I’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically. Real money…real trades.

Options trading is really fascinating, and it’s a great way to make money, and I think it is very important to know when to take profits, especially if you like trading The Wheel as I do.

So the question is, when should you take profits when trading options? How exactly do you figure this out, is there a formula for it?

In this article, I’ll share some guidelines for how and when you should take profits on an option trade. We will answer the question of whether you should let options expire or take profits early.

I will show you some very specific examples of two trades that I have going on right now (at the time of this writing on March 17th, 2021). One of them, I took profits today, and the other one I’m still holding on and I will show you exactly why.

How To Calculate Profits On Options

Firstly, let’s talk about how to calculate profits on options. In order to address this, there are two types of options traders.

One type of options trader are ones that are buying options, and the other, which I feel is very lucrative, and this is what I’ve been doing for a long time, is selling options and collecting premium.

I want to actually talk about selling options and receiving premium, because this is, as I said, what I’ve been focusing on recently with trading The Wheel Strategy.

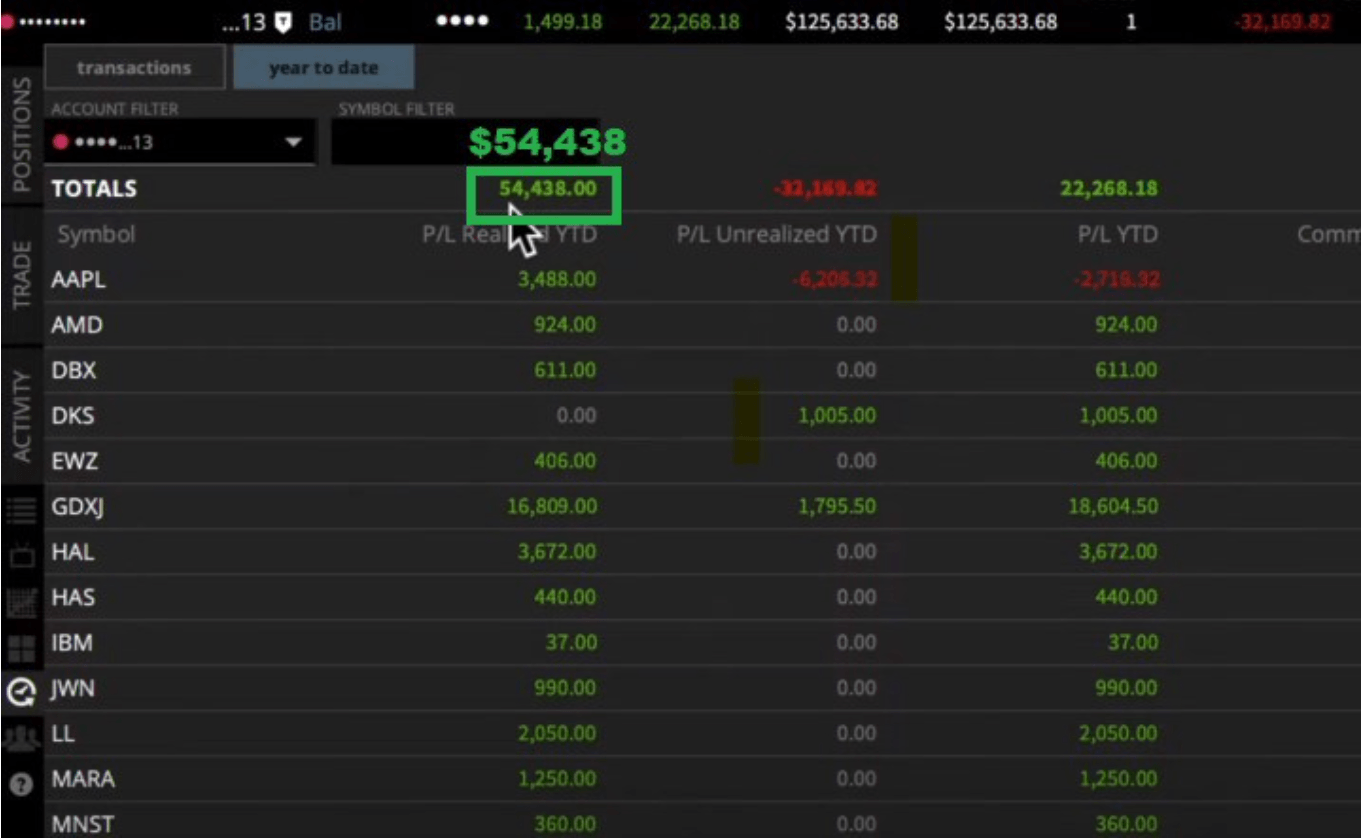

My year-to-date profits on this account so far are more than $54,000 selling premium on options, and I’ll show you exactly how to do this. So when selling options, you’re receiving premium, and for me, the most important metric here is the so-called premium per day or PPD.

MARA Example

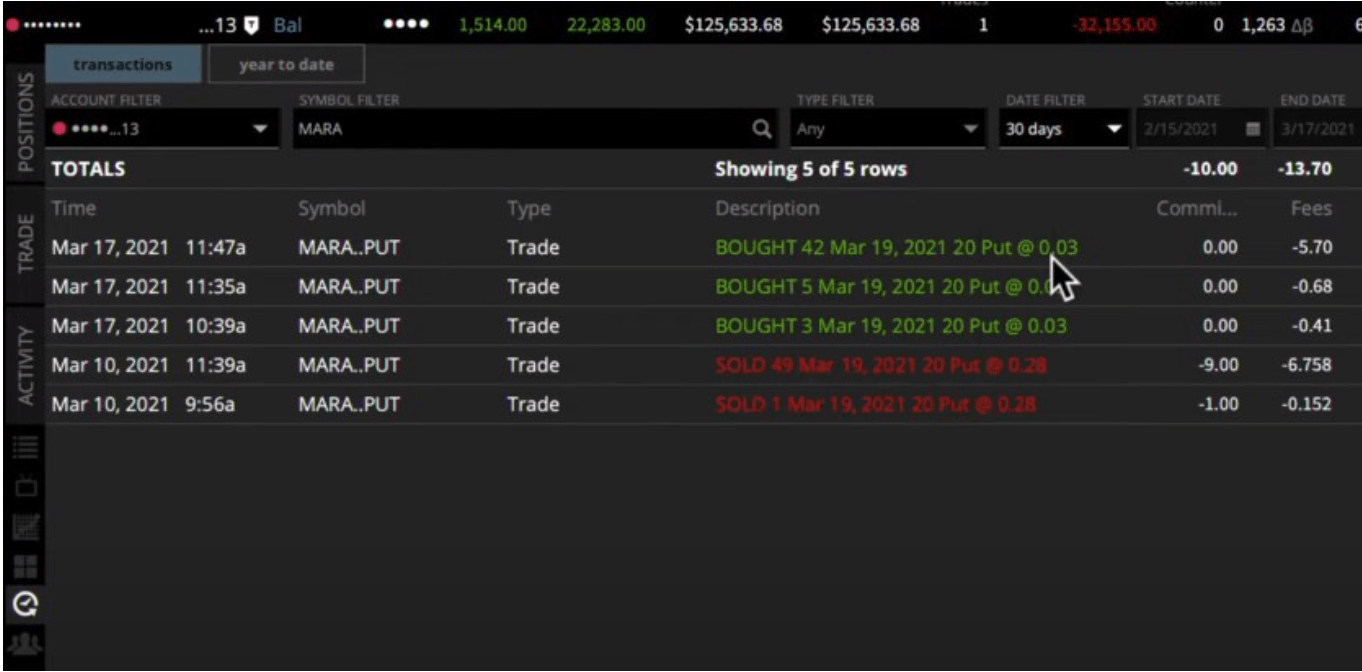

The first example that I want to give you is my position with MARA. Looking over my transactions with MARA over the last 30 days.

I sold puts at a strike price of 20, and for this, I received $0.28 in premium per option that I sold. Now options come in 100 packs, so this means that per option I made $28.

Now, in this specific example, I sold 50 options total, so this means that I’m receiving a premium of $1,400. I put this trade on March 10th, and these options expired on 3/19. This is $1,400 in premium in 9 days. This comes to $155.55 in premium per day (PPD). Now this includes weekends.

My rule is I’m buying back the option when I can get 90% of the maximum profits, but there’s an exception to this rule. First, let me tell you what that means.

So again, I sold each contract for $28, for $0.28. The idea is to buy back the option at $0.03, and this is exactly what I did today (March 17th). So we have another two days to expiration.

So today, I bought back a total of 50 contracts at $0.03, and by doing so I made $0.25 in profits on MARA. Now, this is where again, we’re looking at 50 contracts, times $25, so this is $1,250. I was in this position for 7 days.

So $1,250, divided by 7 days, means that I made $178.57 a day. Let’s just round to $179 per day. As you can see, $179 is more than the $155.55 that I planned per day.

Now let’s think about it. If I would keep MARA right now, if I would keep this option until expiration, but what would happen? I would make an additional $150 in three days. This means that now my premium per day is only $50 per day.

This doesn’t make sense to me because this here is actually bad, because my plan was to make $156 per day, and I was able to make $179 per day by buying the options back.

If I would hold on to this trade and let it expires worthless. So this is where here, and let it expire worthless, right? This is what would happen. I would make an additional $150 in three days and the premium per day would only be $50. That does not make sense to me at all.

This is why here in MARA, it made sense to buy back the put option because by doing so, it frees up buying power meaning that now I can sell more puts. So the idea here is that I’m selling more puts and making more money on the new puts than I would make holding on to MARA.

DKS Example

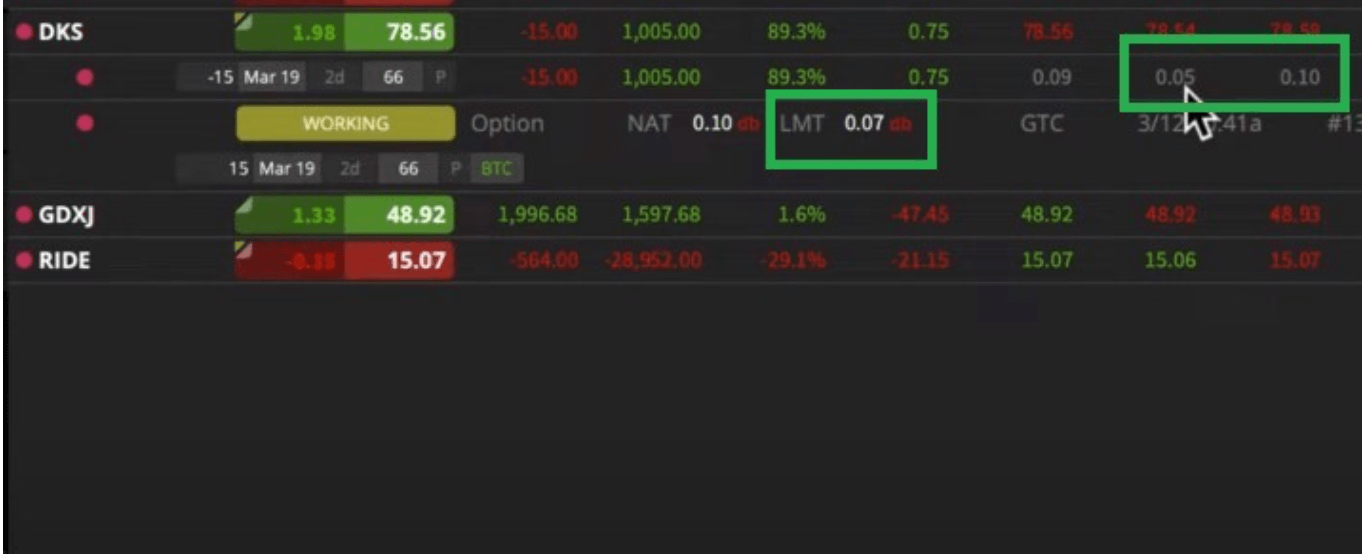

Let’s go over another example with a position I have right now with DKS. I sold the 66 strike on March 10th. I sold 15 of them and I received $75 in premium. 15 contracts times $75 comes to $1,125.

So let’s do the math right now and see if it makes sense to close this trade today (March 17th) or if we should keep it, and we’re using very similar logic here.

So we sold the 66 put expiring March 19th, and we received $75 per contract for it, $1,125 total. We then divide this by 9 days to get to our premium per day, which is $125.

So right now, on March 17th, let’s see how much DKS is still worth. Right now, the bid/ask for DKS is $0.05 over $0.10, and that’s really interesting because I want to buy it back at $0.07.

Let’s say right now, if I would place an order right now, I could buy it back at $0.10. Should I do it? If I did this, I would make $75, minus $0.10 ($10 per contract), which is $65 per contract. For all 15 contracts, I would make $975.

We find our PPD by dividing $975 by 7 days, which comes to $139. So if I really wanted to, and if I needed to free up some buying power, I could do this.

But let’s see what happens if we hold this for a few more days. So if we hold DKS until expiration, we can make an additional $150. It might actually make sense to close it out because $150 over the next three days does not make a lot of sense.

When I looked at the option earlier, DKS suddenly jumped from 78 to almost 79. This is a 10% jump in 30 to 45 minutes. You can see on the chart where we opened this morning.

First, we went down, and then we went a little bit up, and then we were hovering right around where we opened. Earlier this morning, the DKS put was trading at $0.25.

So the question is earlier this morning, would it have made sense to close it? Earlier today on March 17th, I could have bought it back for $0.25. So that wouldn’t have made sense, right? Because then if I’m buying it back for $0.25, I would only make $0.50.

So this here, $0.50, this is then $750 in seven days, and if we divide $750 by 7 days, this is $107 premium per day. As you can see, the $107 premium per day is less than what I expected. If I would hold DKS to expiration, we can make an additional $0.25, $25 times 15 contracts is $375.

Now, if you take the $375 in 3 days, that would be $125 premium per day. So when I’m getting $125 premium per day, this is when it does not make sense to sell it just yet.

Should You Take Profits Early?

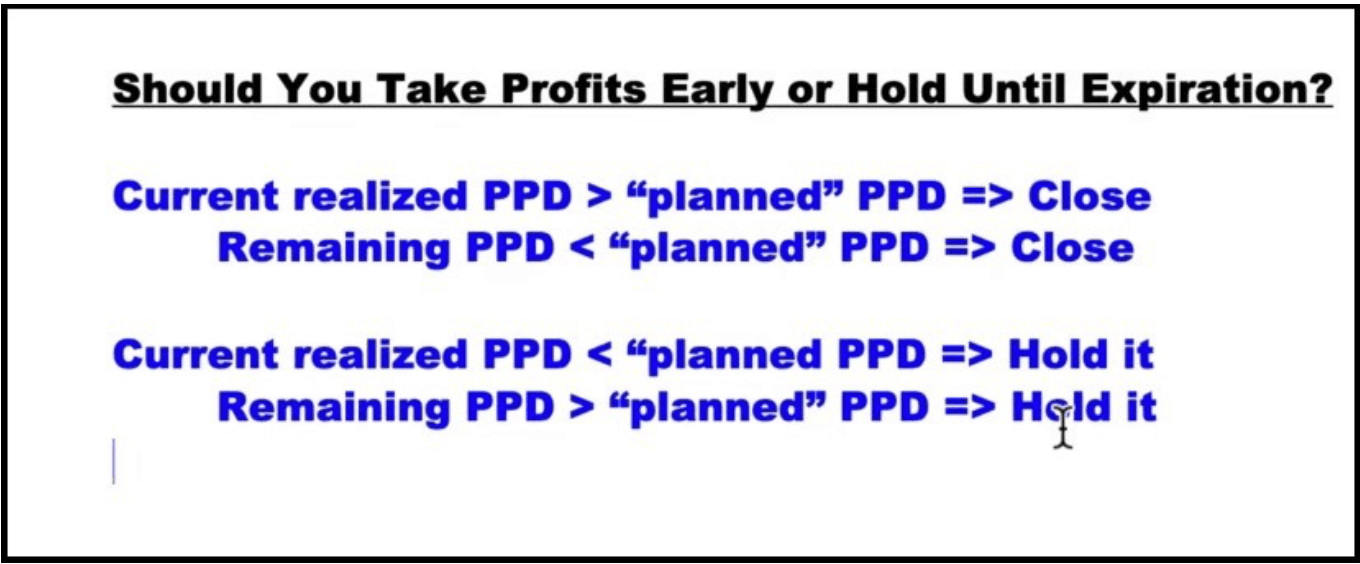

So this is the important thing because the question always is, do you take profits early, or hold until expiration? Well here’s my formula for this.

So I want to give you a very specific formula that you can use if you want to.

If the current realized premium is a premium per day, PPD, is larger than the planned PPD, this means close it out early.

If the remaining premium per day is smaller than the planned premium per day, close it.

Only if the current realized premium per day is smaller than the planned premium per day, in this case, hold it.

If the remaining premium per day is larger than the planned PPD in this case, you want to hold it.

Summary

This is why today I wanted to show you my formula for when to take profits on options, especially when you are an options seller. You see, selling options and receiving premium is what we do with The Wheel Strategy, and the most important metric here is the premium per day (PPD).

This where using the PPD, you can actually get down to a formula of when exactly you should buy or sell.

This is where it’s just a good rule of thumb if you don’t want to do all these calculations. So the rule of thumb is I close a trade when I can realize 90% of the maximum profits.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.