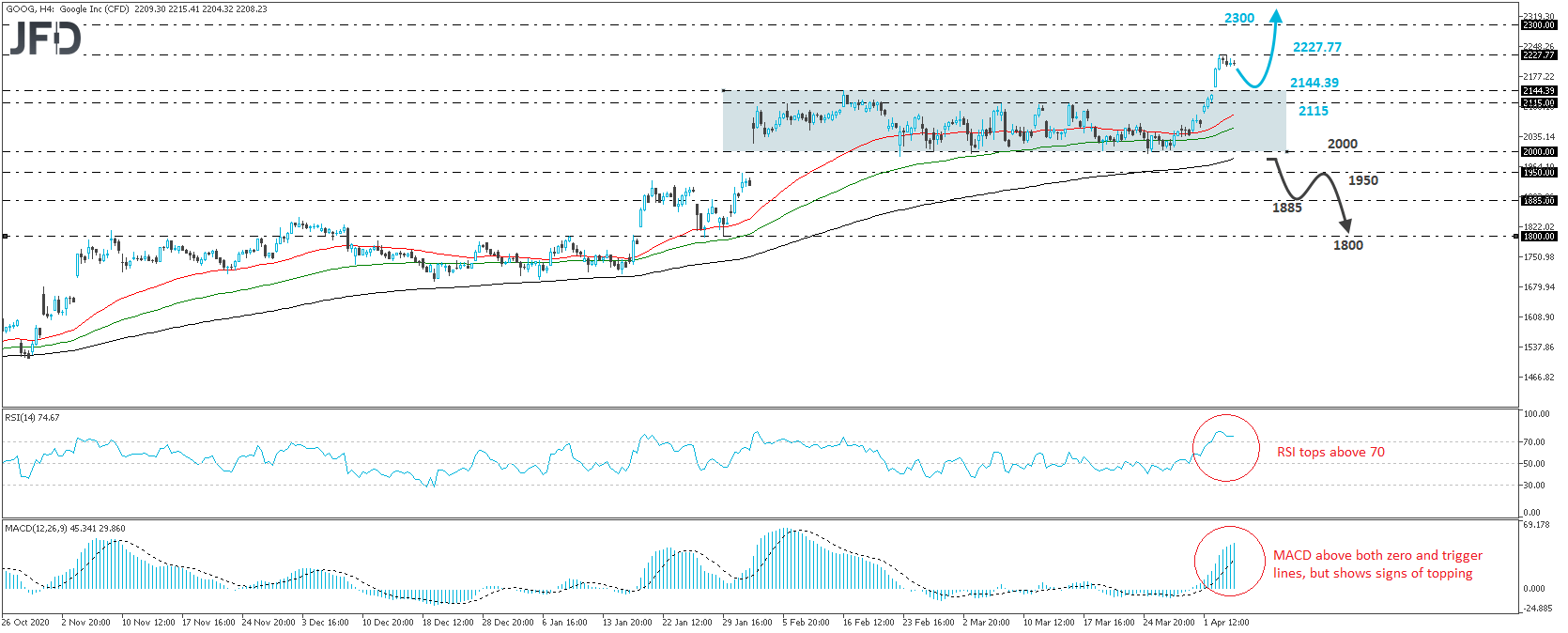

The Alphabet Inc. Class A stock (NASDAQ: GOOGL) surged on Monday, after opening with a positive gap above its prior record of 2144.39. The stock hit a fresh all-time high at 2227.77 and yesterday, it pulled back somewhat. Monday’s move also signaled the upside exit out of the sideways range that’s been in play since February 3rd, between the psychological round zone of 2000 and the 2144.39 level. Bearing also in mind that the broader trend has been to the upside since March of last year, we would expect more advances.

A clear break above 2227.77 would take the stock into uncharted territory and perhaps aim for the next psychological zone, at 2300. If market participants are not willing to stop there, we may experience extensions towards the 2400 area. However, given Monday’s steep rally, we could see yesterday’s setback extending for a while more, perhaps for the price to test the 2144.39 level as a support this time.

Looking at our short-term oscillators, we see that the RSI topped above its 70 line, while the MACD, although above both its zero and trigger lines, shows signs of topping as well. Both indicators detect slowing upside speed and support our view that some further retreat may be on the cards before the next leg north.

In order to start examining the bearish case, we would like to see a dip below the aforementioned range’s lower bound, at 2000. Such a move would confirm a forthcoming lower low on the daily chart, and may initially target the 1950 zone, marked by the high of February 2nd. Another break, below 1950, could see scope for declines toward the 1885 hurdle, marked by the inside swing high of January 28th, the break of which could set the stage for the 1800 area, defined as a support by the lows of January 27th and 29th, as well as by the inside swing high of January 8th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.