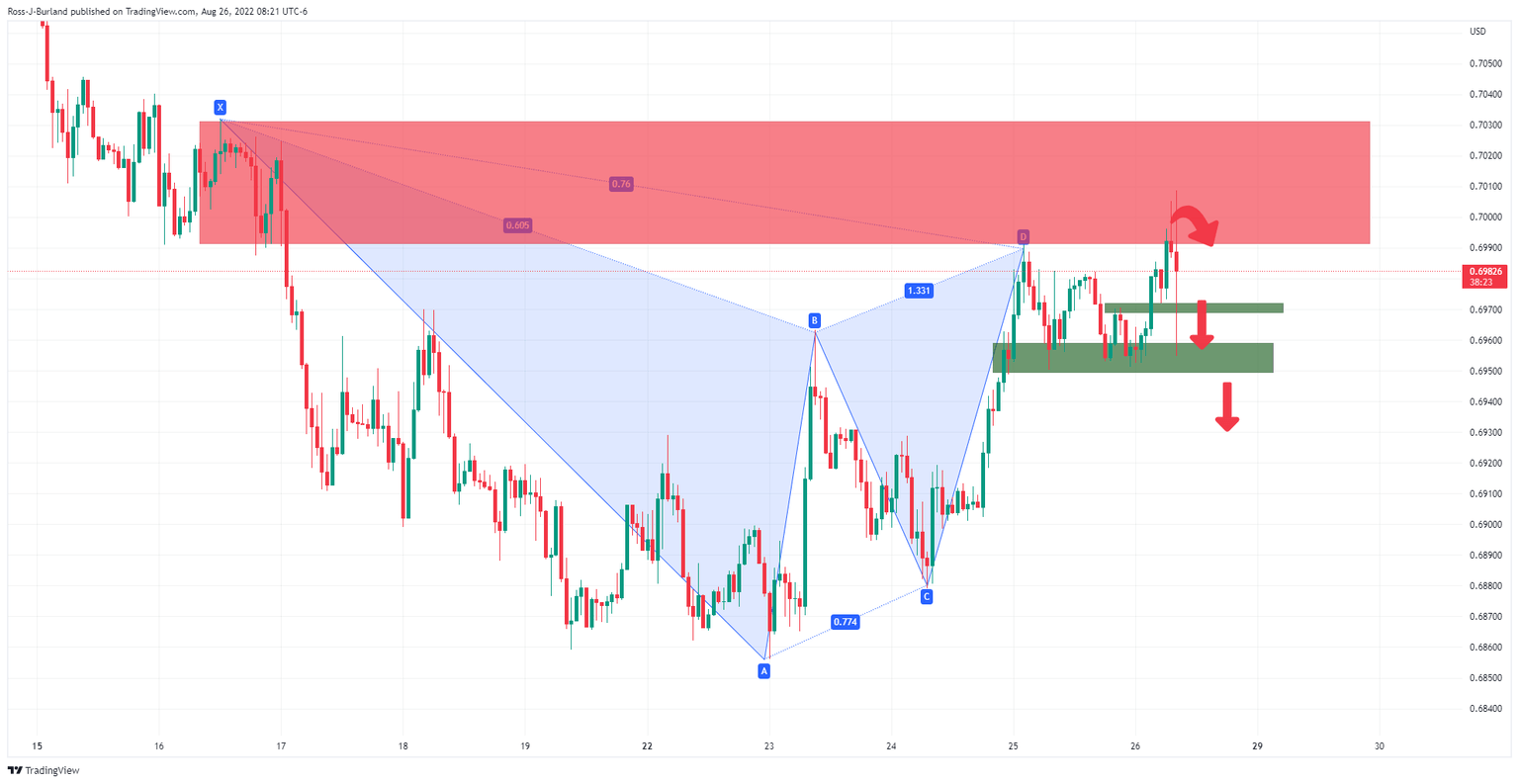

AUD/USD Price Analysis: Bulls could be encouraged at this juncture above 0.6790

- AUD/USD bears are moving in on critical support.

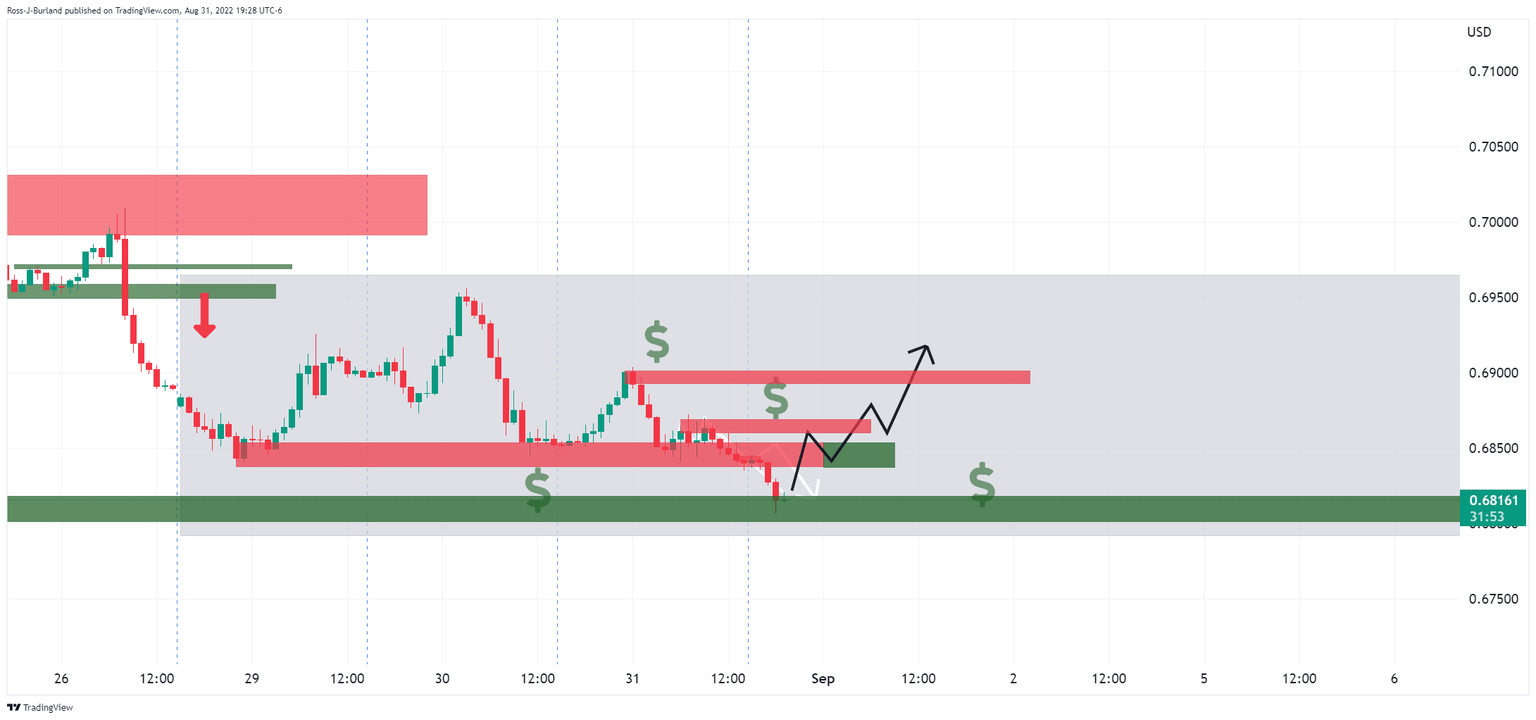

- Bulls could be encouraged if the price decelerates in key demand territory around 0.68 the figure.

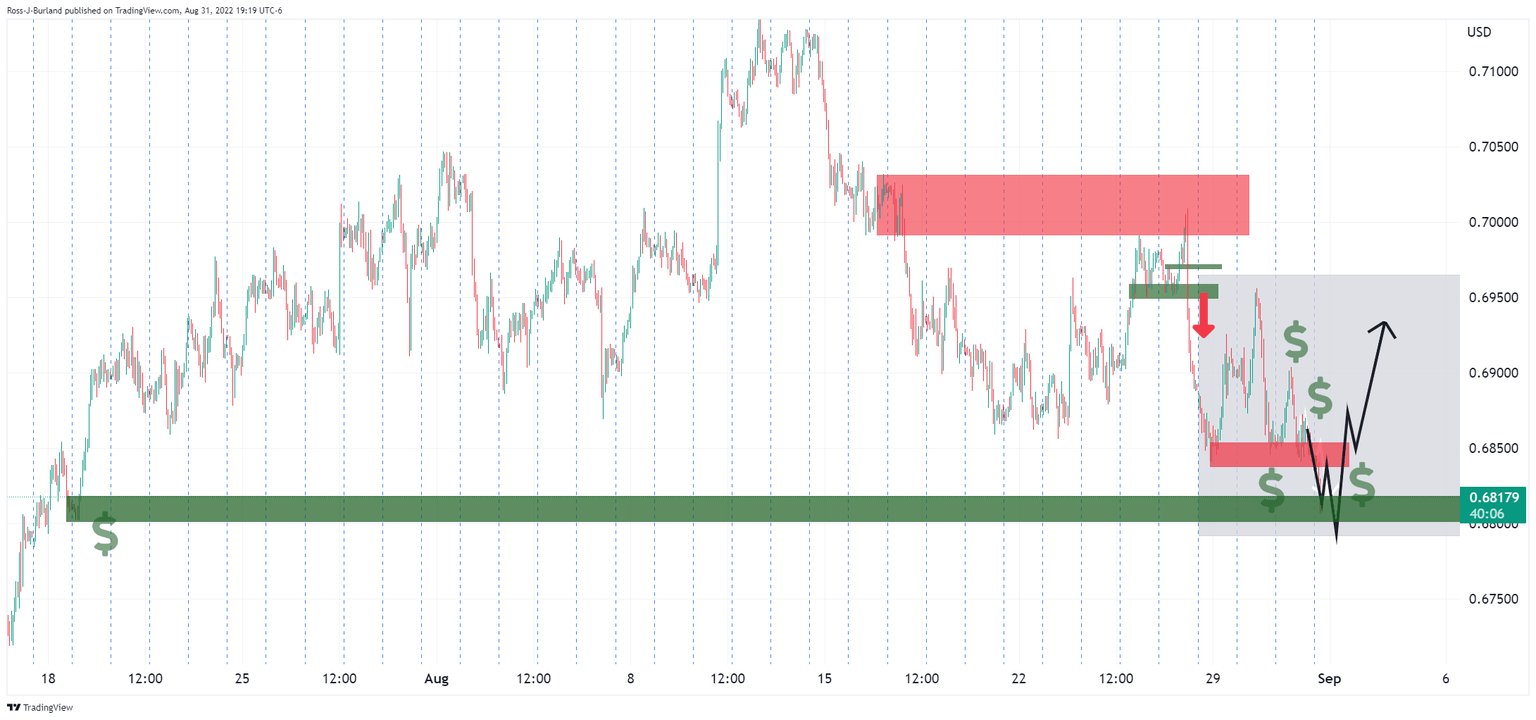

AUD/USD has broken to the downside on further US dollar strength, reaching near to 0.68 the figure which could be a last push for the week before a significant bullish correction.

The bulls set a high for the week in the 0.6950s and the price is now carving out a fresh low for the week. Given the timings of the week, a pullback into stops above recent peaks could be in order for the day ahead before Nonfarm Payrolls on Friday:

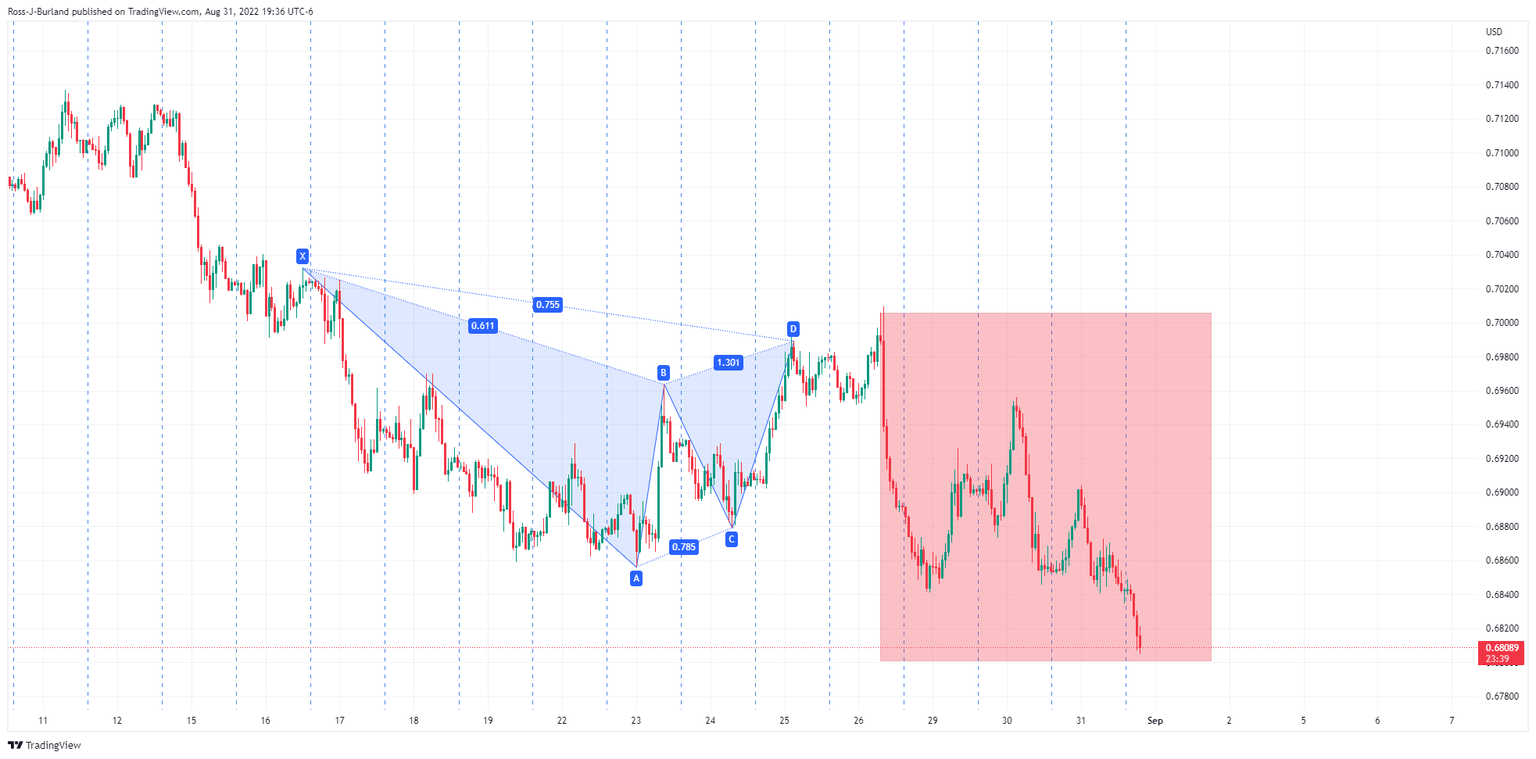

Meanwhile, as per the prior analysis, AUD/USD is volatile around the Powell speech, but focus is on downside while below 0.7000, the price followed suit and melted to the downside as forecasted:

AUD/USD prior analysis

After...

AUD/USD live update

There are a couple of scenarios that point to a reversion to target the sell positions on the way down from the highs that were set this week near 0.6950 and the more recent swing highs around 0.69 the figure and 0.6875.

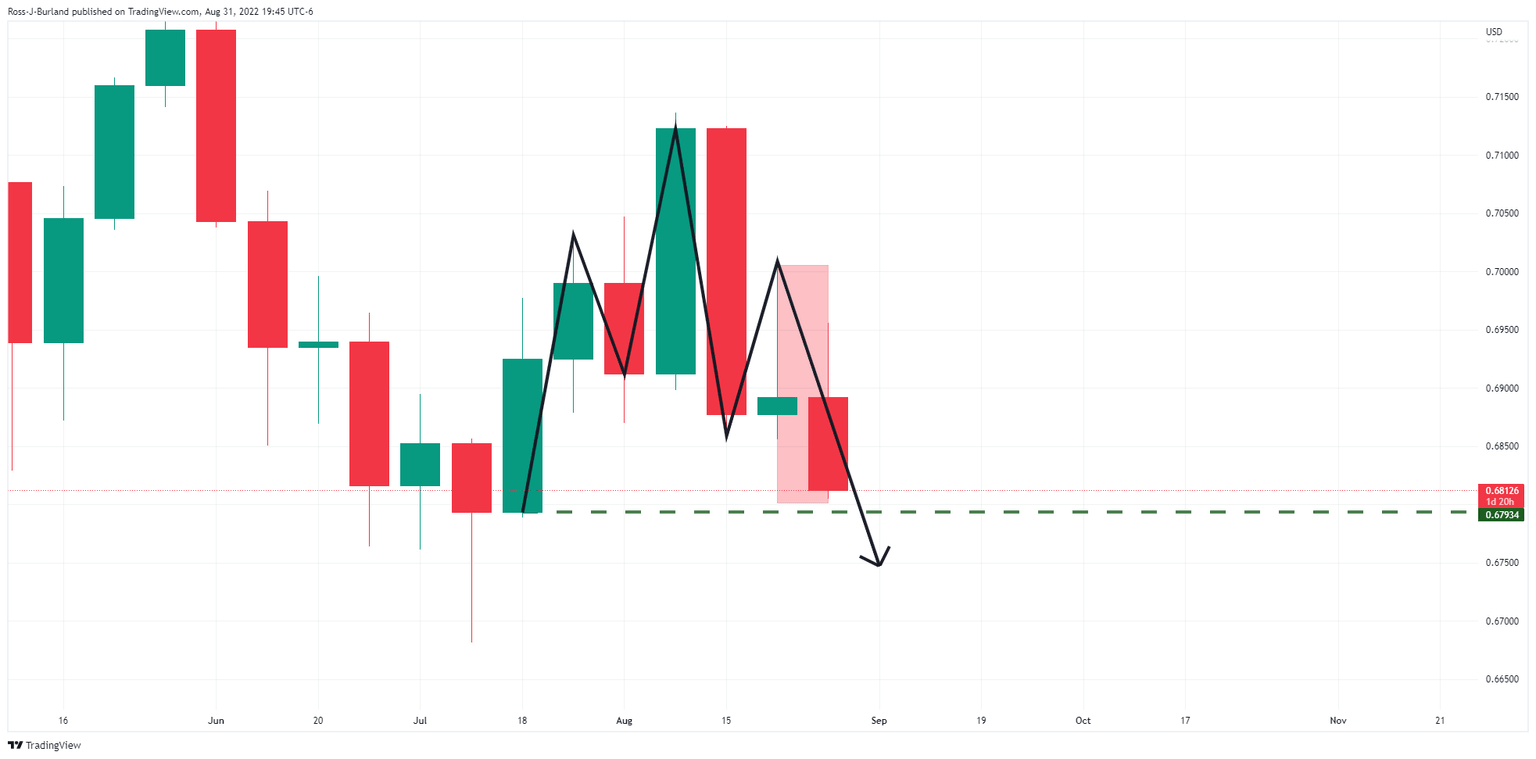

On the other hand, if the US dollar bulls stay in charge all the way into Friday's data, a break of 0.6790 as per the weekly chart could see a significant downside breakout:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.