- AMC shares drop on Tuesday as Citi keeps a $2 target on AMC.

- AMC holder Wanda Group reducing its stake in AMC.

- AMC to open all cinemas in California by Friday.

Update March 16: Citi maintained its sell rating on AMC shares after Q4 results saying the shares are overvalued. Also, Wanda group, AMC's largest shareholder has reduced its stake from 23.8% to under 10% according to AMC filings with the SEC on March 12.

Update March 15: Shares in AMC continue to receive investor support as AMC announced it plans to open most of its LA theatres by March 19. Shares in AMC are trading $13.92 up 25% on Monday.

Stay up to speed with hot stocks' news!

AMC shares stayed calm amid the market furore on Friday as strong jobs report sent indices swinging wildly. Inflation fears initially sent the market lower and Tech stocks again got hammered but the second half of Friday saw a remarkable recovery as Tesla and others rallied sharply.

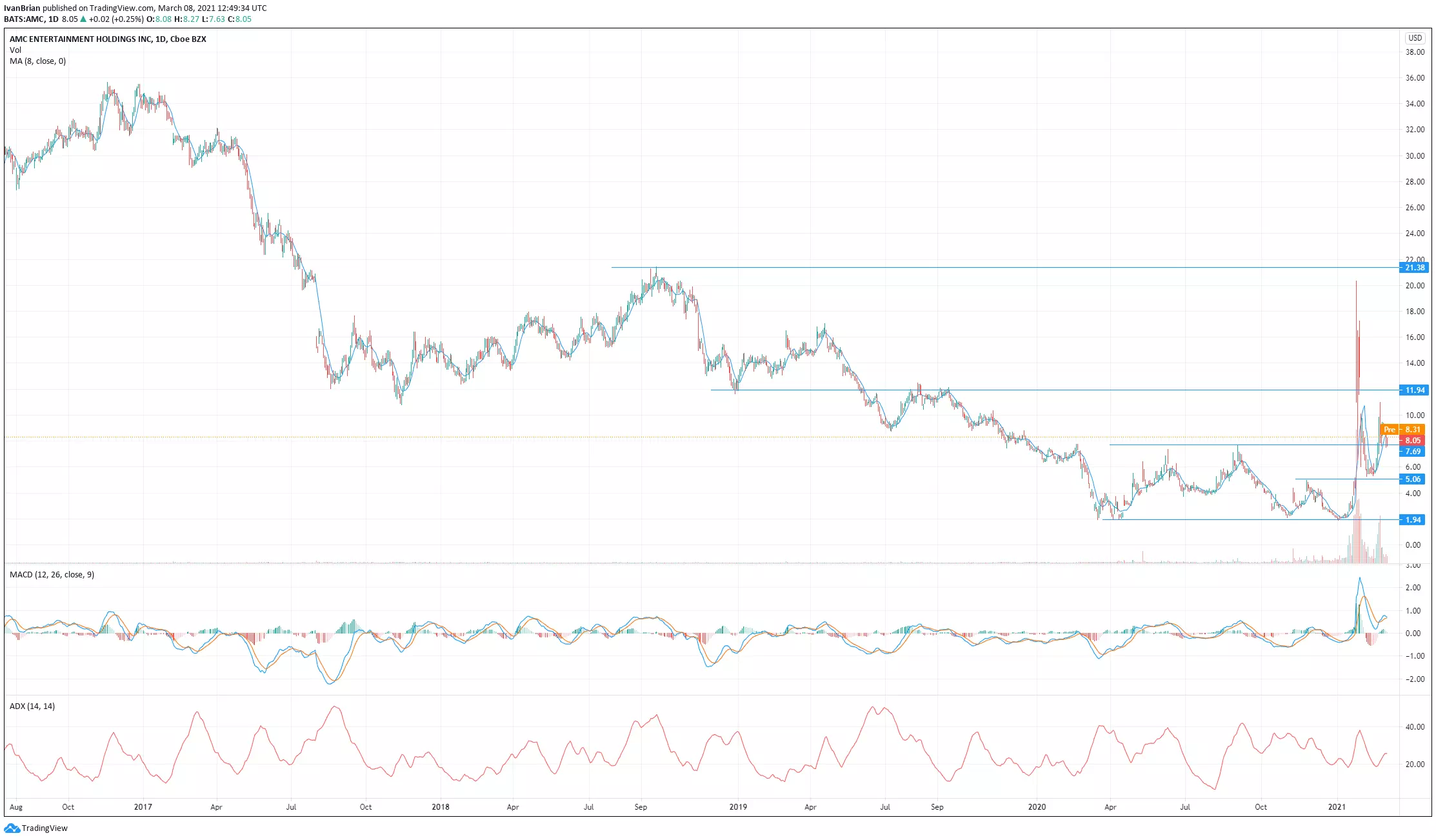

AMC shares closed at $8.05, a gain of 0.25%. The range from high to low was $7.63 to $8.27, a calm day by recent standards.

AMC operates cinema theatres globally and understandably has suffered as a result of the pandemic. AMC operates in the US and Europe with theatres in 44 US states and 13 European countries.

AMC Stock News

AMC is in a strong cash position having raised cash during the crisis to fund future operations. In some respects, the spike in AMC shares on the back of strong retail interest may have helped the company to survive as it enabled AMC to raise capital.

On January 25 AMC "announced today that since December 14, 2020, it has successfully raised or signed commitment letters to receive $917 million of new equity and debt capital. This increased liquidity should allow the company to make it through this dark coronavirus-impacted winter". Adam Aron, AMC CEO and President, said, “Today, the sun is shining on AMC. After securing more than $1 billion of cash between April and November of 2020, through equity and debt raises along with a modest amount of asset sales, we are proud to announce today that over the past six weeks AMC has raised an additional $917 million capital infusion to bolster and solidify our liquidity and financial position. This means that any talk of an imminent bankruptcy for AMC is completely off the table.”

Why is AMC stock going up? Well because of this it meant that AMC would be able to survive the pandemic when many "shorts" were betting it would not". This led to a large spike in prices as AMC shares had to be bought back by shorts to cover their positions. Retail frenzy also reached a fever pitch in AMC and Gamestop around this time. All this led to a huge AMC share price rebound from below $6 to over $20 as retail traders piled into the stock.

But why did AMC shares drop shortly after? Well, the whole debacle over the restrictions placed on purchases of hot retail stocks by a number of retail brokerages impacted Gamestop, AMC, and other related meme stocks. While these restrictions did not last long, AMC shares dropped from a high of $17.25 on February 1 to a low of $6 on February 2.

It wasn't until near the end of February that AMC shares rebounded as New York announced it was allowing partial reopening of movie theatres.

Also in February, AMC made a regulatory filing on Feb 23 with the SEC approving bonuses for top executives and eligible employees. AMC said

"On February 23, 2021, the Compensation Committee of the Board of Directors (the “Committee”) of AMC Entertainment Holdings, Inc. (the “Company”), in consultation with the Company’s independent compensation consultant, approved supplemental special incentive cash bonuses (the “Bonuses”) in lieu of any payments under its 2020 Annual Incentive Plan (“AIP”). The Bonuses are in addition to the initial special incentive bonuses awarded in October 2020, as disclosed in the Company’s Quarterly Report on Form 10-Q filed with the SEC on November 4, 2020. The Bonuses were approved in order to recognize the extraordinary efforts of employees to maintain the Company’s business and preserve stockholder value during the COVID-19 pandemic, encourage continued engagement and retention, and incentivize our management and employees during the continuing and unprecedented difficult business conditions.

AMC Stock forecast

AMC announced on Tuesday, March 2 that it will release Q4 2020 results after the market closes on Wednesday, March 10. Data from Refinitiv shows a loss of $3.61 per share is expected. AMC is expected to post a fall in revenue from $1.45 billion to $155.2 million for Q4 2020.

Q4 results will obviously show the full effects of the covid-19 pandemic and it is more forward-looking statements that investors are likely to focus on. Recent news on the reopening of New York cinemas will be closely watched for attendance extrapolation into future revenue predictions. Commentary on reopening timelines, cash burn, etc will all be closely watched.

Should I buy AMC stock?

Well, the ideal would be to wait for results and watch carefully the outlook guidance and statements over other states and countries reopening timelines. There is a conference call taking place after the results release, which will give more clarity on the details and outlook.

Technically the break out of the sideways channel means $7.69 needs to be held as a break is bearish bringing sub $6 into the sights. Consolidating above $7.69 gives time to prepare a fresh challenge higher with the $12 area is the first target.

Previous updates

Update 2 March 11: AMC shares opened higher on Thursday and are currently trading at $10.33, a gain of 5%. AMC shares had earlier traded as high as $11.30 in early trade during Thursday's pre-market. Investors remained positive on AMC despite Q4 results showing a huge drop in revenue. AMC gave a positive outlook on the post-earnings conference call.

Update March 11: Shares in AMC shrugged off Q4 results showing the devasting effect of the pandemic on the cinema business and instead looked forward to theatre reopening. Q4 Earnings Per Share (EPS) was -$3.15 slightly ahead of estimates and revenue fell nearly 90% to $162.5 million, ahead of estimates for $142.4 million. On the conference call, AMC said the opening up of theatres and the release of movies such as Disney's Black Widow, Top Gun, and other delayed releases would push sales up for 2021 according to Reuters. CEO Adam Aron said "For all the talk of the steps we at AMC have taken to bolster our position, the real salvation of our company will be because of vaccination," "Our focus is no longer on survival, but now has turned instead to directing a surge in movie-going and on the recovery of AMC."

Shares in AMC are up 7% in Thursday's pre-market.

Update March 10: AMC Entertainment Holdings Inc (NYSE: AMC) has surged by some 12% to near $12 early on Wednesday, as traders anticipate the firm's fourth-quarter earnings after markets close. Apart from hopes for robust profits, hopes for America's reopening are rising. Alaska announced that all people aged 16 and higher are eligible to receive COVID-19 vaccines – an acceleration of the immunization campaign. Moreover, retail traders on Reddit's WallStreetBets forum are scooping up "meme stocks."

Update March 9: AMC Entertainment Holdings Inc (NYSE: AMC) is jumping toward $10 on Tuesday, an increase of around 6%. The embattled movie theater company is rising for the second consecutive day, hitting the highest since late January. The rises on Monday came along the jump in "meme stocks" while broader equity markets were struggling. Tuesday's increase comes despite an upswing in share markets. Tension is mounting ahead of Wednesday's all-important earnings report from the Kansas-based firm.

Update March 8: AMC Entertainment Holdings Inc (NYSE: AMC) has been rising on Monday, up by around 5% to $8.45 at the time of writing. The embattled movie theater company's equity is up for the second consecutive day and eyes the $9 level hit earlier this month as the upside target. Tensions are mounting ahead of AMC's earnings figures due out on Wednesday, with veteran and newbie investors vying to be heard.

Update March 9: AMC shares rallied sharply on Monday as equities rallied across the board and further opening up announcements boosted AMC and sector peers. Disney was also strong as California reported theme parks can re-open on April 1. AMC was also boosted as Wedbush analyst Michael Pachter doubled the price target from $2.50 to $5, Benzinga reported. AMC is to release results tomorrow Wednesday, March 10. EPS is estimated to be -$3.32 and revenue is expected to be $142.35 million, estimates from Refinitiv.

Update March 10: AMC wasn't left behind during Tuesday's rally and ended the day with a tidy 13% gain, closing at $10.50. AMC will release its Q4 2020 earnings after the market closes on Wednesday with expectations low due to the pandemic. Data from Refinitiv shows a loss of $3.61 per share is expected. AMC is expected to post a fall in revenue from $1.45 billion to $155.2 million for Q4 2020. Outlook and cash burn will be the key statements. A conference call follows the release of earnings.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.