The crypto market as a whole has seen a small bull-run in the last 30 days, however it seems as if ripple hadn’t received the message.

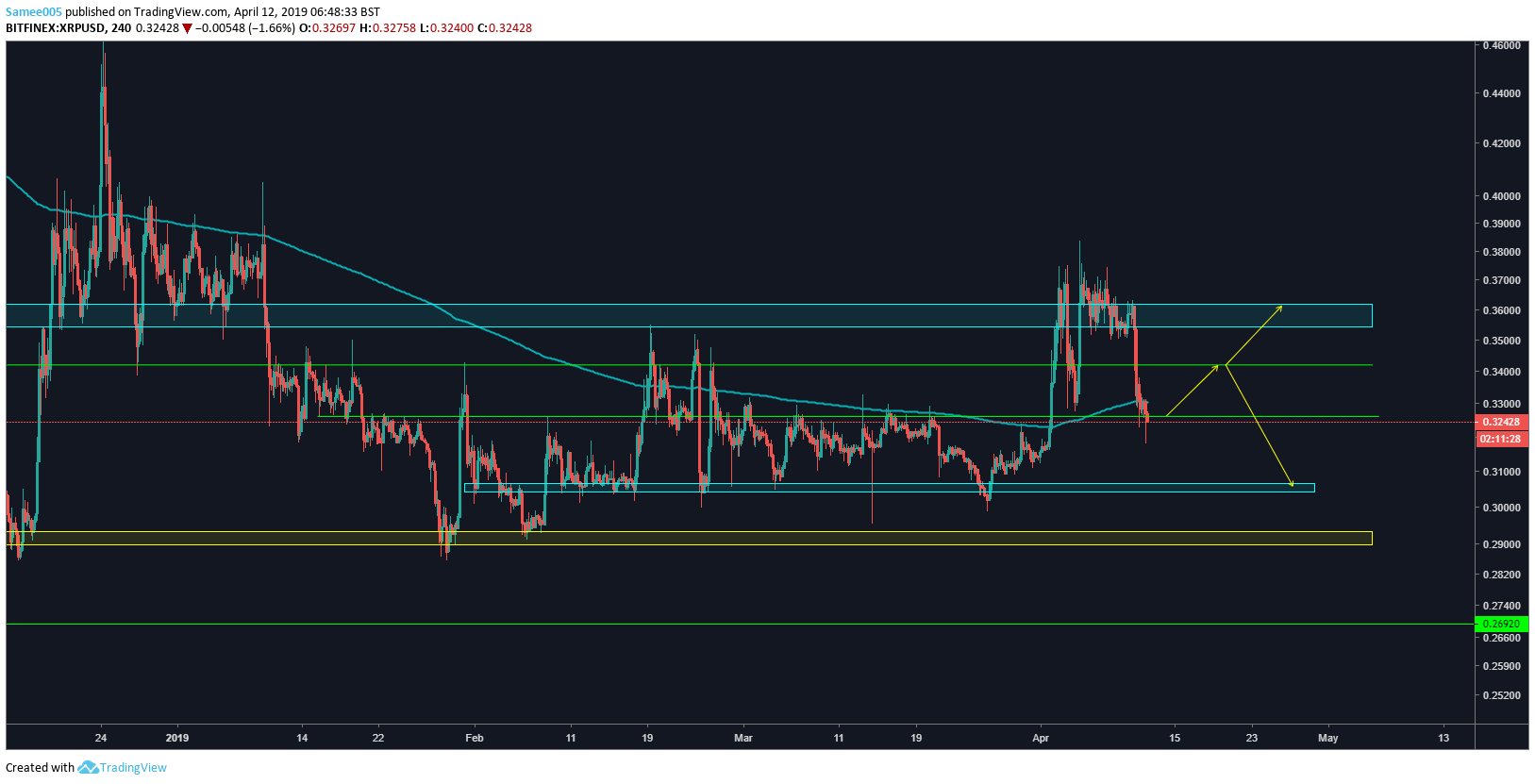

Since the beginning of 2019 there has been a mix of positive and negative fundamental data and as a result the price of Ripple (XRP) has consolidated between $0.30 and $0.36.

Ripple (XRP) continues to fall short of closing beyond the $0.37, a small reversal towards the $0.32 level has occurred.

Price is lingering around this $0.32 level and is rallying around a 200-period smooth moving average, which can be seen as a dynamic support level. With the sellers looking stronger we could potentially see a drop to the $0.307 level, however, I do feel price may choose to bounce to the $0.34 level before deciding to go long or short.

The major upside target is of course the $0.37 level and whether we can close above this price to indicate the start of a bull run. On the contrary, we could see downwards pressure towards the 0.307 level and even further to the $0.29 level.

Taking any short trades would be a short-term outlook on this asset, and I would always recommend in such climates like this crypto market, to look to go long for the long-term. As Baron Rothschild was once credited saying “the time to buy is when there's blood in the streets.”

MY TRADES:

BUY LIMIT @ $0.29 TP: $0.37 SL: $0.25

INTRADAY TRADE BUY @ $0.32 TP: $0.35 SL: $0.30

This is just for informational use only, as always trade with strict risk management.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum dips slightly amid Renzo depeg, BlackRock spot ETH ETF amendment

Ethereum (ETH) suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH (ezETH) crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective (INJ) price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

US intensifies battle against crypto privacy protocols following crackdown on Samourai Wallet

CEO Keonne Rodriguez and CTO William Lonergan of Samourai Wallet were arrested by the US Department of Justice (DoJ) on Wednesday and charged with $100 million in money laundering on a count and illegal money transmitting on another count. This move could see privacy-focused cryptocurrencies take a dip.

Near Protocol Price Prediction: NEAR fulfills targets but a 10% correction may be on the horizon

Near Protocol price has completed a 55% mean reversal from the bottom of the market range at $4.27. Amid growing bearish activity, NEAR could drop 10% to the $6.00 psychological level before a potential recovery. A break and close above $7.95 would invalidate the downleg thesis.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?