- UMA price has broken out of a head-and-shoulders pattern, suggesting a 20% drop.

- Transactional data shows feeble support levels that could allow bears to run rampant.

- A bullish scenario might evolve if UMA creates a higher high above $26.

UMA price shows all signs of an imminent drop as it confirmed a breakout from a bearish technical formation/

UMA price primed for a lower low

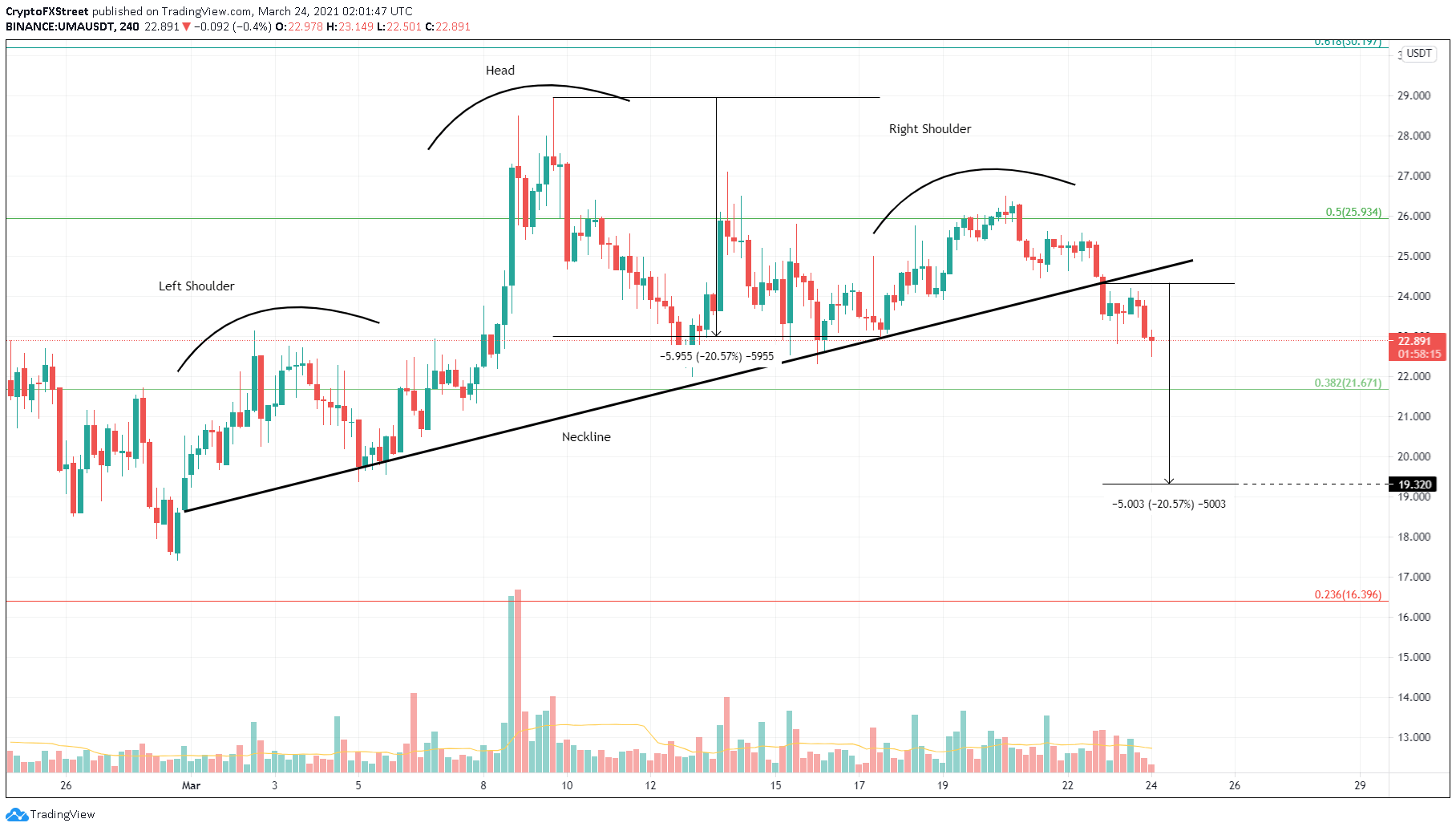

UMA price seemingly formed higher lows since March 1, portraying a bullish outlook. However, three distinctive swing highs formed during this period suggested a head-and-shoulders pattern was in play.

In this setup, the price forms two peaks of almost equal heights known as “shoulders,” while the middle peak, also referred to as the “head,” is significantly higher than the other two. The valleys of these peaks often find support on “neckline,” a breach of which confirms the start of a bearish regime.

UMA price confirmed a breakout as it breached the neckline on March 22. Now, a 20% crash to $19.3, determined by measuring the distance between the peak of the head and the neckline, seems likely.

UMA/USDT 4-hour chart

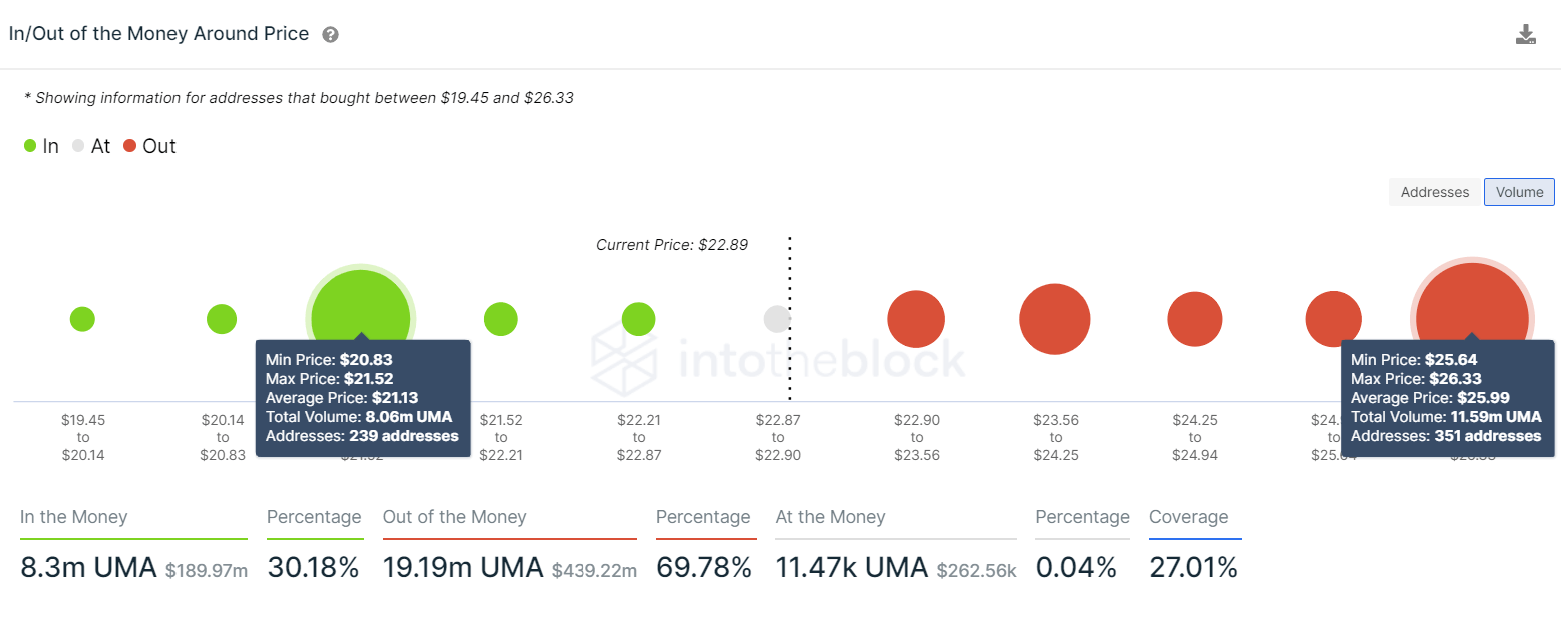

Supporting this bearish outlook for UMA is the IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, which shows a lack of demand barriers for the DeFi coin.

Only $21.13 stands between UMA price and a crash to $19.3. IOMAP cohorts reveal that about 240 addresses hold nearly 8.06 million UMA tokens here. If this level fails, bears will most likely push the cryptocurrency lower.

UMA IOMAP chart

On the flip side, 38.2% Fibonacci retracement level at $21.67 could deter the descent in UMA price. Hence, a bounce from this level could provide bulls an opportunity to invalidate the bearish outlook.

Such a move will require the buyers to push the UMA price past the supply barrier at $26. Transactional data reveals that 350 addresses holding nearly 11.6 million UMA tokens are “Out of the Money” here and could deter an ascent.

If successful, this development creates a higher high further signaling sidelined investors to jump on the bandwagon pushing the altcoin up to $27.22.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle (PENDLE) price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin (BTC) price.

Ethereum shows signs of a potential rally as suspected Justin Sun wallet buys heavily

Ethereum's (ETH) recent price movement hints at a potential rally despite ETH ETPs recording outflows. The recent price improvement follows the fourth Bitcoin halving and a suspected Justin Sun wallet purchasing large numbers of ETH.

Floki poised for growth after listing on Revolut

Floki's (FLOKI) team announced in an X post on Monday that the meme coin would be listed on the popular neobank and Fintech platform Revolut. Floki could rise further following key partnerships to boost retail usage.

Jupiter DEX second Launchpad vote concludes, JUP price rises 5%

Jupiter, a Solana-based decentralized exchange (DEX) has completed the second launchpad (LFG) vote to identify the two projects that will debut on its platform. On March 30, the aggregator network had unveiled its Core Working Group (CWG) budget proposal voting.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?