- Aurora Cannabis Inc's share are on the back foot in both Canada and the US.

- The marijuana firm's financials are its may downers.

- The deepening coronavirus crisis could trigger higher pot consumption and bolster the ACB stock.

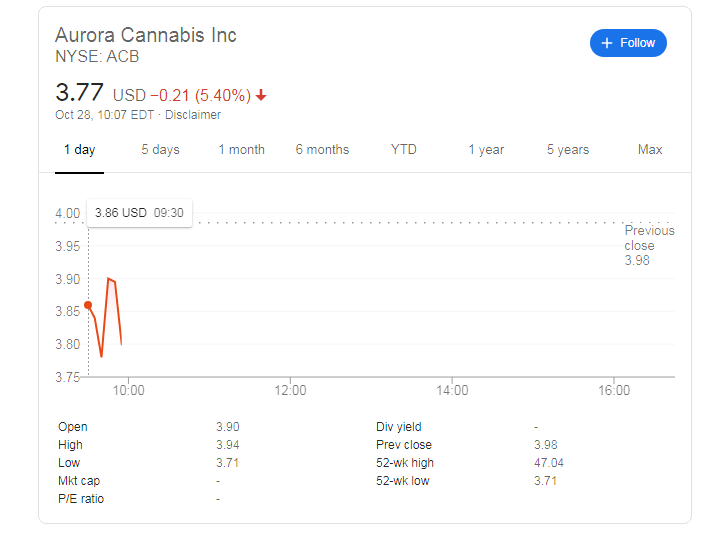

Aurora Cannabis Inc (NYSE: ACB in the New York Stock Exchange and TSE: ACB in the Toronto Stock Exchange) is falling once again. At the time of writing, the Canadian pot firm is down only around 1% to C$5.19 in its home market, while shares trading in the Big Apple is down 4.64% to US$3.80.

Is there room for arbitrage on Aurora's stocks? For such a move to work, equities of the Edmonton, Canada-based company would have to rise – and that is not the case. The recent hit to ACB's stock came from Cantor Fitzgerald, an investment bank, which fell out of love with Aurora and cut its rating from overweight to neutral. Moreover, it slashed the target from C$18 to C$7. As mentioned earlier, shares are trading in Toronto at a lower price.

Cantor Fitzgerlad's influential change of heart came after the cannabis company revealed a dismal financial picture. Aurora announced it will tap markets once again, looking to raise some $500 million after depleting a significant chunk of the money it raised beforehand. As of late October, it has only $272 million.

Moreover, the new attempt to raise money seems desperate. The weed company will try to fill the hole in its finances by selling not only warrants, debt securities, and subscription receipts, but also common and even preferred shares. That indicated Aurora is diluting its current shareholders, lowering the value of what they hold – and diminishing their influence.

Some fear that ACB could continue squeezing and eventually turn into Micro-Cap. That would represent a massive fall from grace for a firm once being at the forefront of the pot sector. Back in October 2018, Canada legalized marijuana and the American market was on the path of decriminalization and potentially even legalization.

Apart from the moderate pace that the world´s largest economy has gone in that direction, pot companies struggled with oversupply and competition. Moreover, their valuations began seeming like a pipe dream. Aurora Cannabis is down no less than 90% in the past 12 months. It is nearing a sub-$200 million which would count as a micro cap and put it off the radar of many investors.

ACB Stock Forecast

However, as long as the company is alive, there are reasons to believe the stock could bottom out. First, Aurora expanded its offering by purchasing Reliva , a US-based company focusing on the cannabidiol (CBD) sector. There is substantial room for growth, as anyone walking on America's high streets knows – CBD seems to be everywhere.

Another reason is the surge in US and Canadian coronavirus cases. The world is focused on the second wave of COVID-19 in Europe, and on the US elections. That crowds out concerns about rising infections in North America.

Even if Canadian province premiers and US state governors do not impose lockdowns, consumers may shy away from crowded places and stay more at home. The cold winter which is responsible for keeping people indoors and contributing to spreading the disease – may also boost the consumption of pot.

Refraining from leaving the house means more free time to consume marijuana, and unfortunately, also raises the probability of feeling lonely and even depressed. The result could be a higher consumption of consicence alleviating substances, including products that Aurora Cannabis sells.

Where is the bottom for ACB at which bargain-seekers come in? That is a hard question to answer, yet the knee-jerk reaction to the downside could be followed by an upside correction.

More Aurora has three (mostly coronavirus-related) reasons rise

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.