

- Bears will eye breakdown of 0.8600 for fresh entries.

EUR/GBP prints mild gains while struggling to keep the bulls hopeful around 0.8660 during the pre-European session on Wednesday. The pair becomes key for the day considering the scheduled release of Eurozone PMIs and the UK budget.

Given the high hopes from the British budget, any disappointment in the form of a future tax hike could derail the upbeat sentiment.

However, technical formations favor buyers after the pair crossed a descending trend line from December 21 the previous day.

The moves also gain support from the bullish MACD, which in turn directs EUR/GBP optimists to the next key hurdles, namely a descending trend line from January 22 and 21-day SMA, respectively around 0.8685 and 0.8705.

Meanwhile, EUR/GBP sellers are less likely to return unless witnessing a daily closing below the 0.8600 round-figure, following that the multi-month low flashed last week near 0.8540 will be the key to watch.

Overall, EUR/GBP has already flashed initial signals for a trend change that need confirmation.

EUR/GBP daily chart

Trend: Further upside expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.