The biotech industry has always had a high potential to grow, but the pandemic has boosted this sector even more and as a result, attracted many new investors especially vaccine producers. Let’s go through the top stocks of the biotech industry.

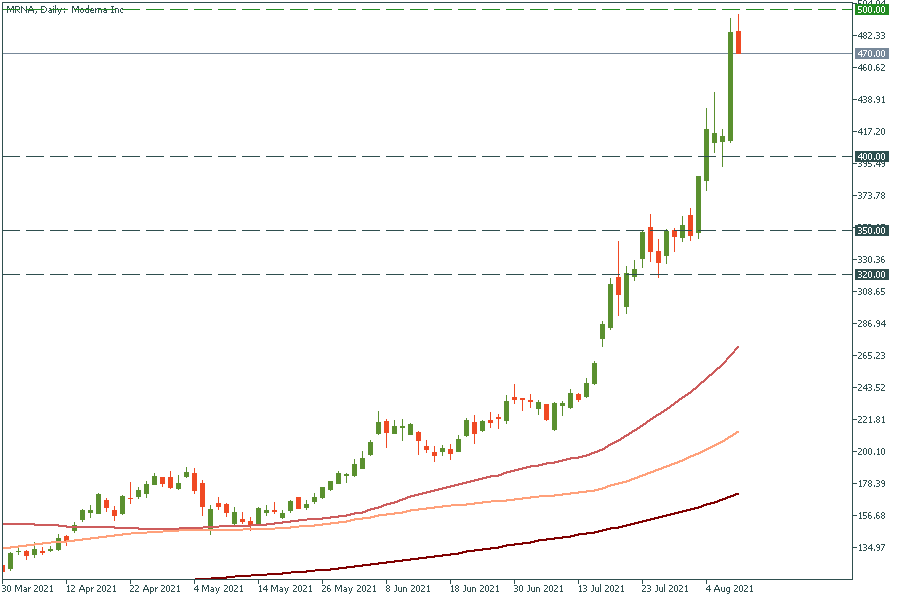

Moderna

Moderna surged on the announcement that its Covid-19 vaccine was granted provisional registration by Australia's administration. Moderna is planning to supply as many as 25 million doses of its vaccine to the Australian government by 2022.

However, this company has a unique feature. It has joined one of the most credible stock indexes in the US – the S&P 500 index. It helped the stock to rise even more!

Moderna has almost reached the psychological mark of $500.00, but as it often happens, it has failed to cross such an important level on the first try. We can expect that sooner or later, it will break this resistance level and rally up further to the next round number of $550.00. Support levels are $400 and $350.00.

Pfizer and BioNTech

BioNTech and Pfizer have recently published better than expected earnings results for the second quarter. The companies claimed they can produce up to 3 billion Covid-19 vaccines this year, with capacity increasing to 4 billion doses in 2022. Pfizer is getting closer to the $50.00 level, while BioNTech has reversed down from $463.00.

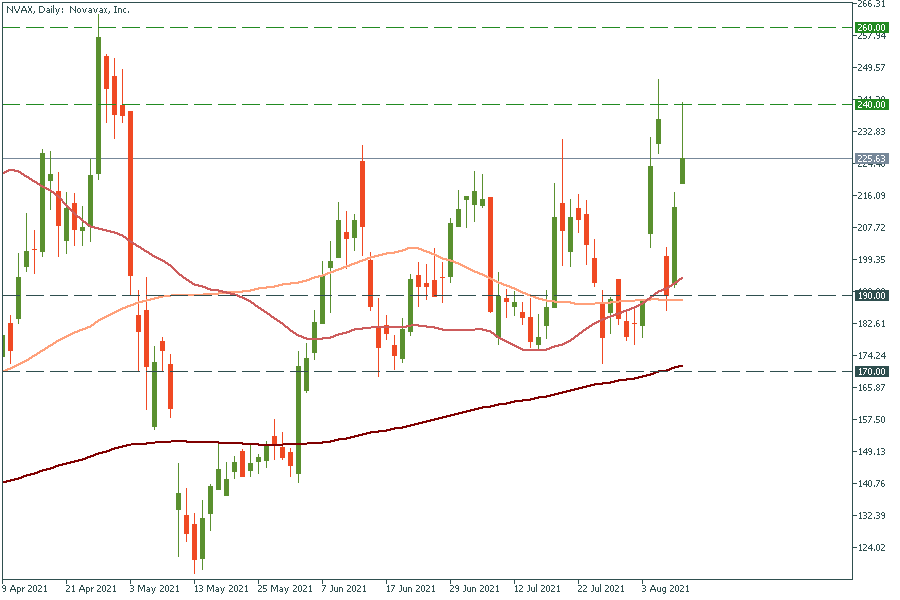

Novavax

Meanwhile, Novavax has gained from Barron’s article. It was written that the New York State Common Retirement Fund, the third-largest public pension in the US, has increased its stake in Novavax and other vaccine stocks. However, the vaccine maker claimed that it would delay submission of its Covid-19 vaccine to the Food and Drug Administration for emergency use authorization until the fourth quarter.

The breakout above the $240.00 resistance level will push the stock up to the high of April 27 at $260.00. After that, the stock price may jump to an all-time high near $320.00. Support levels are the 100- and 200-day moving averages of $190.00 and $170.00, respectively.

This post is written and submitted by FBS Markets for informational purposes only. In no way shall it be interpreted or construed to create any warranties of any kind, including an offer to buy or sell any currencies or other instruments. The views and ideas shared in this post are deemed reliable and based on the most up-to-date and trustworthy sources. However, the company does not take any responsibility for accuracy and completeness of the information, and the views expressed in the post may be subject to change without prior notice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.