The number of COVID-19 cases in the United States topped 3.46 million as of Wednesday afternoon.

There have been more than 136,000 deaths, according to the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University.

California is getting special attention considering how rapidly the virus is spreading.

The number of cases in California is now on pace to double every 29.2 days, a number used to measure how quickly the virus is spreading.

Coronavirus can infect people so rapidly that it has continued to spread despite shutdown orders aimed at slowing the growth of new cases and flattening this line.

Over the past week, the state has averaged 8,902 new cases and 95.6 new deaths per day.

California coronavirus cases today are at 11,126 vs 7346 yesterday.

Outlook for the US dollar

The path of the US economy largely depends on developments involving COVID-19 as the country has failed to control the pandemic, Patrick Harker, president of the Federal Reserve Bank of Philadelphia, said at a virtual event by the Center City Proprietors Association.

Despite the enormous sacrifices made by tens of millions of Americans, the country has still failed to control the virus.

A Fed president might like to think otherwise, but there is only so much policymakers can do right now to affect the economy.

Our country's economic performance in a large part depends on what happens with COVID-19,

Harker said.

The US dollar has prospered in the wake of the virus, and the rationale should be that it would tread softer grounds on signs of a peak or a vaccine.

We have one of those for the playbook in the mix with the news that a vaccine could be on the way.

An experimental vaccine, developed by Fauci's colleagues at the National Institutes of Health and Moderna Inc is the first COVID-19 vaccine tested in the US and it has been reported to have heightened 45 volunteers immune systems just the way scientists had hoped.

"No matter how you slice this, this is good news," Dr. Anthony Fauci, the US government's top infectious disease expert, told The Associated Press.

There is an inflationary theme tied to this which, over time, would likely support the case for a softer dollar.

Emerging markets have been on the move over the course of the recovery from the viruses initial impact which has had a direct negative correlation to the dollar.

A continuation in the trend of the MSCI to the upside will potentially have negative impacts on the DXY going forward.

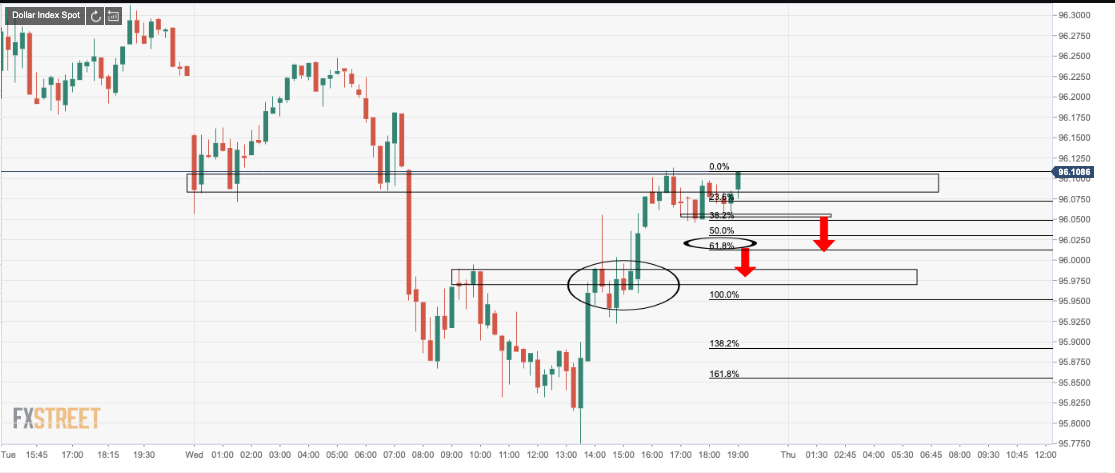

Hourly resistance playing out as well for near term structure analysis:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.