AT&T Inc. is the holding company of an American multinational conglomerate registered in Delaware but headquartered in Whitacre Tower in Downtown Dallas, Texas. It is the world’s largest telecommunications company and the second-largest mobile phone service, provider. The company is scheduled to report its Q2 2021 earnings report on July 22, 2021, with a Consensus EPS forecast of $0.8 with a “hold” rating.

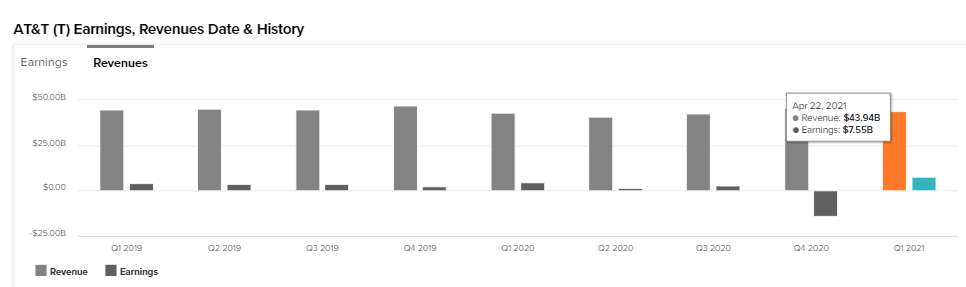

source: TIPRANKs

For the first quarter of the year ended March 31, AT&T reported total revenue of $43.94 billion, an increase of 2.6% compared with $42.78 billion in the same quarter a year earlier. Diluted earnings per share during the quarter was 86 cents, up from 84 cents a year ago. Net profit for the first quarter of 2021 was $7.94 billion, up significantly from $4.96 billion in the first quarter of 2020, driven primarily by higher subscription, advertising, and content revenues, which partially reflected the recovery from the previous year’s COVID-19 impact and lower other revenue.

What investors need to consider now and in the future is AT&T’s business path, which sees mobility, fiber, and 5G as the path to profitable growth in 2021, as the operator continues to refocus efforts on its core telecommunications business. AT&T hit several highs in its financials in the last quarter, with growth in postpaid phone network additions and an increase in HBO Max subscribers. Postpaid phone subscriptions continue to be a key area of growth for AT&T amid declines in several other legacy businesses.

Business wireline service revenues continued to decline, dropping 3.64% during the first quarter of 2021 to $6.05 billion compared to $6.27 billion last year, as businesses shifted to more advanced IP-based offerings. AT&T has seen increased interest around strategic and managed services – AT&T’s most advanced business offering, including VPN and security – over the past few quarters.

AT&T sees 5G as one of the main pathways to profitable growth this year, with its 5G network now covering 230 million Americans in 14,000 cities and towns and AT&T 5G+ now available in 38 US cities. In addition to 5G, fiber, another important pathway for growth for carriers, is getting stronger. AT&T says that more than 650,000 US business buildings are illuminated with fiber from AT&T.

The COVID-19 pandemic weighed heavily on AT&T’s finances last year, but they are now currently on the rise as the company begins to see a recovery from the pandemic. The increase in revenue for smartphones is also higher at relatively high prices this quarter compared to the same quarter last year when retail stores temporarily closed due to the pandemic.

Stock price

Shares of AT&T Inc. rose 0.85% to $28.45 on Thursday, above support at $27.99, the low seen last February. Yesterday’s trading was a positive trading session for the stock market, with broad weakness in the USA500, USA100, and USA30. The stock performed mixed when compared to some of its competitors on Thursday, such as Verizon Communications Inc. (+0.37% to $56.52), while Walt Disney Co. barely moved for 3 days (+0.13% to $183.20).

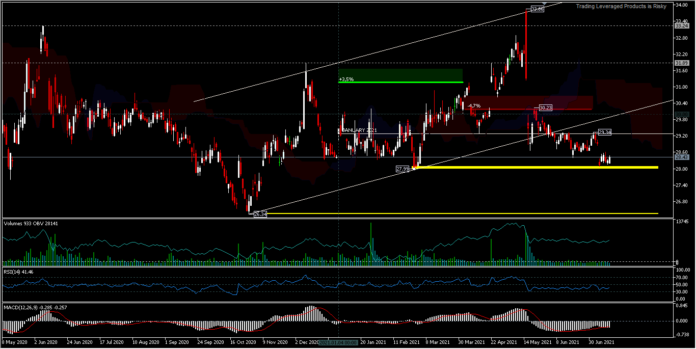

AT&T Inc. daily

The daily bias is still showing on the downside but has been stuck at the $27.99 support level for the last 6 trading days. Further gains will target $29.34 which was the opening price in January 2021. However, a move below the $27.99 support will create selling pressure to the strong $26.34 support. In a relatively quiet trading session, which is read from tick volume, OBV is flat and the RSI and MACD are in the sell zone that has lasted for a long time, and it will take a strong catalyst to end the ongoing consolidation. If there is a strong rebound from this fairly low stock price, it could be a bright start for AT&T, but it all also depends on the upcoming earnings report. If the results are good, it will of course boost the value of the equity going forward.

Note: Analysts on Wall Street suggest a consensus price target of $31.24, implying a 9.09% increase against the share’s recent value, with extreme values ranging from a low price of $23.00 to and a high price of $37.00.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.