The crypto lender will be allowed to return a portion of customer funds locked up at the Metropolitan Commercial Bank which have been frozen until now.

Beleaguered crypto lender Voyager Digital Holdings says it has received a number of “higher and better” buy-out offers than that offered by AlamedaFTX back in July, contrary to the investment firm's continued public statements.

The company has also just been cleared to return $270 million of customer funds held at the Metropolitan Commercial Bank (MCB) by the judge presiding over its bankruptcy proceedings in New York.

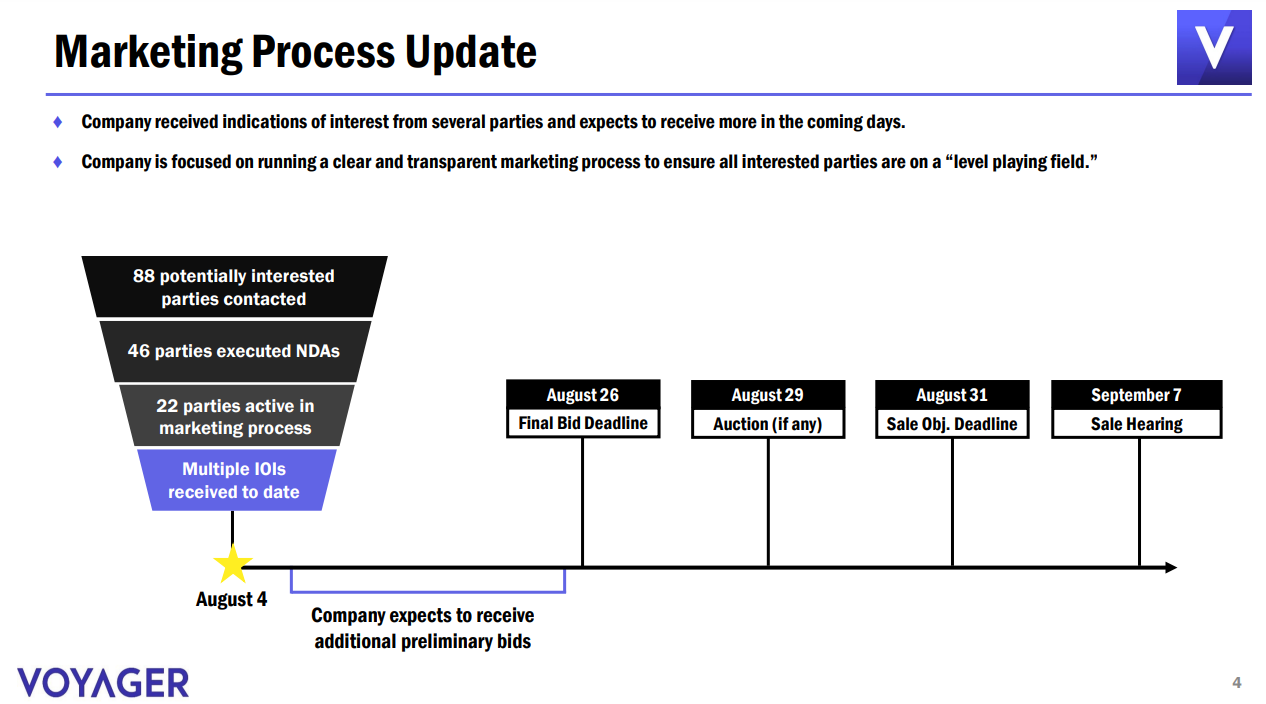

In a Second Day Hearing Presentation on Aug. 4, Voyager stated that it has received word from as many as 88 interested parties keen to bailout the company from its financial woes, adding it is in "active discussions" with over 20 potentially interested parties.

One of the most high-profile bids came from Alameda Ventures and FTX in July.

Alameda had proposed to buy all of Voyager’s assets and outstanding loans except the defaulted loan to Three Arrows Capital, then liquidate the assets and distribute funds in USD through the FTX US exchange.

This was rejected by Voyager on July 25 on the grounds that it was not “value-maximizing” for its customers.

The company also noted that it has already received bids through the marketing process that are “higher and better than AlamedaFTX’s proposal," contrary to alleged "inaccurate" public statements from AlamediaFTX.

Source: Voyager Digital Second Day Presentation

Voyager stated that it has also separately sent AlamedaFTX a cease and desist letter regarding its “inaccurate” public statements, confirming that AlamedaFTX does not have a “leg up” on other bidders.

$270M in customer funds returned

News about other interested bidders comes at the same time that U.S. Bankruptcy Court Judge Michael Wiles has given Voyager the all-clear to return a portion of their customer’s cash deposits.

According to an Aug. 4 report from the Wall Street Journal, Judge Wiles stated that Voyager had provided a “sufficient basis” for its claim that customers should be access to the custodial account held at Metropolitan Commercial Bank (MCB), which is understood to hold $270 million in cash.

[DB] Voyager secures approval to return $270 million in customer cash: WSJ

— db (@tier10k) August 4, 2022

Voyager had funds stashed in the account at the bank when it filed for bankruptcy on July 5. Those funds were frozen when bankruptcy proceedings began.

Voyager Digital CEO Stephen Ehrlich mentioned in July that he intended to return customer funds from MCB as soon as a “reconciliation and fraud prevention process” was completed, and the firm reportedly asked to have the funds in MCB released on July 15.

Voyager’s debt amounts to a sum no greater than $10 billion from roughly 100,000 creditors, but is not the only such brokerage, lender, or investment firm in crypto to have befallen hard times for itself and its users. Celsius, Three Arrows Capital, BlockFi, and others have also been swept up in the ongoing saga.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ethereum dips slightly amid Renzo depeg, BlackRock spot ETH ETF amendment

Ethereum (ETH) suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH (ezETH) crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective (INJ) price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

US intensifies battle against crypto privacy protocols following crackdown on Samourai Wallet

CEO Keonne Rodriguez and CTO William Lonergan of Samourai Wallet were arrested by the US Department of Justice (DoJ) on Wednesday and charged with $100 million in money laundering on a count and illegal money transmitting on another count. This move could see privacy-focused cryptocurrencies take a dip.

Near Protocol Price Prediction: NEAR fulfills targets but a 10% correction may be on the horizon

Near Protocol price has completed a 55% mean reversal from the bottom of the market range at $4.27. Amid growing bearish activity, NEAR could drop 10% to the $6.00 psychological level before a potential recovery. A break and close above $7.95 would invalidate the downleg thesis.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?