- Facebook's counterfeit decision makes the Asian giant's regulators uncomfortable.

- Ethereum and XRP move to the limit of judicious consolidation.

- Bitcoin continues to tighten and increases pressure on price.

Today we have learned, thanks to the question of a German parliamentarian, the composition of the basket of currencies that will support Libra – the stable coin promoted by Facebook.

The distribution leaves the US Dollar with 50% of the quota, followed by the Euro with 18%, the Japanese Yen with 14%, Pound Sterling with 11% and the Singapore Dollar with 7%.

The absence of the Yuan is noticeable. The veto on the Chinese currency was one of the conditions underlined by American legislators. The National Bank of China has commented that the exclusion of the Yuan endangers financial stability since it artificially perpetuates the preponderance of the American currency.

Bakkt's debut and its Bitcoin futures platform Bitcoin were rather sad as it handled only around 30 contracts.

The crypto market didn't help the volume increase, and it moved in a very narrow range for much of the day. Late in the European session, sales appeared, and the consolidation process continued.

Bitcoin slipped below $10,000 and went straight to the congestion support price at $9,700. Ethereum is the one that suffered more, losing the support of the simple moving average of 100 periods and the $200 level.

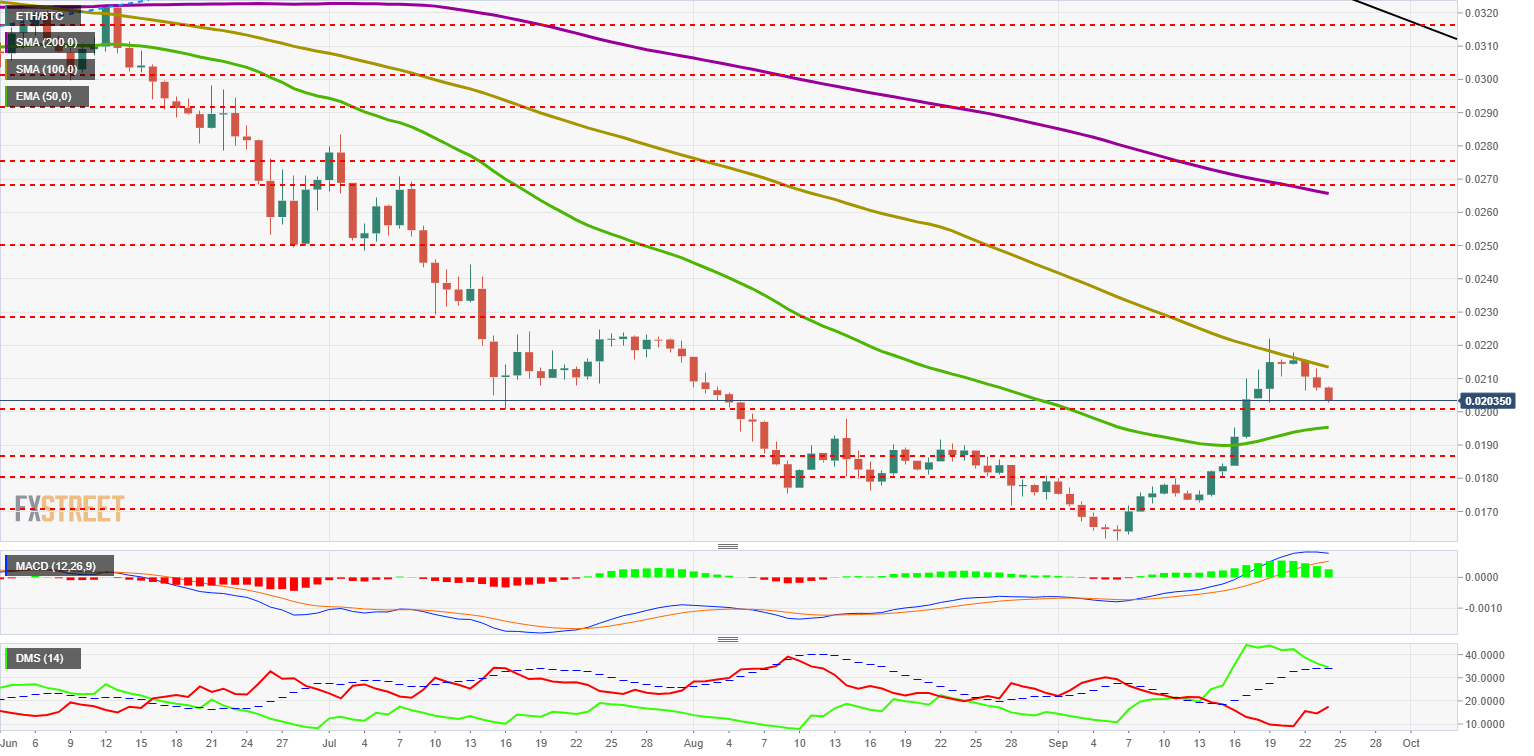

ETH/BTC Daily Chart

The ETH/BTC cross trades at 0.02035 and continues to retreat from the top it found in the 100-period simple moving average. It looks like this consolidation move is going to take a few more days.

Above the current price, the first resistance level is at 0.0213, then the second at 0.02285 and the third one at 0.025.

Below the current price, the first support level is at 0.0201, then the second at 0.0195 and the third one at 0.0186.

The MACD on the daily chart shows a loss of bullish inclination although much of the opening between the lines remains. The current structure proposes laterality with bearish touches for the next few days.

The DMI on the daily chart shows bulls dominating the ETH/BTC pair. The buyer side, represented by the DI+, is just above the ADX line. If it finds support, we can see a bullish rebound. If, on the other hand, it loses that level of support, the falls may accelerate.

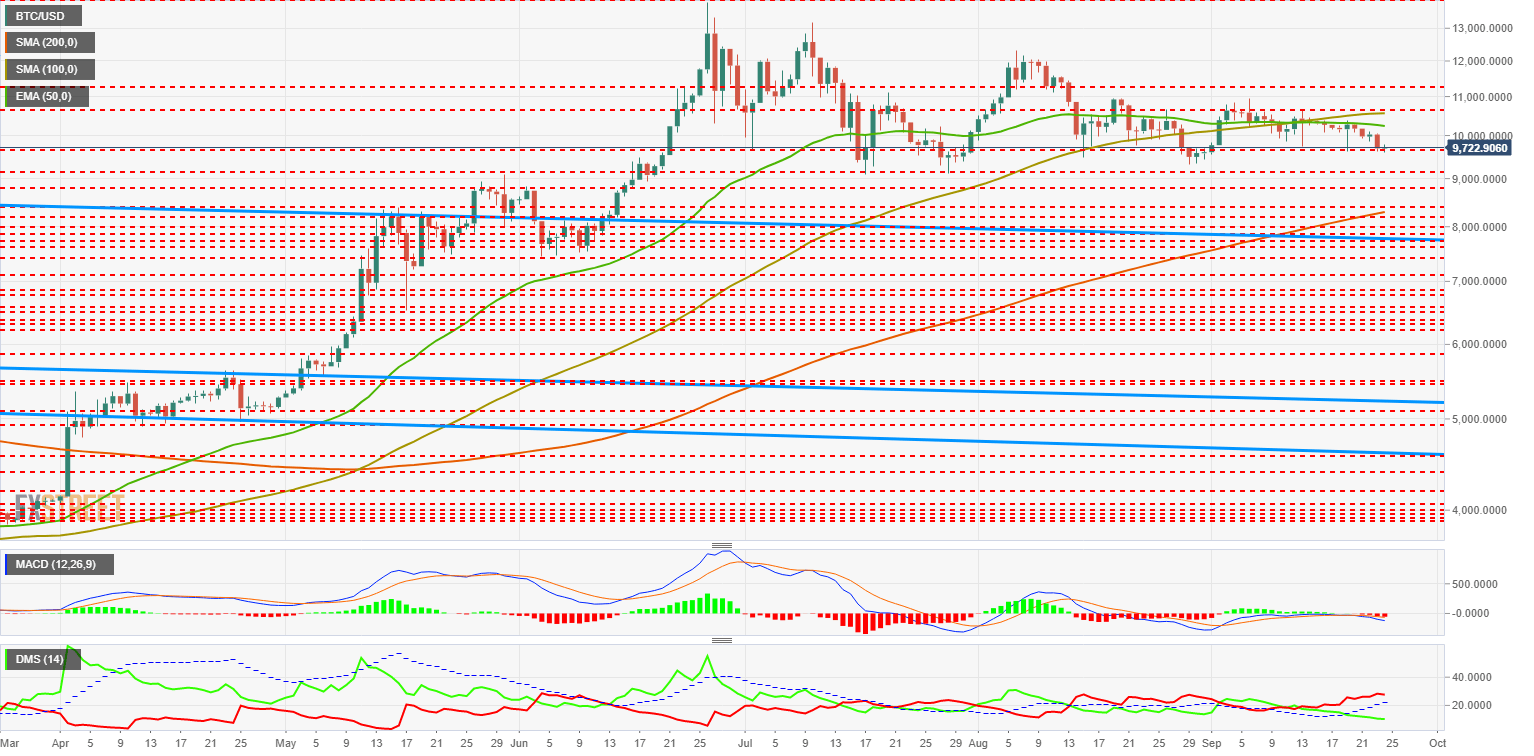

BTC/USD Daily Chart

BTC/USD is currently trading at $9,722 and is the only component of the Top 3 that is now in the green. Bitcoin narrows its daily range more and more and increases the chances of an explosive exit.

Above the current price, the first resistance level is at $10,250, then the second at $10,650 and the third one at $11,250.

Below the current price, the first support level is at $9,700, then the second at $9,150 and the third one at $8,850

The MACD on the daily chart continues to cross downward but with little inclination or openness between the lines. As the indicator stands, it would be straightforward to turn it around.

The DMI on the daily chart shows how the bears control BTC/USD while the bulls do not have any confidence in a possible recovery in the short term.

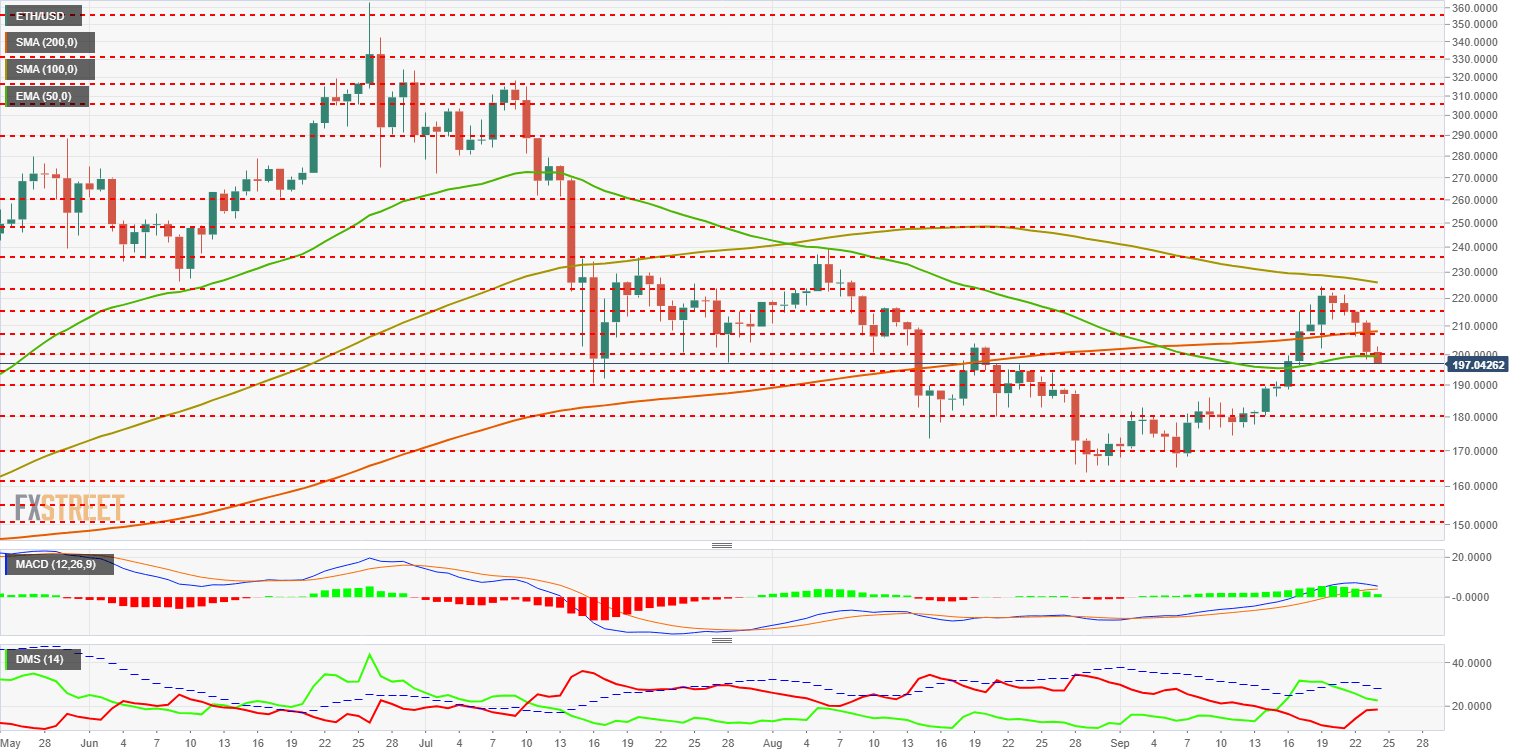

ETH/USD Daily Chart

ETH/USD is currently trading at $197.64 after losing the psychological support of $200. The 50-period exponential moving average supports the price.

Above the current price, the first resistance level at $208, then the second at $215 and the third one at $225.

Below the current price, the first support level is at $195, then the second at $190 and the third one at $180.

The MACD on the daily chart continues to cross bullish but with a minimum distance to a possible bearish cross. There is likely to be a rebound to the upside in the next few days, although it is not possible to know the further development.

The DMI on the daily chart shows bulls with a slight advantage over bears. The bullish side continues to signal an ongoing trend, but the bears react to the upside and come very close to the cross-level with the buyer side.

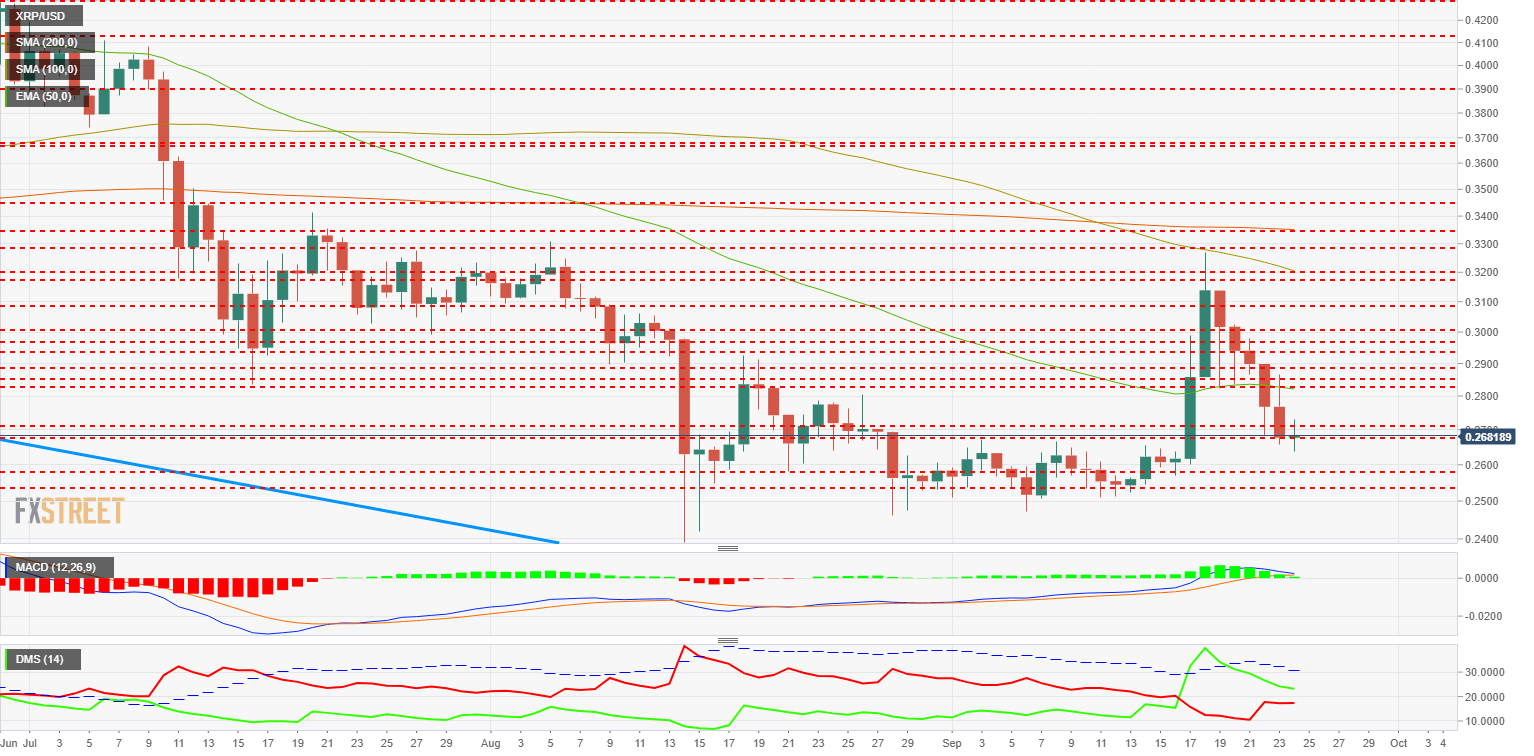

XRP/USD Daily Chart

XRP/USD is currently trading at $0.268 and is losing most of last week's gains. XRP doesn't have much more room to fall if it doesn't want to miss all its bullish potential.

Above the current price, the first resistance level is at $0.271, then the second at $0.282 and the third one at $0.288.

Below the current price, the first support level is at $0.26, then the second at $0.258 and the third one at $0.253.

The MACD on the daily chart shows a flat profile and virtually no opening between the lines. The averages move on the bullish side of the indicator, resulting in a bullish lateral structure.

The DMI on the daily chart shows the advantage of bulls over bears. Bears react quickly to price declines, which could indicate that they expect to see new lows rather than new relative highs.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Uniswap nears $3 billion in daily trading volume despite Wells notice and fee hike

Uniswap's (UNI) price witnessed a double-fold crash in the past week after it received a Wells notice from the SEC and later due to the general crypto market crash over the weekend. In the past week, UNI has decreased more than 38%.

Arbitrum Price Prediction: 10% losses likely for holders ahead of $107 million worth of cliff token unlocks

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply.

Ethereum recovers from dip as Hong Kong ETH ETF approval sparks whale buying spree

Ethereum's (ETH) price slightly improved on Monday after Hong Kong approved applications for a spot Bitcoin and Ethereum ETF. Whales have also been accumulating ETH after the market dip over the weekend.

Bitcoin price delays pre-halving rally as US and China battle for BTC supremacy ahead of halving

Bitcoin has failed to showcase an enticing pre-halving rally. As the event remains less than a week out, traders and investors remain at the edge of their seats, with thoughts on whether the impact of the fourth cycle will be different than what has been seen before.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.