- Calibra calls for democratizing banking, especially in the third world.

- With over two billion users, it may be the Holy Grail for massive adoption of cryptocurrencies.

- The market has yet to value the growth potential implied by Facebook’s initiative.

Facebook, WhatsApp, Instagram will all be opened to Calibra – a massive development.

Calibra will initially offer a global payment and money transfer platform with low commissions and instant execution. However, this is only the beginning.

Calibra will probably start offering a series of financial products such as loans, interest-bearing deposits, and more in the future.

Also, as the Geneva-based Libra Foundation states in the white paper of the project, Calibra could be connected to exchange platforms, such as Coinbase or Binance, but without going into that business.

In my opinion, Calibra provides the disruptive factor that Libra, as a concept, lacks. The hidden potential offered by creating a gateway between the Crypto market and the digitalized everyday world is immense.

Facebook has the capital, influence, and dominance in the social networking sector necessary to bring this initiative to a successful conclusion – even in the face of the more than secure opposition of the global banking cartel.

The cryptocurrencies market has yet to adjust the price to the vast possibilities of Zuckerberg’s initiative – but it is only a matter of time.

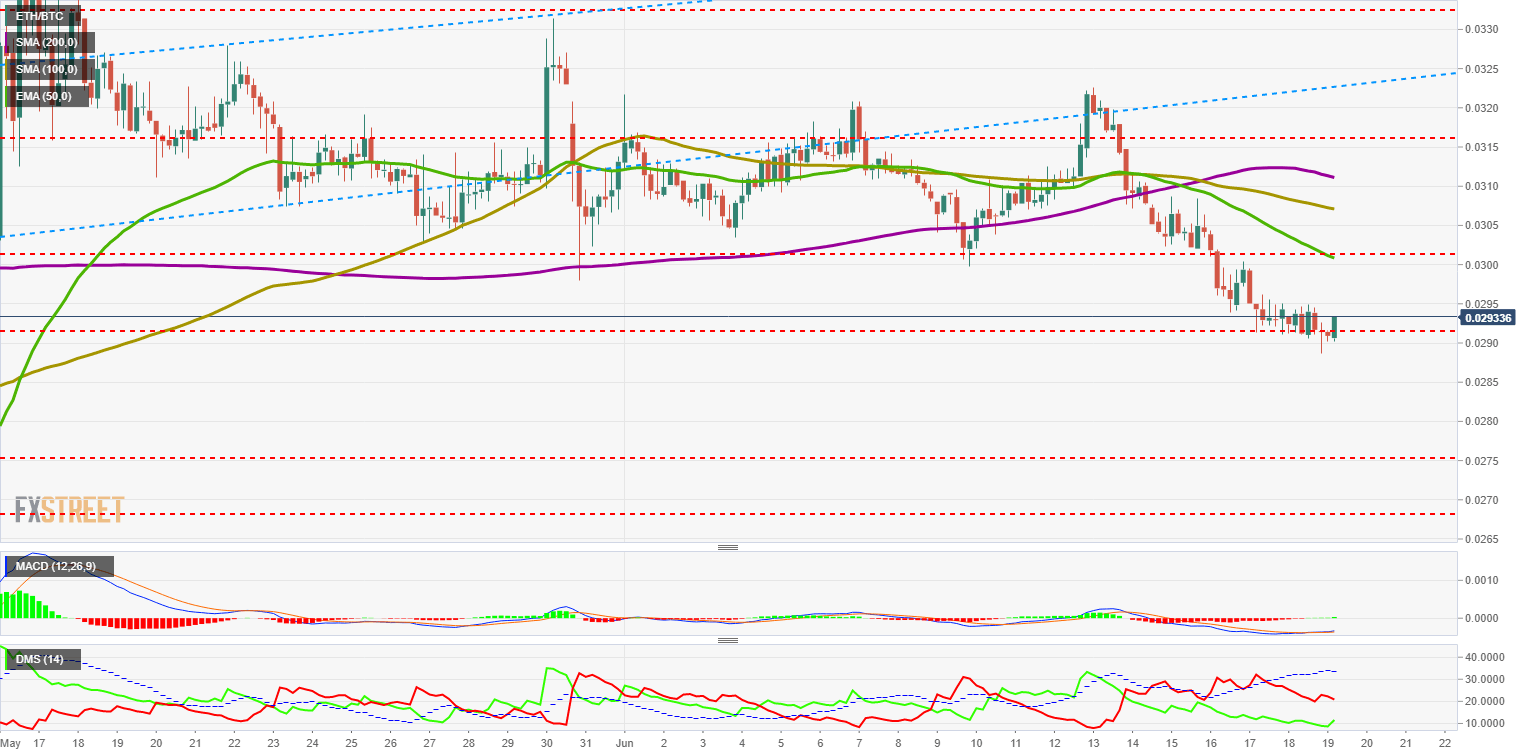

ETH/BTC Daily Chart

The ETH/BTC pair has been reacting to the bullish trend at this hour and recovers support for price congestion at 0.0291.

Above the current price, the first resistance level is at 0.0301 (price congestion resistance and EMA50), the second one is at 0.031 (confluence of the SMA100 and SMA200) and the third one at 0.0316 (price congestion resistance).

Below the current price, the first support level is at 0.0291 (price congestion support), then the second support level at 0.0275 (price congestion support). The third level of support for the ETH/BTC pair is at 0.0268 (price congestion support).

The MACD on the 4-hour chart shows an incipient bullish cut. However, the daily chart shows a strong bearish inclination, that is complicated with the short-term movement can end up dragging more extended time frames.

The DMI on the 4-hour chart shows how the bears have already started withdrawing yesterday, probably convinced that there is little downward trajectory. The bulls, on the other hand, increase their trend strength but still far from disputing the control of the market to the bears.

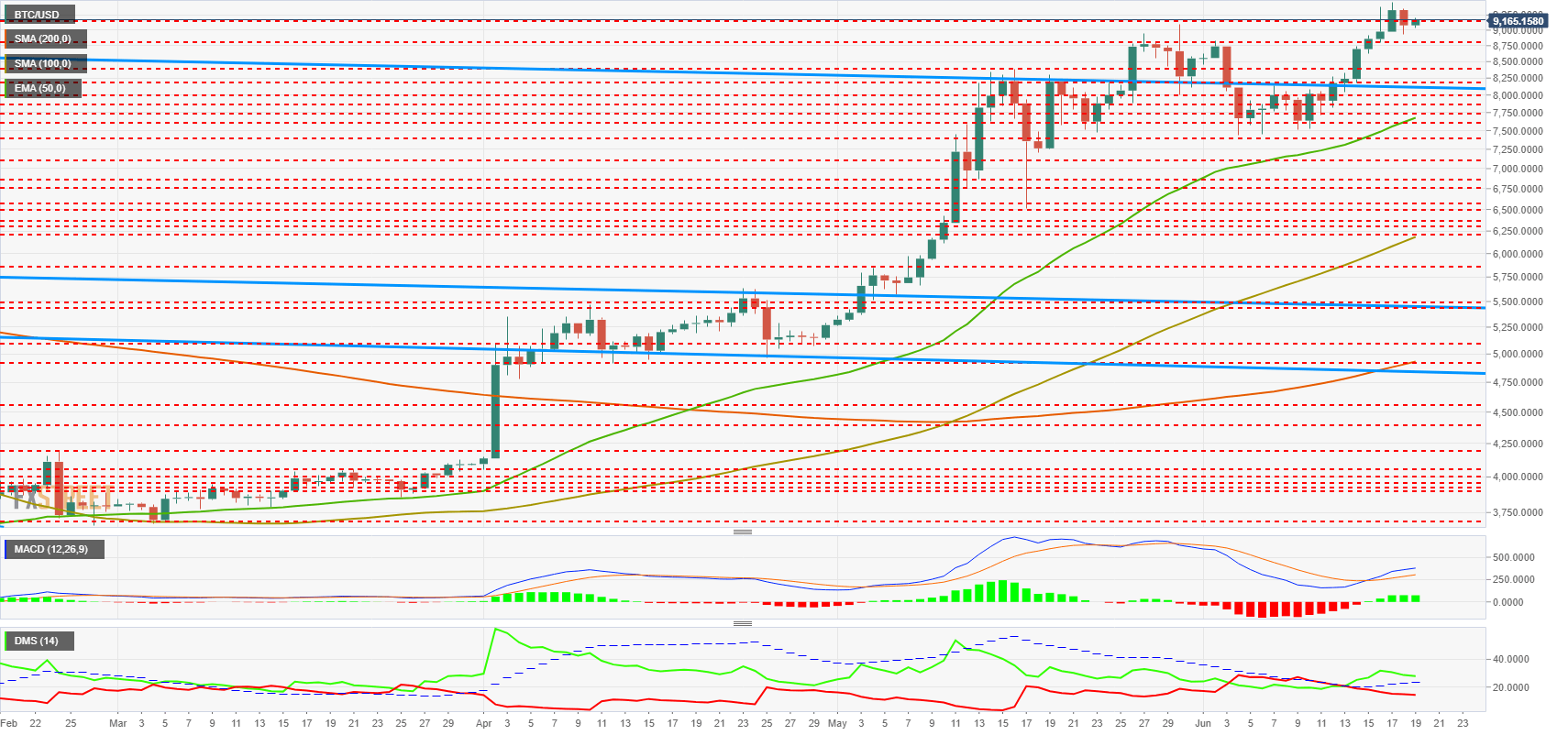

BTC/USD Daily Chart

BTC/USD is currently trading at $9,169 and marginally above the price congestion resistance level of $9,150.

Above the current price, the first resistance level is at $9,600 (price congestion resistance), the second one at $10,600 (price congestion resistance) and the third one at $11,250 (price congestion resistance), above which the BTC/USD pair could fly higher.

Below the current price, the first support level is at $9,150 (price congestion support), then the second is at $8,750 (price congestion support) and the third support level for the BTC/USD pair is at $8,400 (price congestion support).

The MACD on the daily chart shows an improvement in the opening between the lines – implying that the bullish trend may resume sooner than expected.

The DMI on the daily chart shows a slight decrease in the bull's trend strength, despite the fact that the bears are also in retreat and it improves the overall situation – the bullish potential remains intact.

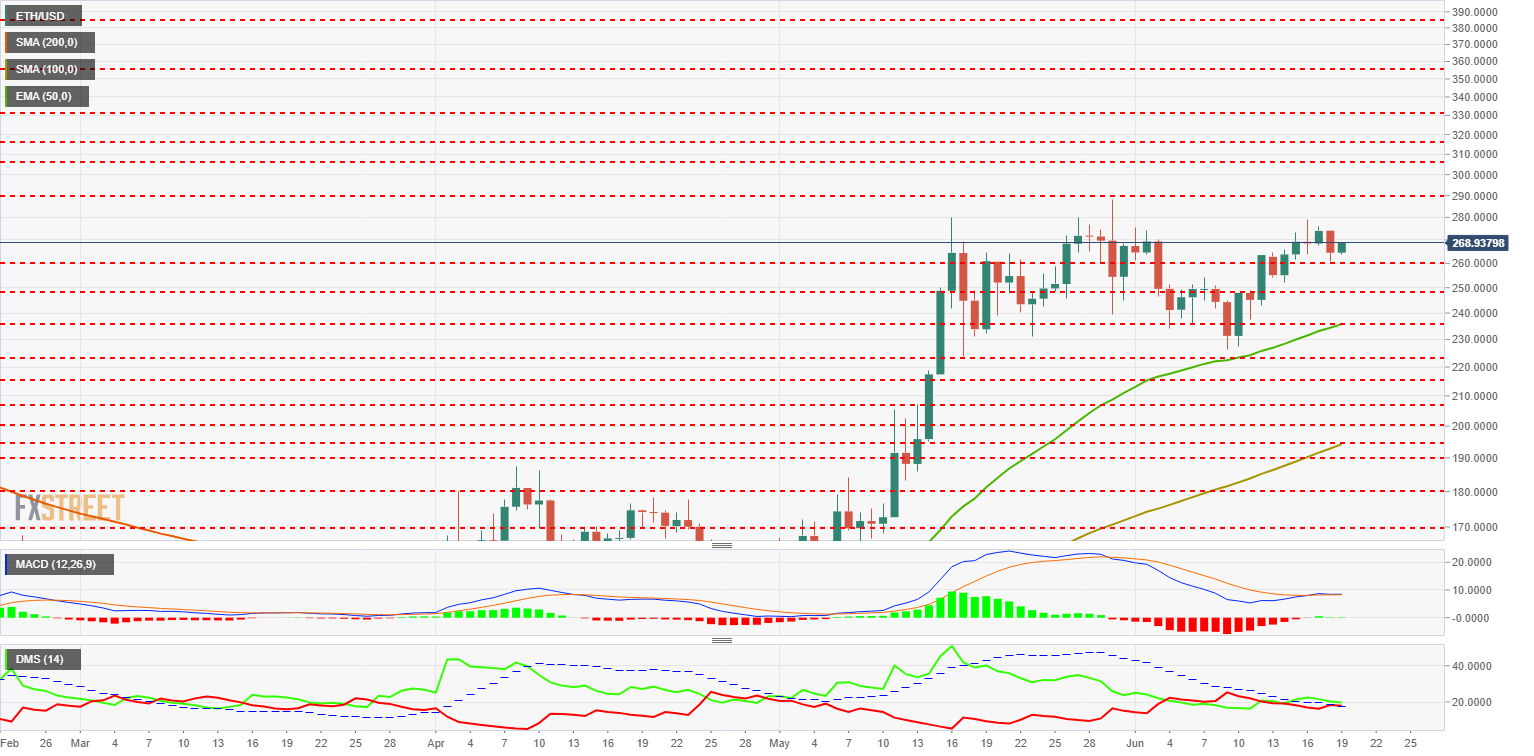

ETH/USD Daily Chart

ETH/USD trades at $268 and heads into the first resistance level at $290 (price congestion resistance and relative maximum), then the second resistance level is at $308 (price congestion resistance) and the third one is at $318 (price congestion resistance).

Below the current price, the first level of support for ETH/USD is at $260 (price congestion support), then the second level of support is at $250 (price congestion support), and the third level of support is at $238 (price congestion support and EMA50).

The MACD on the daily chart shows a very flat profile with no line spacing. It is a profile that lacks direction.

The DMI in the daily chart shows bulls with a minimal advantage over bears. The buyer side is kept to the minimum above the ADX. The bears, on the other hand, do not see it either and they drop slightly today.

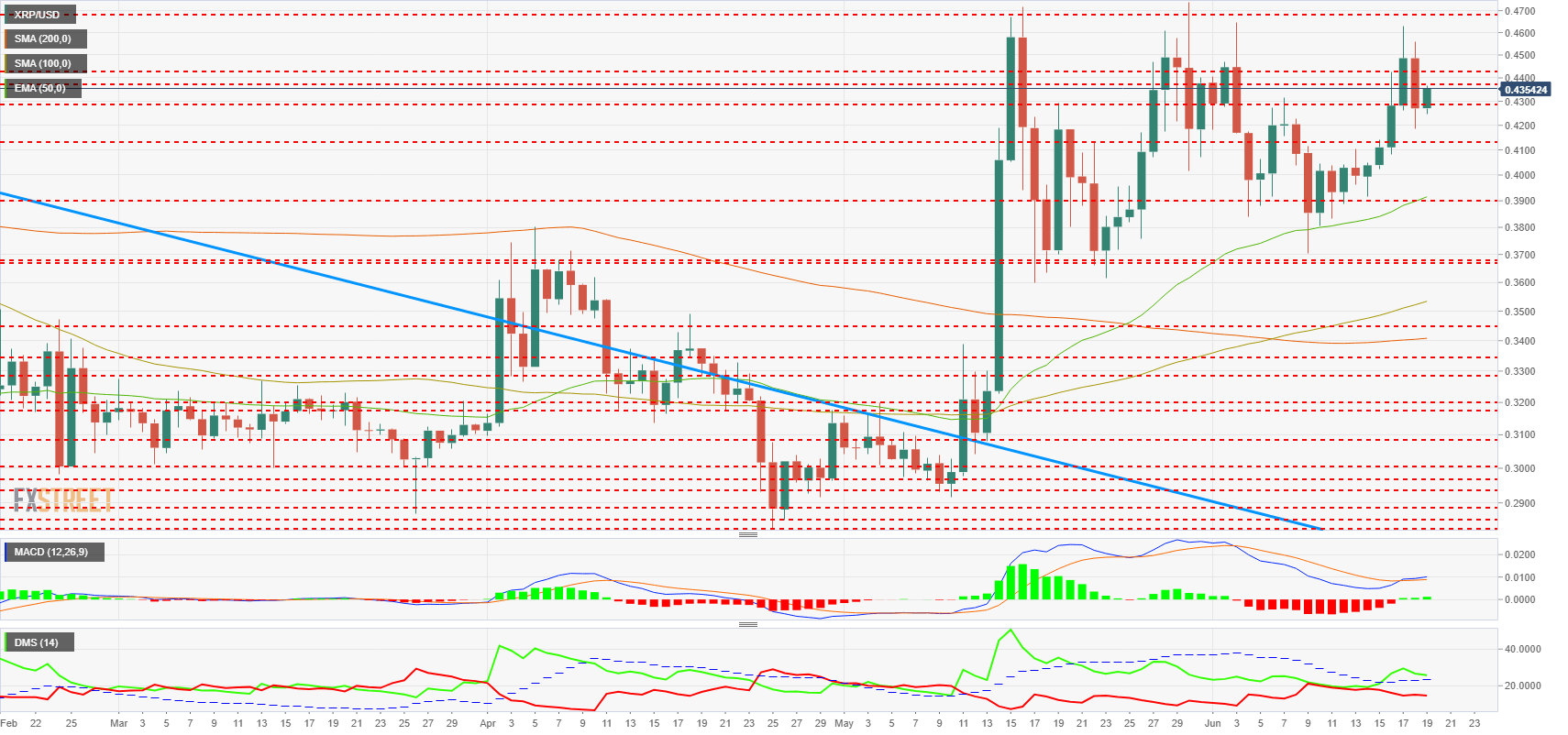

XRP/USD Daily Chart

XRP/USD is currently trading at $0.436 and approaches the first resistance level at $0.438 (price congestion resistance), then the second at $0.445 (price congestion resistance) and the third one in the primary resistance zone at $0.47 (price congestion resistance and relative maximum).

Below the current price, the first support level is $0.43 (price congestion support), then the second one awaits at $0.412 (price congestion support) and the third one is $0.39 (price congestion support and EMA50).

The MACD on the 4-hour chart shows an upwardly inclined profile with a minor opening between the lines. It is a more favorable profile than the one seen in Ethereum. The next two days will help define the scenario for the end of June.

The DMI on the daily chart shows the bulls controlling the market and moving above the ADX with comfort. The bears retreat and seem to invite the bulls to continue leading the situation.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?