- AMC shares one of the meme stocks of 2021.

- AMC is due to release Q4 earnings on Thursday, February 25.

- AMC shares bounced as New York reported to be opening theaters.

Update March 1: AMC Entertainment Holdings Inc (NYSE: AMC) has kicked off the new week and the new month with a rise of around 10% to just under $9. Shares of the embattled movie theater company are still below the late February closing high of $9.09, which serves as resistance. Over the weekend, the US FDA approved the Johnson and Johnson single-shot COVID-19 vaccine. Doses are being rolled out and the first inoculations of this third vaccine are due out on Tuesday. Any addition to America's firepower against coronavirus brings forward a return to normal and contributes to getting people back to see films.

AMC shares have been a /wallstreetbets favourite for 2021, perhaps only Gamestop has been more popular among retail traders this year. AMC describes itself as "the largest movie exhibition company in the United States, the largest in Europe and the largest throughout the world with approximately 960 theatres and 10,700 screens across the globe". "AMC operates among the most productive theatres in the United States' top markets, having the #1 or #2 market share positions in 21 of the 25 largest metropolitan areas of the United States. AMC is also #1 or #2 in market share in 9 of the 15 countries it serves in North America, Europe and the Middle East." So as from the company's own website it is indeed a behemoth in the entertainment and consumer leisure space.

AMC Share Price News

So understandably the pandemic had a huge impact on AMC business. Cinemas and theatres across the world have been largely shuttered for nearly a year now as the pandemic rages on. Accordingly, AMC was heavily targeted and the shares slid in 2020 from a high of near $8 to below $2. More pertinent for retail traders was the short interest in the stock, which while not as high as Gamestop, was still significant.

The rally caught fire in late January as retail traders piled into the stock driving it through $2 and on to above $20 in a matter of days. While this move may have seemed overdone it did help AMC to actually survive the pandemic.

On January 25 AMC announced "it has successfully raised or signed commitment letters to receive $917 million of new equity and debt capital. This increased liquidity should allow the company to make it through this dark coronavirus-impacted winter. Of this $917 million in much-welcomed monies, AMC has raised $506 million of equity, from the issuance of 164.7 million new common shares, along with the previously announced securing of $100 million of additional first-lien debt and the concurrent issuance of 22 million new common shares to convert $100 million of second-lien debt into equity."

On January 25 Adam Aron, AMC CEO and President, said, “Today, the sun is shining on AMC. After securing more than $1 billion of cash between April and November of 2020, through equity and debt raises along with a modest amount of asset sales, we are proud to announce today that over the past six weeks AMC has raised an additional $917 million capital infusion to bolster and solidify our liquidity and financial position. This means that any talk of an imminent bankruptcy for AMC is completely off the table.”

So the retail-led rally did have a societal good in that AMC was able to raise funds to survive the crisis. So far so good.

AMC Stock Forecast

So where to from here. Well, recent economic developments would seem to give hope to AMC shareholders. It was reported on Monday that New York was planning to reopen movie theaters with reduced capacity. AMC posted that "In response to the announcement that movie theatres can reopen in New York City, Adam Aron, CEO and President of AMC Entertainment (NYSE:AMC), today issued the following statement"

"Governor Cuomo's announcement that movie theatres can reopen in New York City in the first week of March is another important step towards restoring the health of the movie theatre industry and of our Company. We are excited to announce that AMC, the largest movie theatre exhibitor in New York City, will reopen all 13 of our theatres in New York City beginning March 5.

Also on the horizon are the recent developments in the UK which are well advanced in its vaccination program announcing plans to re-open its economy. The US vaccination program also continues to expand and hopefully by summer things will begin to look a lot brighter for AMC and perhaps even allow for the traditional summer blockbuster season.

AMC Earnings

AMC is due to announce Q4 2020 results on Thursday, February 25, although this is not confirmed. It is possibly too early in the reopening cycle to see any feed though to results so it is outlook comments and statements around liquidity etc that will carry the most weight with investors. Cost control will also be closely watched to see how much cash AMC is having to burn through to see out the pandemic.

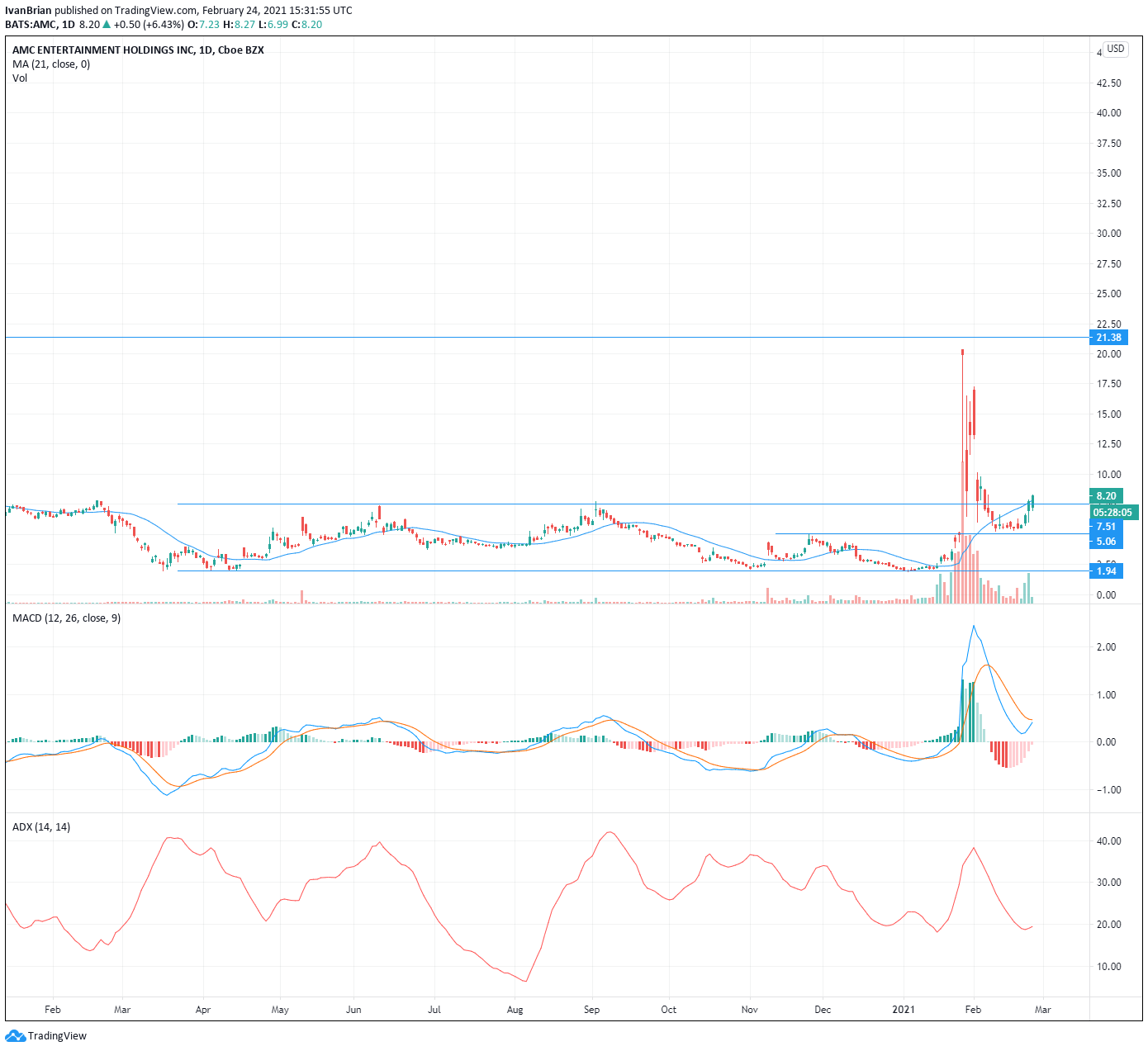

AMC Technical analysis

AMC shares have been hugely volatile in 2021 and as can be seen from the volume profile interest is much higher than average. In the classical sense, a powerful breakout from the long-term channel is bullish but the failure to hold and consolidate above the channel top around $7.71 (Sept 2020 high) has made the bullish case less clear. The next level to retake for bulls is the 21-day moving average. Beyond that, the next resistance would be the low from July 2019 at $8.73. A pullback would need to hold $5 for the bullish trend to hold.

Previous updates:

Update, February 25: AMC Entertainment Holdings Inc (NYSE: AMC) is set for a second day of double-digit rises. After closing Thursday's session at $9.09, an increase of 18.05%, another increase is on the cards according to premarket data – nearly 14% to $10.20. Americans are set to return to theaters as another vaccine will soon become available to Americans. The FDA is on course to approve Johnson and Johnson's COVID-19 single-shot solution in the next few days. More importantly for the short term, "meme stocks" – those touted on Reddit's WallStreetBets forum, are surging again. See Gamestop (GME) Stock Price and Forecast: Soars 273% as “diamond hands” trigger meme stock comeback

Update February 26: AMC Entertainment Holdings Inc (NYSE: AMC) has kicked off Friday's session with an increase of some 1.40% to $8.40 at the time of writing. Share of the embattled and veteran movie-theater firm is seemingly trading like a "normal" company, advancing with the broader stock market. That contrasts its previous price action, dominated by the mood on Reddit's WallStreetBets forum. It is essential to note that the frenzy in meme-stocks – and the bond-rout – episodes are far from over, and that may trigger additional volatility.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.