- A variety of trends influences the cryptocurrency market.

- BTC/USD struggles to confirm the breakthrough above 61.8% Fibo.

- Altcoins are moving in sync with the digital king.

The cryptocurrency market has been rather quiet during early Asian hours on Friday. However, just as usual, this calm may precede a storm ready to erupt into the end of the week.

On the good side

The cryptocurrency universe continues penetrating a traditional financial system. The trading platforms for digital assets keep on adding support for various fiat currencies. In the latest development, the US-based cryptocurrency exchange Kraken expanded its fiat-based crypto trading services with the Swiss franc. Thus, with the new addition, the exchange now supports six fiat currencies: US dollar, Canadian dollar, euro, British pound, and Japanese yen and Swiss Frank.

Also, recently, the world's largest cryptocurrency exchange Binance, included Russian Ruble and Ukrainian Hryvna to the list of supported fiat currencies, which is clear evidence of the growing crypto awareness in those countries.

On the ugly side

On Thursday, EU finance ministers agreed on a tough stance towards Libra and similar private digital currencies. The European authorities are not going to allow those types of money in Europe until all the associated risks and concerns are removed.

The ministers said in a joint statementˆ

No global stablecoin arrangement should begin operation in the European Union until the legal, regulatory and oversight challenges and risks have been adequately identified and addressed.

While they referred mostly to Facebook'sFacebook's Libra and fiat-backed stabelcoins, the industry might feel the heat as the regulators send clear signals that they won't tolerate any competition from the private sector.

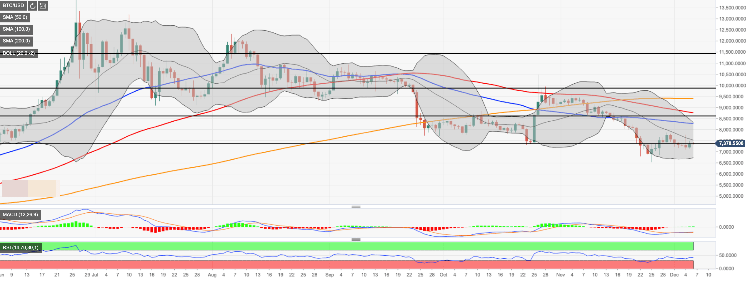

BTC/USD, the technical picture

Bitcoin (BTC) is still pretty much indecisive at this stage. The price of the first digital coin is moving to and fro around the pivotal $7,350 created by 61,8% Fibo retracement for the move from $3,226 to $13924. A cluster of intraday resistance levels at $7,400 caps the recovery and hamper Bitcoin'sBitcoin's attempts to verify the breakthrough.

Once $7,400 is out of the way, the upside momentum may gain traction with the next focus on $7,700 and December 4 high of $7,770. This barrier stands on the way to psychological $8,000. Notably, BTC/USD has been trading below $8,000 since November 21 with bullish sentiments waning each week.

On the downside, $7,000 is the first barrier that should stop the sell-off. However, a sustainable move below this will unleash bearish potential and push the price towards $6,700 ( the lower line of the daily Bollinger Band).

BTC/USD, the daily chart

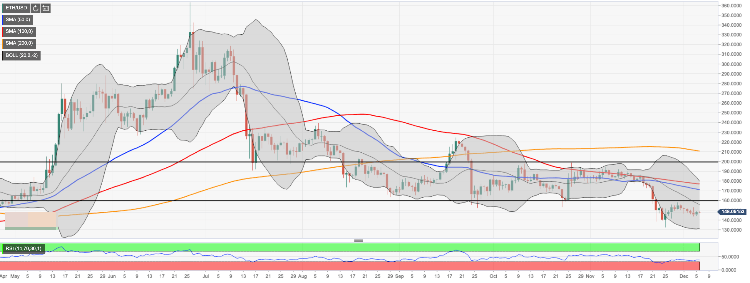

ETH/USD, the technical picture

While ETH/USD has recovered from the recent low of $132.58, it is still moving within the long-term downside trend with little signs of the upcoming reversal. The coin desperately needs to return to the previous consolidation range that had been dominant in the last three months until it was broken at the end of November. The lower border of the range is located at $159.40 and followed by another strong resistance of $160.00.

On the downside, the initial support is created by $144.00. This support coincides with the lower line of 4-hour Bollinger Band and the lower boundary of this week's channel. A sustainable move below this barrier will attract new sellers to the market and push the price towards a psychological $140.00. The ultimate support is created by the above-said low at $132.58.

Considering the flat RSI (Relative Strength Index) on a daily chart, the strong upside looks unlikely at this stage.

ETH/USD, the daily chart

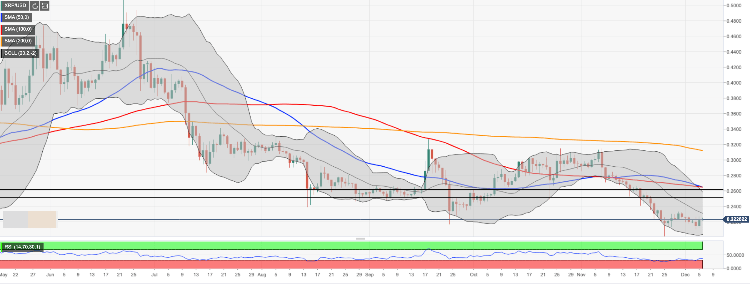

XRP/USD, the technical picture

XRP/USD is moving in sync with the market. The third digital coin has been trading below $0.2300 since the end of November amid worsened, market sentiments. The outlook for the coin remains bearish as long as it stays below mentioned $0.2300.

The initial support is located at $0.2200; however, an even stronger barrier is seen at $0.2100 as it separates is from November 25 low of $0.2014. This area is likely to stay unbroken due to strong speculative interest clustered around it.

On the upside, a strong move above $0.2300 will allow the third-largest coin to regain strength and proceed to $0.2500, which is the lower boundary of the previous consolidation channel.

XRP/USD, the daily chart

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?