- TRON's Justin Sun had another lunch with crypto celebrity.

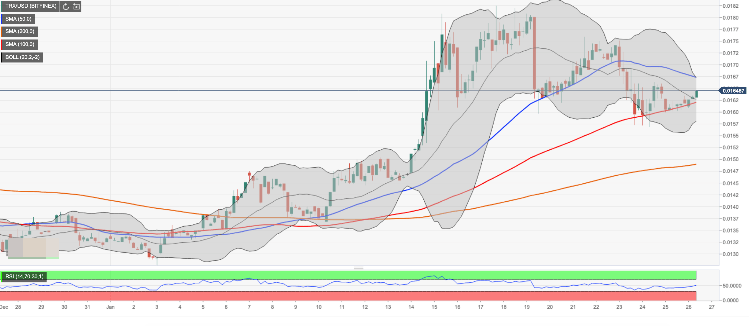

- TRX/USD is moving inside the downside channel.

TRON's TRX, now the 12th largest digital asset with the current market value of $1 billion, has lost about 1.5% in recent 24 hours. The coin has been moving in sync with the market amid growing bearish sentiments. Tron's 7-day volatility peaked at 25.98% on January 10 and retreated to 18.5% by the time of writing. TRX/USD is changing hands at $0.0164, off the recent low of $0.0156.

Justin Sun and Charlie Lee

Tron's creator Justin Sun announced the meeting with Litecoin's founder Charlie Lee. He said that they had discussed Bitcoin, Litecoin and Tron and "some secrets". The reference to the mystery, secrecy and mystifications are very typical to Sun. However, usually, all his super-secret projects and news are grossly overestimated, that's why they produce little effect on the community sentiments.

Meeting @SatoshiLite. Talking about #Bitcoin, #Litecoin, #TRON & some secrets.

Notably, earlier this week Justin Sun met with Apple's co-founder Steve Wozniak. The date of the postponed dinner with Buffet remains unknown.

Also, Charlie Lee suggested that miners should donate 1% of their block rewards to the system.

TRX/USD: technical picture

On the intraday charts. TRX/USD is moving within a downward channel with the upper boundary currently at $0.0171 and the lower border a $0.0156. Considering an upward-looking RSI on 4-hour chart, we may suggest that the coin is poised for a further recovery towards the upper boundary of the said channel.

On the downside, a sustainable move below $0.0162, reinforced by SMA100 4-hour, will open up the way towards $0.0160 and the recent low of $0.0156.

TRX/USD 4-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat (WIF) price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu (BONK), WIF token’s show of strength was not just influenced by Bitcoin (BTC) price reclaiming above $63,000.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

PUPS, WZRD, and PEPE are gaining liquidity through Bitcoin Ordinals. Creator of Bitcoin’s Ordinals protocol is debuting a new fungible token standard to rival BRC-20, Runes.

Ethereum shows firm support at key level as its correlation with US indices increase

Ethereum's price continued a sideways movement on Thursday as the market still awaits a trigger. Ethereum isn't alone in this horizontal trend; several major index funds have also traded sideways.

Mango Market attacker convicted of fraud and market manipulation

Mango Market attacker Avi Eisenberg was convicted by a federal jury on Thursday for "fraudulently obtaining" funds from the Solana-based decentralized exchange (DEX). He could face up to 20 years in prison for his role in the $110 million attack.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.