Investing psychology is a subject most books and so-called professionals keep separate from the mechanics and strategies of proper investing. A reality, largely misunderstood, is that the underlying mechanics and strategies within investing are a direct function of your psychological belief system. At any given time in the stock market, there are buy and sell invitations sent out in the form of news events, technical indicators, earnings reports, company announcements, brokerage upgrades and downgrades and much more. These invitations are then received by the belief systems of hundreds of millions of investors worldwide.

What separates the consistently profitable market player from everyone else is a psychological belief system that filters all these invitations to buy and sell through the markets ongoing supply and demand relationship. When this is done properly, you will quickly realize for example, that often a buy recommendation from a brokerage firm and/or a good earnings report from a company do not equate to market demand or higher prices for the company’s stock. Conversely, negative news or a brokerage downgrade may actually be a low risk/high reward buying opportunity. Some of the most common and popular invitations to buy and sell occur with stocks.

A psychological belief system that enjoys consistent low risk/high reward profits is one that identifies and accepts an invitation to buy into a market when objectively, market price is at a level where demand greatly exceeds supply (wholesale prices). A belief system that suffers consistent poor results is one that identifies and accepts an invitation to buy into a market when objectively, price is at a level where supply exceeds demand (retail prices). There are two types of buy and sell invitations. The first are the markets buy and sell invitations which are based only on the governing dynamics of supply and demand. The second includes everything from good and bad news, to positive and negative earnings reports, to brokerage upgrades and downgrades, etc. The first has you focus on reality while the second has you focus on everything but reality.

Why would someone make such an obvious mistake and buy at retail prices and/or sell at wholesale prices? Simple, the belief system that drives their behavior/action is flawed. When you understand that your psychological belief system is what drives your investing strategy, you will realize how important it is to align your belief system with reality. You are essentially searching for truth, so beware of illusion. The addition of even the slightest amount of illusion into your belief system ensures truth will never be found.

Often, the focus of poor results when investing is a lack of discipline when attempting to follow the rules of a strategy. What keeps people from not following rules is not a lack of discipline, it is because their invitations to buy and sell are not in line with their psychological belief system. There is internal conflict when it is time to take action. Don’t punish yourself for not acting when the market calls you to action. Instead, take a step out of the box that is your belief system and make sure it is only filled with objective information and reality.

Any and all influences on price are reflected in price

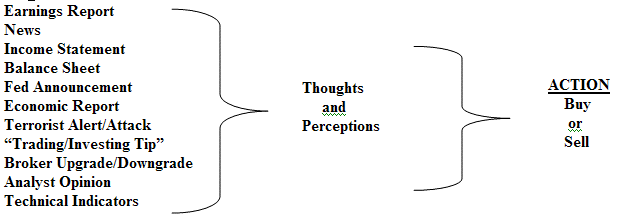

The news and market information are filtered through your belief system. Your belief system is responsible for the thoughts and perceptions created from the news and information. Those thoughts and perceptions then lead to action and when investing, action is either buying or selling. Therefore, all the astute investor needs to focus on is price. Whatever the news and information for the stock is, your belief system MUST filter that information through a filter that quantifies the markets true supply and demand relationship before a perception is created and action is taken. This will ensure you will not fall into the trap that has you buying high and selling low. Instead, it will allow you to profit from the many others that consistently do fall into that trap.

Once you’ve aligned your belief system to understand that any and all influences on price are reflected in price, your next step is to know what true supply and demand look like on a price chart. If you’re not careful on this step, illusion can again creep into the equation. If you think the conventional technical analysis definitions of support and resistance are the answer, think again. A cluster of trading activity above and below current price is not necessarily supply and demand. There is a very unique and simple chart pattern that represents real demand and peak supply. Once you are able to identify true supply and demand on a price chart, simply follow these two rules:

-

A negative news event or negative stock market information which brings price to a level of demand is typically an opportunity to buy, not sell.

-

A positive news event or positive stock market information which brings price to a level of supply is typically an opportunity to sell, not buy.

What you perceive to be a rational decision-making process is actually your emotions reflected by a set of behavioral patterns you likely don’t even know exist. The process that all humans operate under is a process whereby emotions are reflected from ingrained patterns of behavior. As rational as it seems to buy when news is good and sell when news is bad, it certainly isn’t logical. That rational, again, is due to a faulty belief system that is not in line with reality.

The natural invitation to buy is completely inversely related to how you make money buying and selling anything. It is certainly not in alignment with supply and demand. Most people, however, are not naturally invited to buy when the objective low risk/high reward buying opportunity is in front of their face. The vast majority of people are only comfortable buying after a period of rising prices, not declining prices. Also, most people are not comfortable buying when the news is bad. What challenges your natural human emotion most is the fact that pretty rising charts and good news rarely if ever bring price down to levels where demand exceeds supply.

This is all quite ironic if you think about it because if you take your average investor out of the market environment, they act almost opposite when buying and selling anything else. For example, when we go and buy a car, we try and get the best deal we can. The astute car shopper finds a car and knows what price he or she is willing to pay and attempts to get that price. If that dealership is not willing to drop the price to the desired price of the buyer, that potential buyer typically goes from dealership to dealership to find someone willing to sell the car at the lower price. When investing however, people wait for good news and higher prices before deciding to buy, this makes absolutely no logical sense if your goal is to buy low and sell at a higher price. It is completely inversely related to how we profit when buying and selling anything.

Whether you invest in stocks, bonds, futures, currencies, options or anything else, how you profit in these markets and how you quantify supply and demand never changes. Furthermore, an investing strategy that works is one that is not market specific or time period specific. The strategy that offers consistent low risk returns is one that mechanically filters the vast amount of illusion creating information by objectively quantifying real supply and demand in any market and at any period in time. Don’t let the shadow of illusion darken the reality of a governing dynamic that is always right in front of you.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.