Sound too good to be true? Think again, think different…

Investors worldwide have most of their investment and retirement capital in the stock market. This means your financial well-being and, therefore your quality of life, ebbs and flows with the rise and fall of the stock market. On the other hand, Wall Street Pros profit whether the market goes up, down or sideways. One group profits, the other group doesn’t… One group gets to live the life they choose, the other doesn’t.

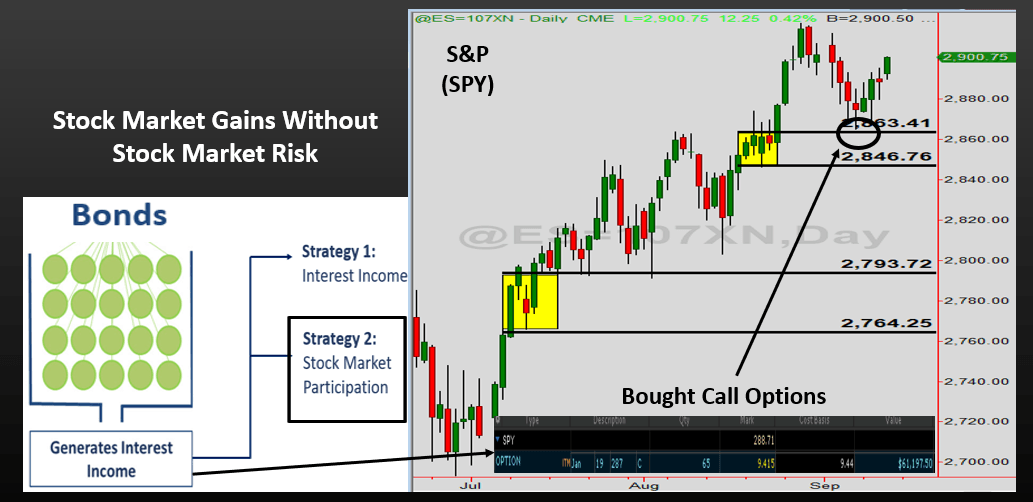

You can enjoy stock market gains with zero stock market risk to your capital, here is how it’s done. Instead of putting your investment capital in the stock market, you can put it in bonds or a bond fund that is high yield, short maturity and very safe. Then, take the interest you generate and use that to buy options on the stock market. Call options go up in value as the market goes up. In the diagram below, that’s exactly what I did.

I used interest from a bond fund, bought call options at demand, where banks are buying, and profited nicely when the market rallied from demand. Poof… Stock market gains with no stock market risk to my capital. There is no stock market risk because your capital isn’t in the stock market. The only risk is if bonds default, but we can keep that very safe. So, when the market goes up you make money, when it goes down your investment capital loses nothing.

Wall Street wraps heavy fees around this, steep surrender charges, long lock up periods and more fees, calls it an annuity and sells it at a premium. Anyone can do this on their own without all that, it’s actually quite simple. Wall Street won’t want me writing about this but I don’t answer to Wall Street…

The key is to stop thinking and acting like a novice investor and start thinking like a Wall Street Pro. Before I got involved in trading and investing, I thought financial professionals were smarter than everyone. When I then worked on that side of the business, what I realized is there aren’t any complicated strategies that the average investor can’t do on their own. Email me with any questions.

Read the original article here - Stock Market Gains Without Stock Market Risk

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.