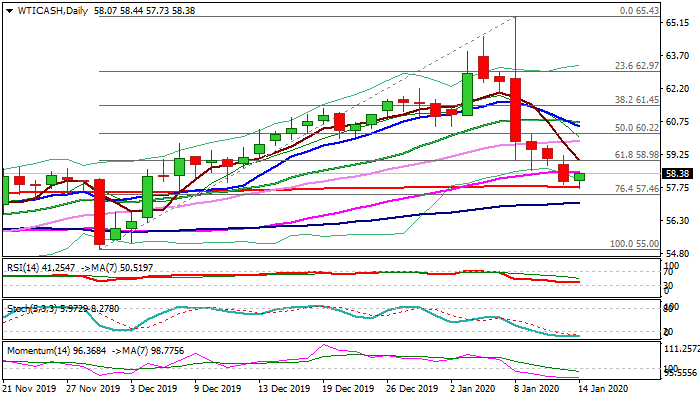

WTI Oil Outlook: bears are pausing above 200DMA, awaiting US crude inventories reports

WTI oil price edged higher on Tuesday after steep fall in past six days found footstep at 200DMA ($57.75).

Oil price came under pressure on signs of de-escalation of US/Iran conflict as unexpected rise of US crude stocks last week that also raised concerns about global oversupply.

Positive signals come from expectations that US and China will sign phase 1 of their trade deal and raise expectations that China would increase oil imports from the US.

Bears need break below 200DMA to generate fresh bearish signal for continuation and attack at daily cloud (spanned between $57.15 and $55.33), but may take some time for consolidation, as daily stochastic is deeply oversold. Read more...

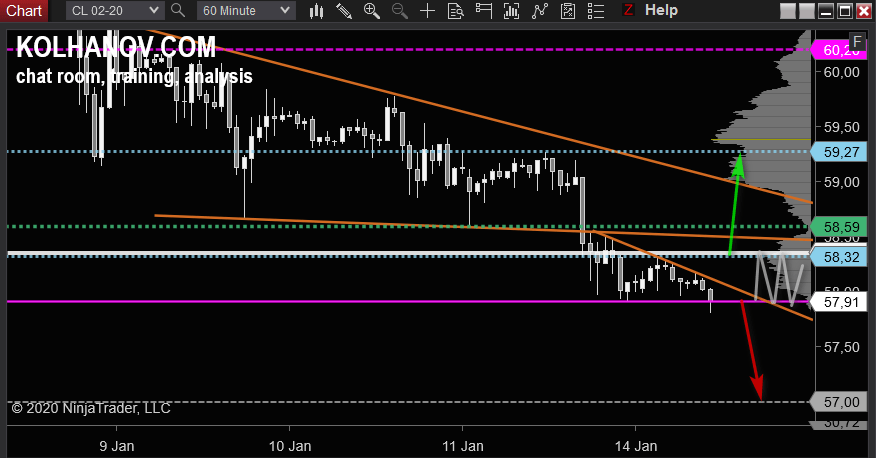

WTI Crude oil can continue downtrend below 57.90 to 57.00

Uptrend

An uptrend will start as soon, as the pair rises above resistance level 58.30, which will be followed by moving up to resistance level 59.30.

Downtrend

An downtrend will start as soon, as the pair drops below support level 57.90, which will be followed by moving down to support level 57.00. Read more...

WTI bounces-off six-week lows at $57.75 ahead of API data

WTI (oil futures on NYMEX) is trying hard to extend the recovery from six-week lows of $57.75 reached over the last hour, having regained the 58 handle, at the time of writing.

The black gold extended its week-long losing streak on Tuesday, mainly fuelled by receding US-Mid East tensions after both the US and Iran decided to stand down on the military responses after this month’s missiles attacks.

Meanwhile, the markets appear to have turned risk-averse ahead of the much-awaited US-China phase one trade deal signing scheduled on Wednesday. Therefore, the higher-yielding oil witnessed a fresh round of selling in tandem with other risk assets such as Treasury yields, European equities etc. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.