- NYSE:CCIV sheds 1.8% in first hour of tuesday's trade.

- CCIV has lost momentum since annoucning th Lucid merger.

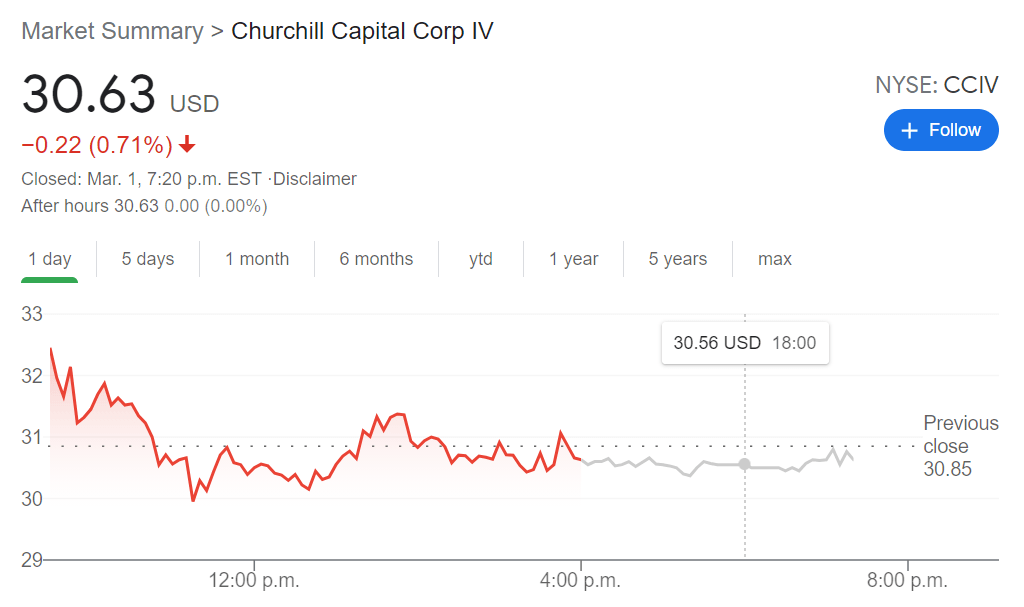

- CCIV shares moved from $60 to $30 and have stabilised there.

Update Tuesday, March 2: Shares in CCIV continue to stabilize around $30 after the long-awaited merger was announced with Lucid Motors. Shares suffered as the PIPE transaction details were announced. Recent news from established auto manufactures that they would move solely to Electric Vehicle (EV) production have also hurt the EV sector. Volvo said on Tuesday it is to go fully electric by 2030 for its entire vehicle range. Ford had said in February it was to be fully electric in Europe by 2030.

NYSE:CCIV was the hottest stock on the market a couple of weeks ago, but since it officially announced its reverse merger with Lucid Motors, investors have slammed on the brakes. On Monday, despite a broader market rally that saw the S&P 500 jump 2.4%, CCIV traded sideways trimming 0.39% to close the trading session at $30.63. Shares are now trading 52% lower than the 52-week high price of $64.86 that it saw in mid-February.

Stay up to speed with hot stocks' news!

The broader electric vehicle sector rallied on Monday as tech stocks and the NASDAQ rebounded by 3.01%. Industry leader Tesla (NASDAQ:TSLA) jumped by 6.36% after lagging for most of the year so far, and Chinese electric vehicle maker NIO (NYSE:NIO) surged by 8.96% ahead of its fourth quarter earnings report after the closing bell. CCIV recorded a lower than average daily trading volume, as the recently quoted valuation of $68 billion seems to have scared some investors off of its sky-high stock price.

CCIV Stock Price

As CCIV and Lucid Motors head towards their impending merger, the stock still represents an opportunity to get into a company with a strong management team and a manufacturing plant that is nearly completed. Lucid definitely targets a high-end demographic as its Lucid Air sedan is priced at $96,000, $139,000, and $169,000, depending on which model you prefer. While expected vehicle deliveries certainly will not be as high as companies with entry level models, with time Lucid could see some impressive margin growth as production ramps up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.