- Cryptocurrencies have consolidated their gains ahead of Thursday's ETF launch.

- The technical picture remains bullish for digital coins.

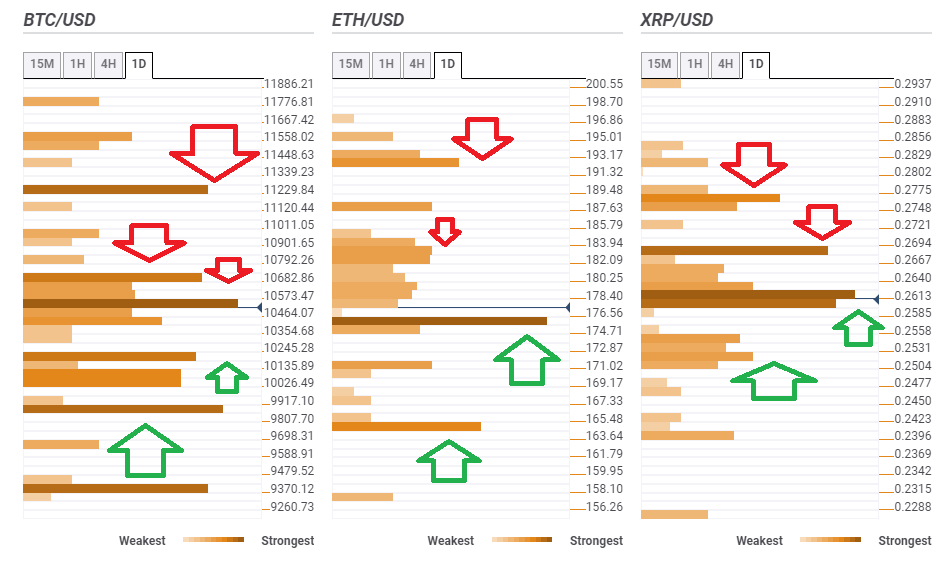

- Here are the next levels to watch according to the Confluence Detector.

On Thursday, September 5, VanEck and SolidX are set to offer a Bitcoin Exchange Traded Fund (ETF). The firms will begin selling shared in a limited version of an ETF, exploiting an exemption by the Securities and Exchanges Commission (SEC). The companies plan to go ahead even if they lose the consequent broader decision related to retail investments.

Nevertheless, this is a crack in the door to make an investment in cryptocurrencies more accessible to the broader public. Digital coins have advanced on the news but have failed to go very far. Nevertheless, they are technically well-positioned to extend their gains.

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD is battling $10,520

Bitcoin is fighting a dense cluster of levels around $10,520. These include the Fibonacci 38.2% one-month, the Fibonacci 61.8% one-day, the Simple Moving average 10-4h, the Bollinger Band 1h-Lower, the BB 15min-Lower, and more.

If it breaks free, some resistance awaits at $10,682, which is the convergence of the SMA 5-4h, the previous 4h-high, the Fibonacci 23.6% one-day, and the previous weekly high.

Next up, the granddaddy of cryptos faces resistance at $11,229, which is where the Fibonacci 61.8% one-month and the Pivot Point one-week Resistance 2.

Support awaits BTC/USD at $10,180, which is the confluence of the Fibonacci 61.8% one-week, the SMA 100-1d, and the BB 1d-Middle.

Further down, further support awaits at $9,860, where the Fibonacci 38.2% one-week and the PP 1d-S3 converge.

ETH/USD enjoys strong support

Ethereum is trading above significant support at $175, which is a juncture of lines including the PP 1d-S1, the SMA 50-4h, the SMA 200-1h, the BB 4h-Middle, and the Fibonacci 38.2% one-week.

Looking up, resistance is weak. The next noteworthy cluster is around $183, which is the convergence of the Fibonacci 23.6% one-month, the BB 1h-Upper, and the previous daily high.

Next up, the next cap is $192, where the Fibonacci 38.2% one-month, and the PP 1d-R3 meet.

Lower support awaits at $164, which is where both the previous monthly low and the previous weekly low meet the price.

XRP/USD stuck in a minefield

Ripple is trading in a minefield of technical lines that runs from $0.2585 to $0.2613. This includes the previous 4h-low, the BB 15min-Middle, the SMA 5-1h, the SMA 50-1h, the SMA 200-15m, the Fibonacci 23.6% one-month, the BB 4h-Middle, the PP 1d-S1, the SMA 200-1h, the Fibonacci 38.2% one-week, the BB 1h-Lower, and the SMA 10-15m.

Further up, resistance is waiting at $0.2680, where we see the confluence of the BB 1d-Middle, the previous daily high, the Fibonacci 61.8% one-week, and the PP 1d-R1.

Higher, the target is $0.2760, which is where the Fibonacci 38.2% one-month meets the PP 1w-R1.

Looking down, support awaits at $0.2504, which is where the PP 1d-S3 and the BB 1d-Lower converge.

See all the cryptocurrency technical levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

HBAR price jumps 75% as BlackRock tokenizes Money Market Fund on Hedera

Archax, Ownera and The HBAR Foundation have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera. Last year Hedera Council member abrdn’s successfully tokenized its MMFs on Hedera.

Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Bitcoin (BTC) price remains range-bound, holding above the $63,000 level, while its upside is capped below $68,000, going against or delaying the assumption that the fourth halving would be a 'sell-the-news' outcome.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce reliance on the US dollar after plans for a stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?