Currently, AUD/USD is trading at 0.7667, down -0.31% or (27)-pips on the day, having posted a daily high at 0.7712 and low at 0.7657.

Today's empty US economic docket allowed market participants to adjust positions and remove risk from their portfolios as there were no Tier 1 or 2 news releases to weigh. Furthermore, next week the RBA Meeting's Minutes could intensify the current mild bearish selling pressure the Australian dollar vs. American dollar seems to build below 0.77 handle.

On the other hand, dollar bulls paused their bullish impetus as the two most relevant risk events are no longer data-linked, meaning Trump's tweets and comments are back in the spotlight being the 'phenomenal tax' his latest hit. Also, an upside tick in the probability to have the Federal Reserve hiking rates in March moved institutions to believe, once again, in the impossible possible. Currently, Fedwatch from the CME Group clocked lower at 13.3% from a previous day 22.1%; that impossible needs now a miracle.

Finally, the IMF shared a more pessimistic economic outlook compare to RBA's Governor Lowe. Hence, there is evidence to expect a disconnected view as Lowe shared, "the days of further monetary easing are behind' and meanwhile, Australia's household debt keeps building up; what matters the most for a nation?

AUD/USD losing 0.77 handle in consolidation of recent key data events

Historical data available for traders and investors indicates during the last 7-weeks that AUD/USD pair, a commodity-linked currency, had the best trading day at +1.18% (Jan.17) or 89-pips, and the worst at -0.81% (Jan.18) or (61)-pips. As of writing, the US 10yr treasury yields fell from 2.46% to 2.40%, down -1.82% on the day or -0.0445.

Technical levels to consider

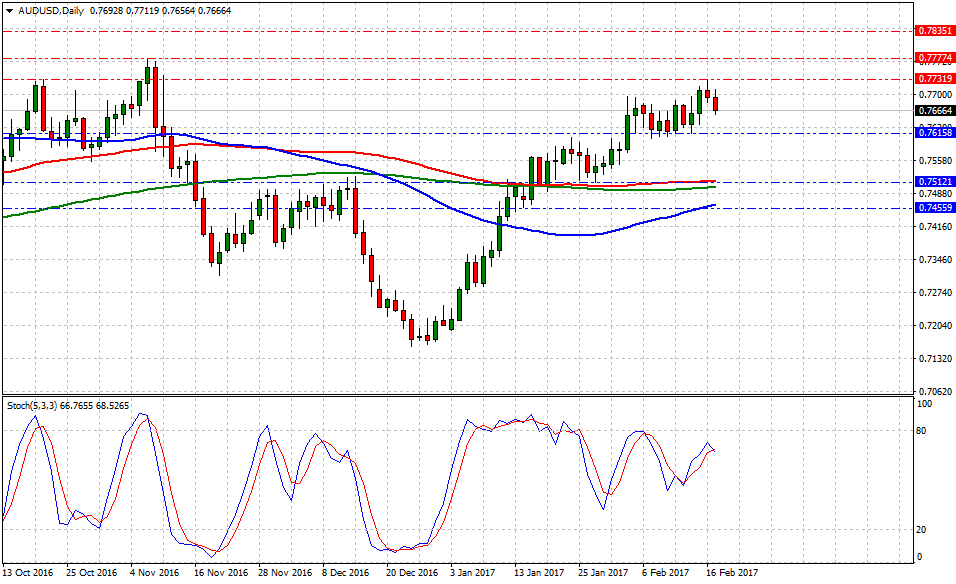

In terms of technical levels, upside barriers are aligned at 0.7731 (high Feb.16), then at 0.7777 (high Nov.8) and above that at 0.7834 (high April.21). While supports are aligned at 0.7617 (low Feb.14), later at 0.7512 (100-DMA) and below that at 0.7459 (50-DMA). On the other hand, Stochastic Oscillator (5,3,3) seems to shift south and finally head south. Therefore, there is evidence to expect further Aussie losses in the near term.

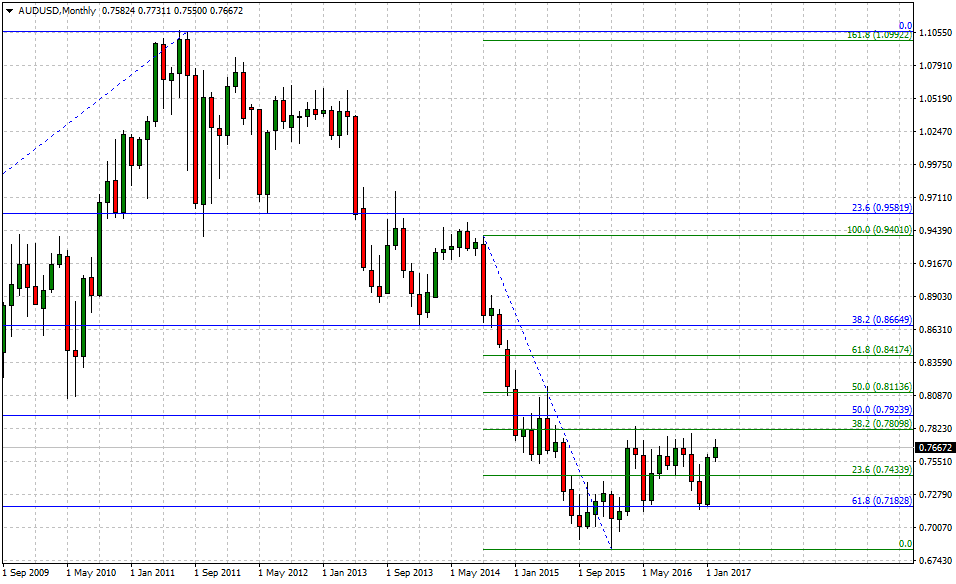

On the long term view, if 0.7834 (high April 2016) is in fact, a relevant top, then the upside is limited at 0.7809 (short-term 38.2% Fib). Furthermore, if the RBA has 'no ammo' nor solid reasons to increase rates in 2017, the interest rate advantage should decrease organically as the Federal Reserve continues increasing rates with 3-hikes in the next 16-months. To the downside, supports are aligned at 0.7433 (short-term 23.6% Fib), later at 0.7182 (reverse long-term 61.8% Fib) and below that back to 0.6826 (low Jan.2016).

AUD/USD analysis: holding ground, but sellers above 0.7700 still strong

© 2013 "FXstreet.com. The Forex Market" Todos los Derechos Reservados. Todos nuestros esfuerzos están destinados a proporcionar información precisa y completa. Aún así, con los centenares de documentos disponibles, a menudo publicados con poco margen de tiempo, no podemos garantizar la falta de errores en los mismos. Cualquier publicación o redistribución de contenido de FXstreet.com está absolutamente prohibido sin el consentimiento previo por escrito de FXstreet.com.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.