-

Momentum works across all markets.

-

Momentum works because humans are social animals.

-

Plenty of powerful examples.

-

Momentum fails miserably in investment management.

-

Chase price not performance.

Momentum works across all markets

One of the greatest anomalies in finance is that momentum works. Momentum – the strategy of buy high, sell higher or sell low and sell lower – is one the great mysteries of the market because it works on every asset, every market every time frame.

There have been numerous academic studies to prove this point across a variety of US and international databases going back a century or more. No less than the father of Efficient Market Theory Eugene Fama noted the following, “ The premier market anomaly is momentum. Stocks with low returns over the past year tend to have low returns for the next few months, and stocks with high past returns tend to have high future returns.”

Momentum works because humans are social animals

The outperformance is massive. As this graphic from Larry Swedroe and Andrew Berkin shows, the pick up premium wallops all other factors.

Momentum works because human beings are social animals no different than schools of fish. When aggregated into a large gathering such as the market investors will begin to act in unison sometimes driving prices to seemingly insane levels way beyond rational valuation.

Plenty of powerful examples

This year alone we’ve seen two extreme cases of momentum with GameStop (GME) and Bitcoin (BTCUSD) and perhaps even Tesla (TSLA) as investors plowed into each instrument at any available price. In some cases the moves were coordinated in others they were simply expressions of the general mood but in all instances the power of momentum created outsized returns that far surpassed the market averages.

Momentum fails miserably in investment management

One of the great ironies of momentum is that while it works well on assets, it is almost always a terrible strategy on asset managers. In addition to chasing price, investors love to chase performance by giving their money to the hottest performing fund manager. That is perhaps the single worst bet they can make.

Chase price not performance

Study after study after study has shown that investment performance tends to mean revert rather than trend. Investment managers who were in the top decile in the current year were almost always absent from the leaderboard five years forward. In fact the only strategy that seems even more profitable than momentum is mean reversion on money managers. Academics have shown that best performers in one year have often wound up in the lower half of the table two or three years forward, while the worst performers often returned back to the top.

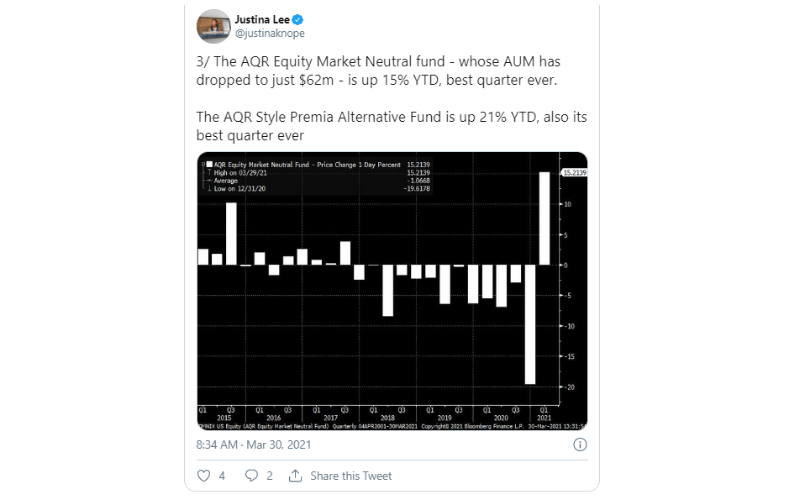

This thesis was once again proven right by the recent news that the AQR family of funds which has been eviscerated by terrible performance and near universal fund outflows just had its best quarter ever.

Unfortunately it’s impossible to trade money managers like money managers like financial assets because of the notoriously short shelf life of the losers. But it’s important to understand that while chasing price can be very profitable, chasing performance is almost always a sucker bet.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.