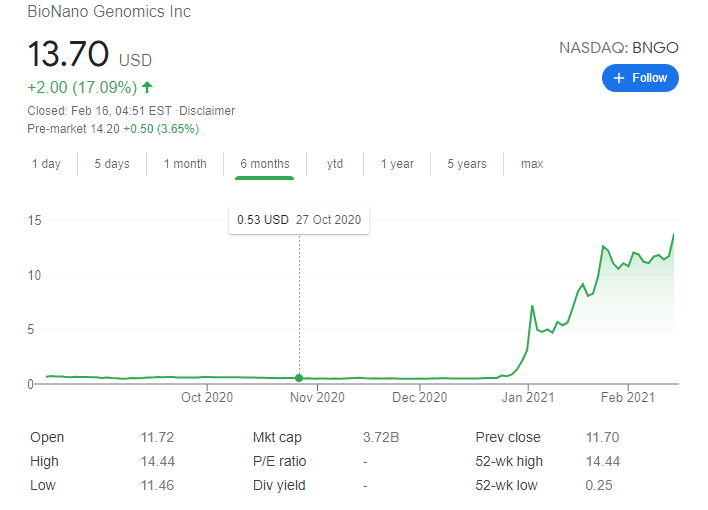

- NASDAQ: BNGO has surged by over 17% on Friday, amid ongoing enthusiasm for its technology.

- Genetic mutations of COVID-19 amplify the need for upgraded genetic sequencing.

- BioNano Genomics is set to extend its gains, amid growing interest.

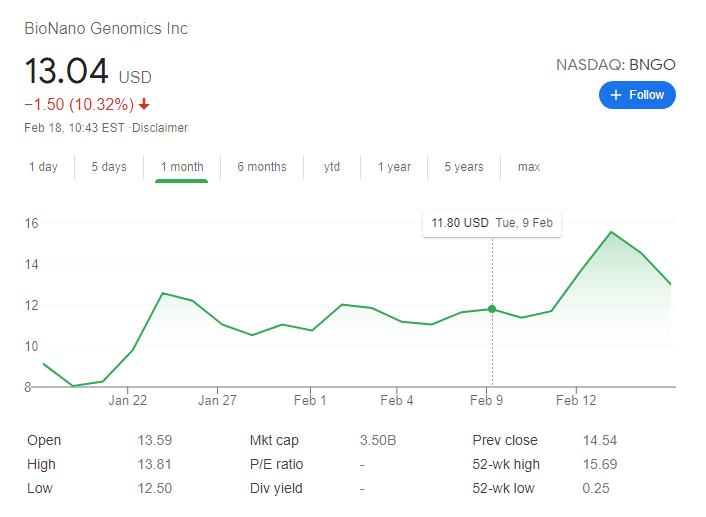

Update February 18: BioNano Genomics Inc (NASDAQ: BNGO) has been falling by double digits on Thursday – down 10.75% to just below $13 at the time of writing. The San Diego-based firm's equity is thus extending its slide from the high close of $15.57 on February 16 as it is carried lower with the broader stock market. The S&P 500 is suffering a sell-off as rising bond yields make investing in equities less attractive. BioNano is also dropping due to its own profit-taking, despite the firm's leading genetic technology – needed more than ever in the COVID-19 age. Critical support awaits at $12.50, which was a high point in late January. So far, NASDAQ: BNGO is holding above that level. Coronavirus: Statistics, herd immunity, vaccine calendar and impact on financial markets and currencies

Update February 17: BioNano Genomics' shares have been trading in the red on Wednesday, changing hands at $14.81 at the time of writing, down nearly 5%. The downside correction comes after two days of substantial gains. NASDAQ: BNGO shot higher from below $12, and its current price still represents a jump of over 25% from levels seen last week. Profit taking is in play, but what's next? The company still has fundamental reasons to rise amid the coronavirus crisis. On the other hand, part of the gains were inspired by previous advances – the stock's gains attracted the RobinHood crowd. Hodling above $12 is critical for the next upside moves.

Update: BioNano Genomics (NASDAQ: BNGO) has closed Tuesday's trading session at $15.57, an increase of some 13.65%. Investors returned from their long weekends and piled into the San Diego-based company's shares amid the growing demand for genetic sequencing and other genomics technologies. Wednesday's premarket trade is pointing to a dip of some 3% to $15.10 as some are set to take profits. Looking at the BNGO's recent past shows that such dips – some related to the biotechnology company's issuance of stock – have proved temporary. Will investors have a "buy the dip" opportunity?

Is the strain a stain on a country's image – the world's approach is changing from one that is fearful of COVID-19 variants to one that appreciates countries that understand what is going on. Coronavirus mutations have raised awareness of genetic sequencing and BioNano Genomics (NASDAQ: BNGO) is well-placed to benefit from this growing need.

The San Diego-based biotechnology firm's shares rose early in 2021 after it showcased its technologies related to the autism spectrum, several cancer types, and also coronavirus. Regarding the disease that grips the world, BioNano presented ways to identify why certain patients suffer severe disease and some are not.

The covid crisis is far from over and as the world ramps up its vaccination campaigns, the virus is forced to mutate. The so-called British variant – or B 1.1.7 – has proven far more transmissible than the original wild type and potentially more lethal. To the comfort of British scientists and the world, existing vaccines have proven efficient against it.

However, the E484K genetic mutation – also nicknamed Erik – may already be a different ballgame. The UK is far ahead of other countries in its genomics, with Denmark and Australia somewhere behind. In the US, where BioNano is based, there is still limited sequencing capacity. The renewed focus on genomics is. in itself, enough to boost shares.

BNGO stock news

BioNano Genomics' latest announcements came from its conference, where it presented the capabilities of its Spahyr tools – impressing medics. After the event, the company was able to raise funds in markets, bolstering its financial arms chest.

The recent rise has not come from any declaration made by the firm but rather growing interest from investors.

BNGO stock forecast

NASDAQ: BNGO has closed Friday's trading on a high note – a leap of $2 or 17.09% to close at $13.70. That represented a closing peak for the stock, but below the intraday high of $14.44, which is now the upside target.

Support awaits at BioNano's recent "valleys" in trading such as $10.53, $10.76, $11.05 and $11.38.

Tuesday's premarket trading is pointing to an advance of around 4% to $14.23. However, it is essential to remember that US traders are returning from a long weekend – due to Presidents' Day and volatility is set to rise.

For broader markets, optimism about President Joe Biden's proposed $1.9 trillion stimulus bill is boosting shares, but fears that this would result in inflation have pushed bond yields higher. In turn, better returns on safe US debt make investing in stocks marginally less attractive. Nevertheless, the upbeat mood has prevailed so far and may continue.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.