- Canopy Growth Corporation is enjoying broad momentum after appointing a new CEO.

- CGC's new line of Cannabis 2.0 products is inspiring investors.

- The weed firm's entry into the vast US CBD market is also an encouraging move.

Canopy Growth Corporation (CGC) is one of the prominent marijuana stocks. While rivals such as Aurora struggle with financial acrobatics, the Smiths Falls-based firm has its books more in order.

Yet the main drivers of the recent rise in its stock price stem from three reasons.

1) New boss: David Klein, formerly the CFO of Constellation Brands, has assumed his role as the new CEO of Canopy on January 14. The parachuting of a seasoned corporate manager into the driver's seat provides confidence for investors. Moreover, Klein is familiar with the firm as he already served on Canopy's board. CNBC's Jim Cramer has also weighed in, praising the new CEO and saying he has got "horse sense."

2) Cannabis 2.0: Chocolates, vapes, and also distilled cannabis offering form part of GCC's new line of products dubbed "Cannabis 2.0." The recently secured license to operate its large new beverage facility in Smiths Falls will enable it to develop and market THC and CBD-infused beverages. These include the Houseplant Grapefruit and Houseplant Lemon, both standard 355ml beverages containing 2.5mg of THC. Canopy will use the Quatreau brand name to market CBD-based wellness drinks.

3) US CBD Market: Perhaps most importantly for the Canadian company is its entry to the vast American market. Late in 2019, CGC launched its First and Free brand in 31 US states where CBD is legal. Apart from the vape products, the firm offers softness, oils, and creams. It has also begun sourcing hemp from American farmers based in New York state, among other places.

All in all, these three drivers are pushing the firm forward.

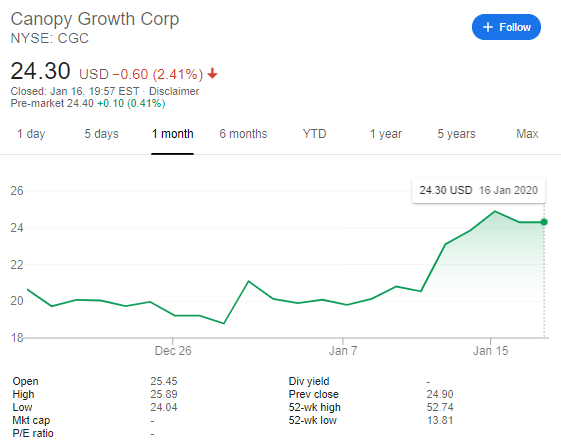

Canopy Growth Corporation Stock price today

CGC, traded in the New York Stock Exchange, has risen by over 25% from the lows under $20 in late December to $24.30 at the time of writing. On Thursday, shares corrected some of their gains and dropped by 2.4% or $0.60.

Nevertheless, CGC's reasons to rise and the general upbeat market mood – following the signing of the Sino-American trade deal – may help Canopy resume its rises.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.