- Major cryptocurrencies trade in relatively tight ranges this weekend.

- NY financial regulator gives green light to Bakkt to offer Bitcoin futures.

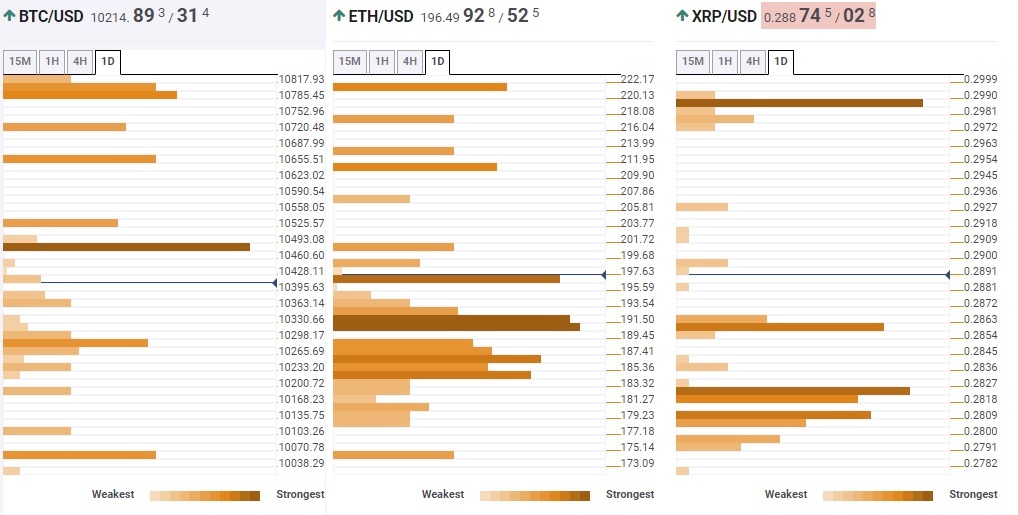

- Confluence Detector shows Ethereum sits above multiple strong support levels.

The strong selling pressure surrounding major cryptocurrencies eased a little on Friday following the news of the NY financial regulator granting Bakkt, cryptocurrency platform affiliate of Intercontinental Exchange Inc, a license to operate as a limited liability trust company, in other words, allowing it to offer Bitcoin futures contracts to its institutional customers. Although the market sentiment turned positive on the back of this development, the three-biggest cryptocurrencies with regards to total market capitalization, Bitcoin, Ethereum, and Ripple, all look to post weekly losses.

Meanwhile, according to a press release published on Globe Newswire, Bitcoin’s mysterious creator Satoshi Nakamoto will reportedly reveal his identity among other information such as education, professional background, and confirm his holding of 980,000 Bitcoins worth around $10,000 billion, in a three-day event title "My Reveal," which will go live on the Satoshi Nakamoto Renaissance Holdings and the Ivy McLemore & Associates websites live at 20:00 GMT on Sunday.

Now let's take a look at the technical picture and identify the key technical levels revealed by the Confluence Detector for the top 3 cryptocurrencies.

BTC/USD to face strong resistance near $10,490

After dropping to its lowest level of August at $9,467 on Thursday, the BTC/USD pair staged a recovery and is now trading above $10,300. Despite this rebound, the pair remains on track to lose around 10% for the week.

On the downside, the 10-period SMA on the H4 chart at $10.280 seems to have formed interim support ahead of $10,060 (the Fibonacci 23.6% retracement of the monthly price action.) Meanwhile, the initial resistance could be seen at $10,480 (previous daily high and the upper range of the Bollinger Band on the 15-minute chart before $10,800 (the Fibonacci 61.8% retracement of the weekly price action and Fibonacci 161.8% retracement of the daily price action.)

ETH/USD trades above multiple support levels

According to the Confluence Detector, the ETH/USD pair is trading a little above the critical $196 support (the 200-period SMA on the daily chart, the upper range of the Bollinger Band on the hourly chart). Just below that level, $189/191 area (daily pivot point R2, the Fibonacci 38.2% retracement of the weekly price action, previous monthly low, the upper range of the Bollinger Band on the H4 chart) is likely to make it difficult for the pair to extend its slide.

On the upside, $210 (weekly pivot point R1, the 100-period SMA on the H4 chart) could be seen as the first hurdle before $222 (the Fibonacci 23.6% retracement of the monthly price action).

XRP/USD recovery unlikely to encounter any resistance until $0.2990

Ripple (XRP/USD) is likely to extend its recovery to $0.2990 (weekly pivot point R1) as the Confluence Detector shows a lack of resistance levels until that point. On the downside, the 10-day moving average is acting as dynamic support at $0.2860 ahead of $0.2840 (daily pivot point R3, the 200-period moving average on the hourly chart and the 50-period moving average on the H4 chart) and $0.2808 (the Fibonacci 61.8% retracement of the weekly price action.)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

HBAR price jumps 75% as BlackRock tokenizes Money Market Fund on Hedera

Archax, Ownera and The HBAR Foundation have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera. Last year Hedera Council member abrdn’s successfully tokenized its MMFs on Hedera.

Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Bitcoin (BTC) price remains range-bound, holding above the $63,000 level, while its upside is capped below $68,000, going against or delaying the assumption that the fourth halving would be a 'sell-the-news' outcome.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce reliance on the US dollar after plans for a stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?