- AUD/USD is erasing the Reserve Bank of Australia (RBA) inspired losses.

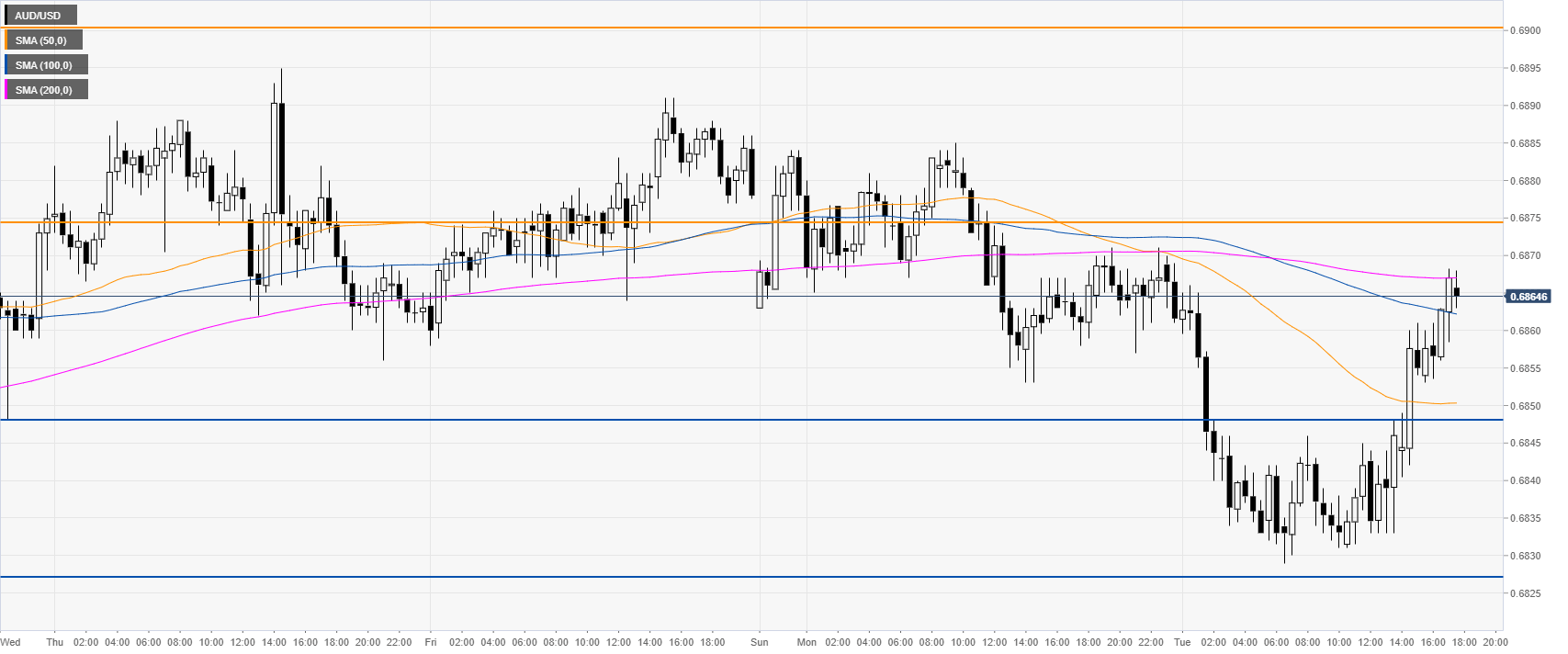

- The level to beat for bulls is the 0.6874 resistance.

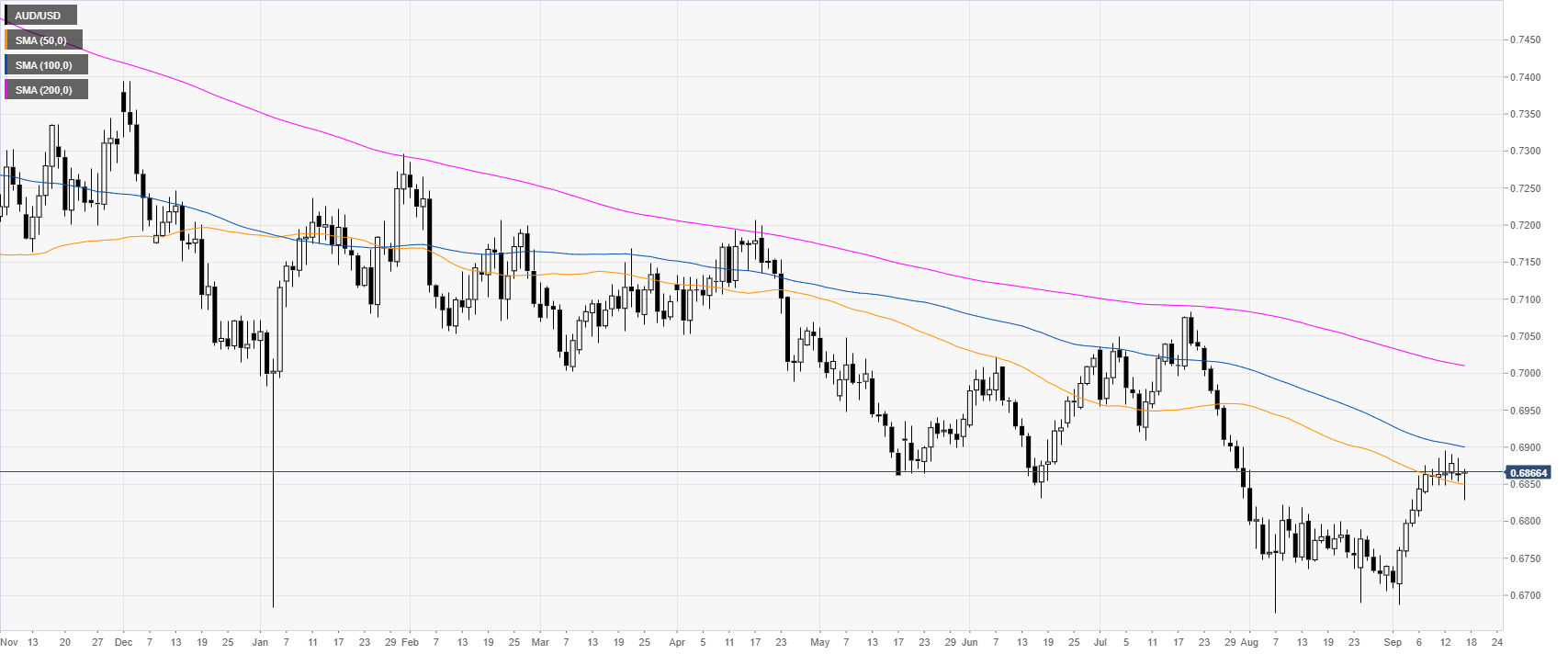

AUD/USD daily chart

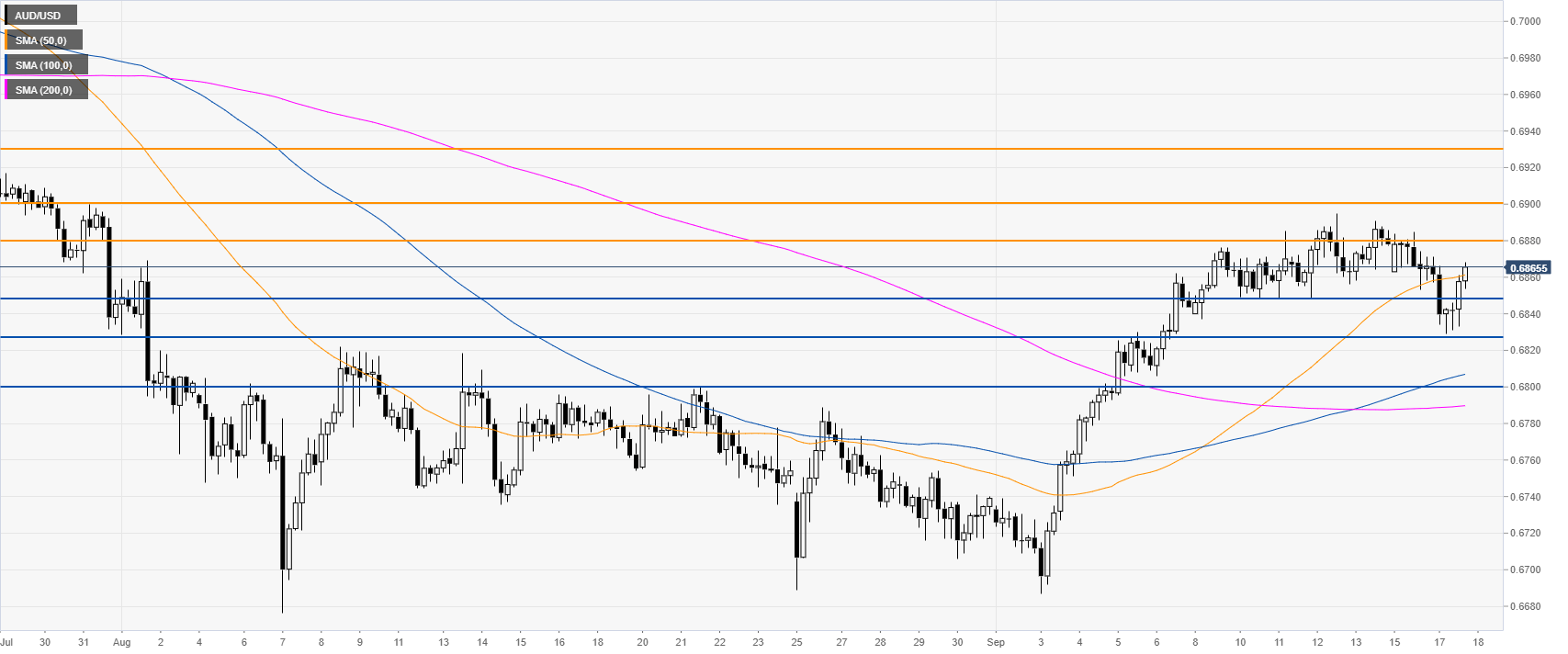

AUD/USD 4-hour chart

AUD/USD 30-minute chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD bounces back from five-month lows

AUD/USD ends its three-day decline on Wednesday, bouncing back from levels not seen since mid-November. Nevertheless, hawkish remarks from Federal Reserve officials and the influx of safe-haven flows could bolster the US Dollar and potentially limit the upside of pair in the short term.

USD/JPY trades with mild losses below 155.00 on risk-aversion

USD/JPY trades with mild losses near 154.65 on Wednesday during the early Asian trading hours. The robust US economy and sticky inflation data have triggered the expectation that the Fed might delay the easing cycle to September from June, which provides some support to the US Dollar.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

Fetch.ai Price Prediction: FET must hold above $1.70 for strength

Fetch.ai is trading with a bearish bias. It comes as chatter about the proposed integration with the Ocean Protocol and the SIngularityNET ecosystem remains fresh.

UK CPI inflation data ahead: Sterling hovering north of key support

Following today's mixed bag of employment and wages data, today’s attention is directed to the March UK CPI inflation release. Both headline and core measures are expected to demonstrate further evidence of disinflation.