- Apple shares remain rangebound above 9-day moving average.

- AAPL should see Nasdaq pump as yields dump.

- Price remains stable, lags behind FAANG stocks.

Apple shares continue to remain steady and sideways as the Nasdaq gears up for a push to new record highs. The S&P 500 is already en route but the Nasdaq has a little more work to do. The benign yield environment continues as US 10 Year yields dip under 1.5% on Wednesday which should underpin growth and Nasdaq stocks.

Facebook is the one FAANG name to set new highs on Tuesday while Apple lags behind. This occurred despite AAPL producing stunning earnings in late April and announcing an increase to its dividend and buy-back programs. Apple shares have used the long-term 200-day moving average as support recently and have not been trading below its 200-day moving average since the pandemic crash in March 2020.

Forecast for AAPL price

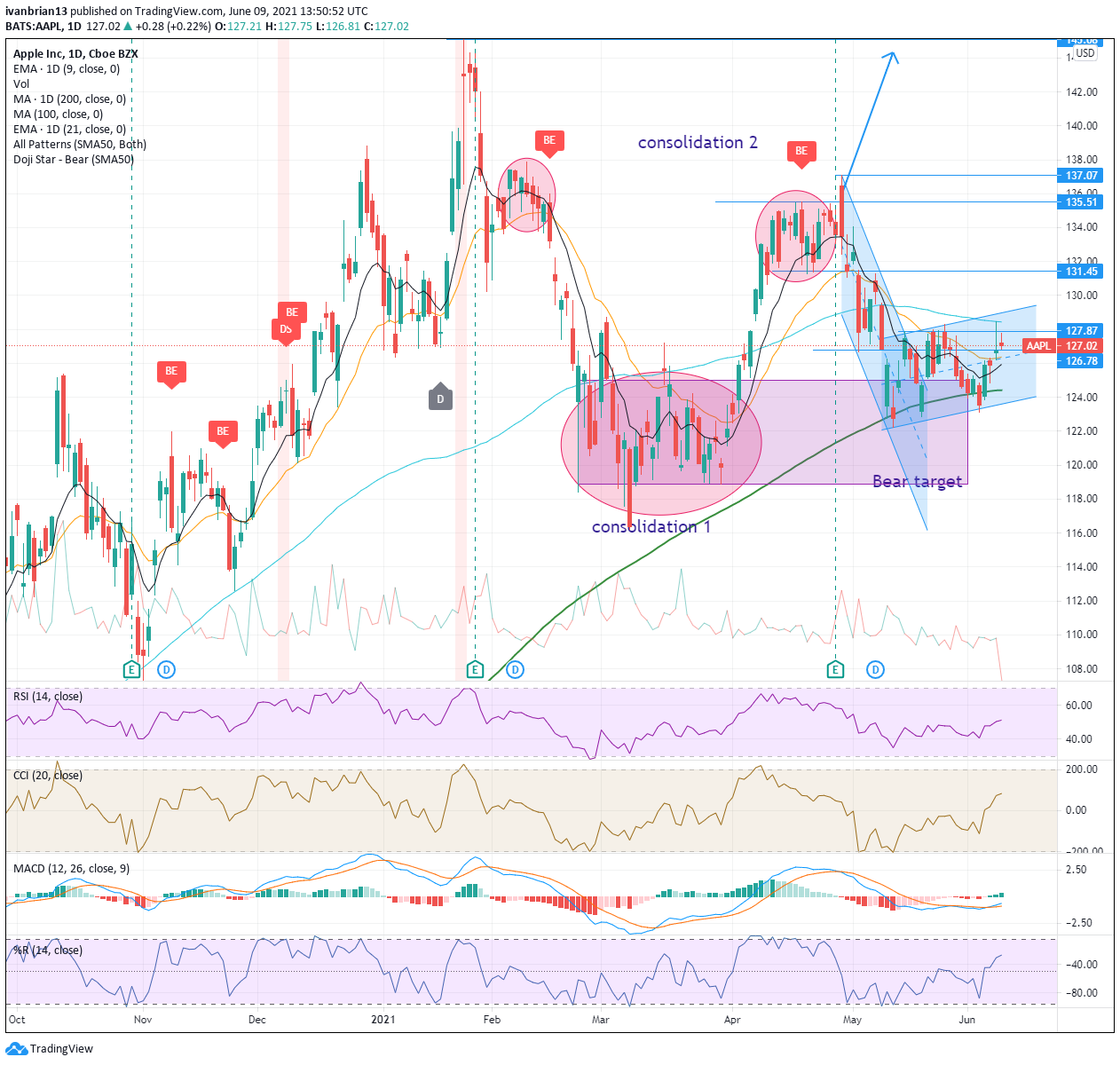

Facebook (FB) powers on but Apple lingers despite both companies producing strong earnings results. Apple did have a brief post-earnings surge but has since slipped more than 10% below. The 200-day moving average at $124.42 remains as key support and this area is a strong support zone as identified on the chart. Holding above the 9 and 21-day moving averages should encourage short-term traders and entice further buyers in. The broad market looks inviting with the S&P 500 making new highs and the Nasdaq in a bullish setup.

AAPL breaking the $131.45 resistance level remains key for bulls to end the series of lower highs and lows and set up a test of new highs. The momentum oscillators, Relative Strength Index (RSI) and Commodity channel Index (CCI), are hopefully ahead of the game in the potential of price breaking out of the downtrend. All that is needed is for the share price to confirm this, which places our first target for bulls at the upwards channel at $129. Any dips toward $120 can be used as buying opportunities if the trend remains intact and as always, use careful risk management.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.