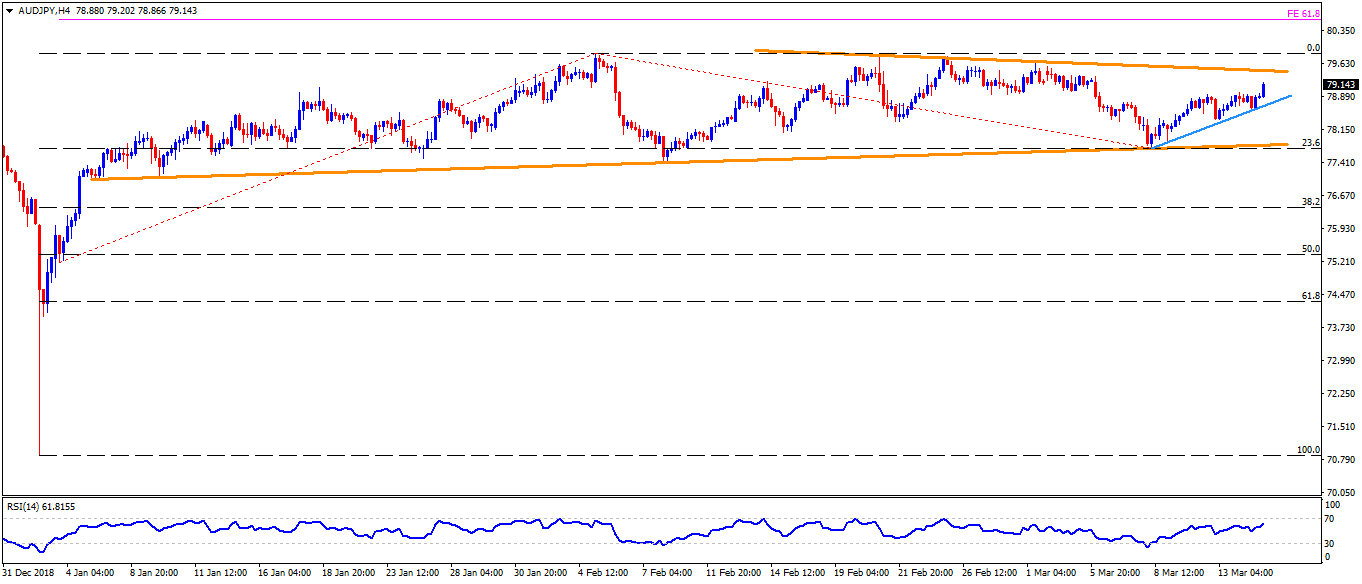

- AUD/JPY trades near 78.20 ahead of the Bank of Japan’s (BoJ) monetary policy meeting on early Friday.

- The quote recently confirmed inverse head and shoulders bullish formation by clearing 79.00 on hourly chart and is presently rising toward three-week-old descending trend-line, at 79.50.

- Should prices manage to cross 79.50 immediate upside barrier, February month highs near 79.80/85 could act as buffers prior to highlighting 80.00 round-figure.

- Also, 61.8% Fibonacci expansion (FE) of its early January – March moves, around 80.60, may gain buyers’ attention post-80.00.

- Alternatively, pair’s dip beneath 79.00 can take rest on a weeklong upward sloping support-line at 78.60, a break of which may extend the pullback to 78.30 and 78.00.

- However, an ascending trend-line stretched since January 07 can challenge sellers around 77.70, if not then 77.00 can come back on the chart.

AUD/JPY 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 79.16

Today Daily change: 25 pips

Today Daily change %: 0.32%

Today Daily Open: 78.91

Trends:

Daily SMA20: 78.97

Daily SMA50: 78.58

Daily SMA100: 79.71

Daily SMA200: 80.55

Levels:

Previous Daily High: 78.98

Previous Daily Low: 78.57

Previous Weekly High: 79.65

Previous Weekly Low: 77.72

Previous Monthly High: 79.85

Previous Monthly Low: 77.44

Daily Fibonacci 38.2%: 78.82

Daily Fibonacci 61.8%: 78.73

Daily Pivot Point S1: 78.66

Daily Pivot Point S2: 78.41

Daily Pivot Point S3: 78.25

Daily Pivot Point R1: 79.07

Daily Pivot Point R2: 79.23

Daily Pivot Point R3: 79.48

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0700, eyes on US first-quarter GDP data

EUR/USD hovers around the 1.0700 psychological level on Thursday during the early Thursday. The modest uptick of the major pair is supported by the softer US Dollar. Later in the day, Germany’s GfK Consumer Confidence Survey for April will be released.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.