- Bitcoin price returns to a price level that could prevent further downside risk.

- Ethereum price erases weekly losses to bring ETH into positive territory.

- XRP price moves closer to the critical $0.75 zone, then $1 above that.

Bitcoin price action has generated a significant amount of buying during the early NY trading session, pushing higher by more than 5%. Likewise, Ethereum price has rallied over 24% from the weekly lows. XRP price continues to lag BTC and ETH in performance, but a rally of its own is likely to develop very soon.

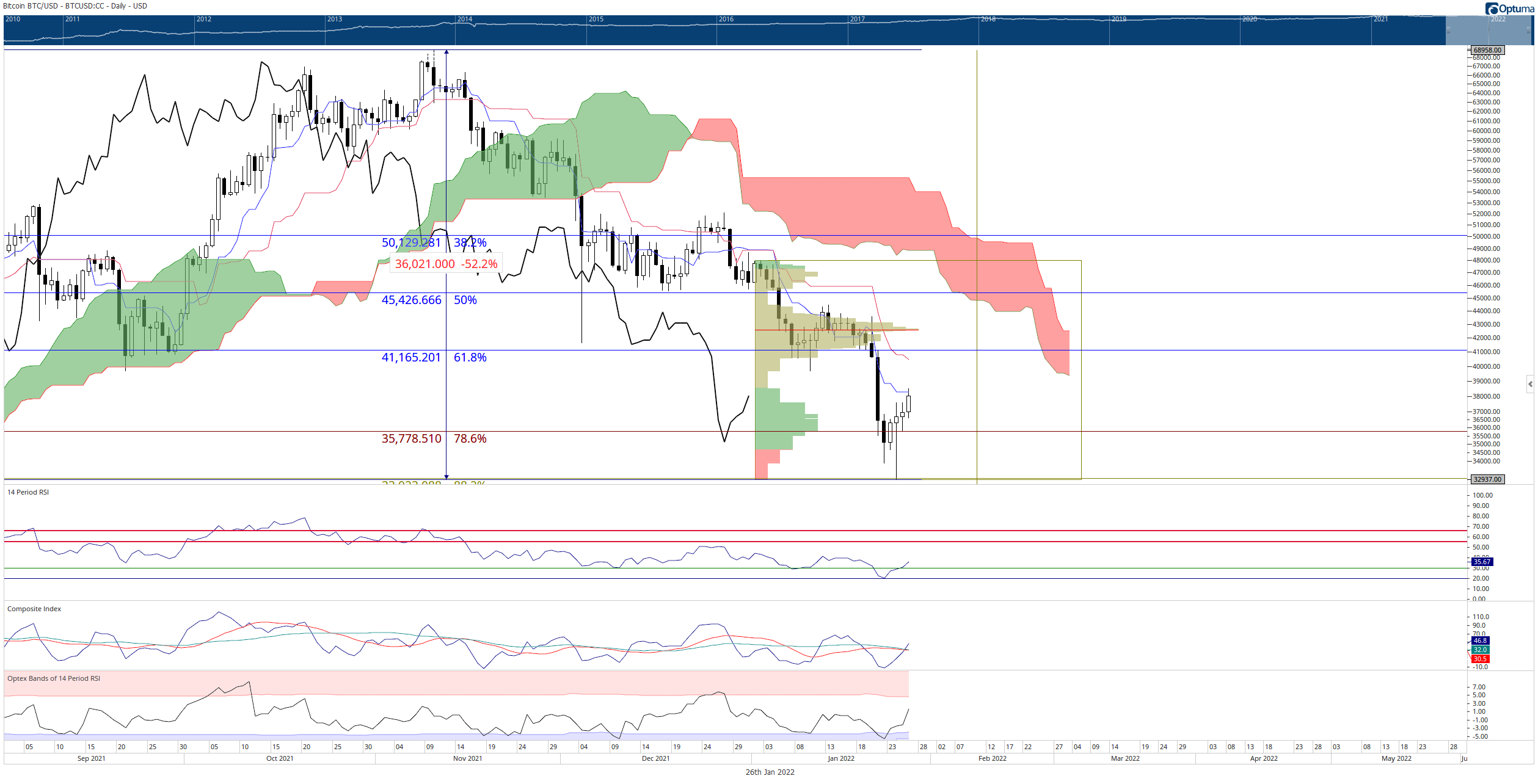

Bitcoin price targets a return to $40,000

Bitcoin price is setting up for a significant spike higher - or an aggressive and bearish continuation move. On the daily Ichimoku chart, Bitcoin’s intraday resistance is the Tenkan-Sen at $38,275. Failure to move and close above the Tenkan-Sen on the daily chart could trigger a resumption of selling - this is especially true for today due to the first ‘Fed Day’ of 2022.

If buyers can rally Bitcoin to a close above the Tenkan-Sen, then the next resistance zone to test is a value area between $40,000 (Kijun-Sen) and $41,000 (61.8% Fibonacci retracement).

BTC/USD Daily Ichimoku Kinko Hyo Chart

Upside potential beyond $40,000 is likely limited to the 50% Fibonacci retracement at $45,500. Downside risks are limited to the 2022 swing low at $33,000.

Ethereum price action rallies higher during the Wednesday trading session

Ethereum price is on a roll. It’s hard to believe that ETH was down 18% from the open earlier this week and is now up over 4% - and likely pushing higher. The 24% rally off the weekly lows has likely triggered many short squeezes that have yet to pop.

The most crucial technical behavior that Ethereum price displayed is a return above the weekly Ichimoku Cloud. The combination of a weekly close above the Cloud and the extreme oversold conditions in the weekly oscillators form a robust base to see Ethereum retest the $4,000 value area.

ETH/USD Weekly Ichimoku Kinko Hyo Chart

Traders should be cautious despite the current bullish activity, especially today due to ‘Fed Day.’ The US Federal Reserve will share comments and forward guidance regarding future interest rates, tapering, and inflation. Any hint of increased wariness by the Fed could have a bearish effect on Ethereum price and all risk-on markets like cryptocurrencies.

A weekly close below the bottom of the Cloud at or below $2,300 would invalidate any bullish outlook.

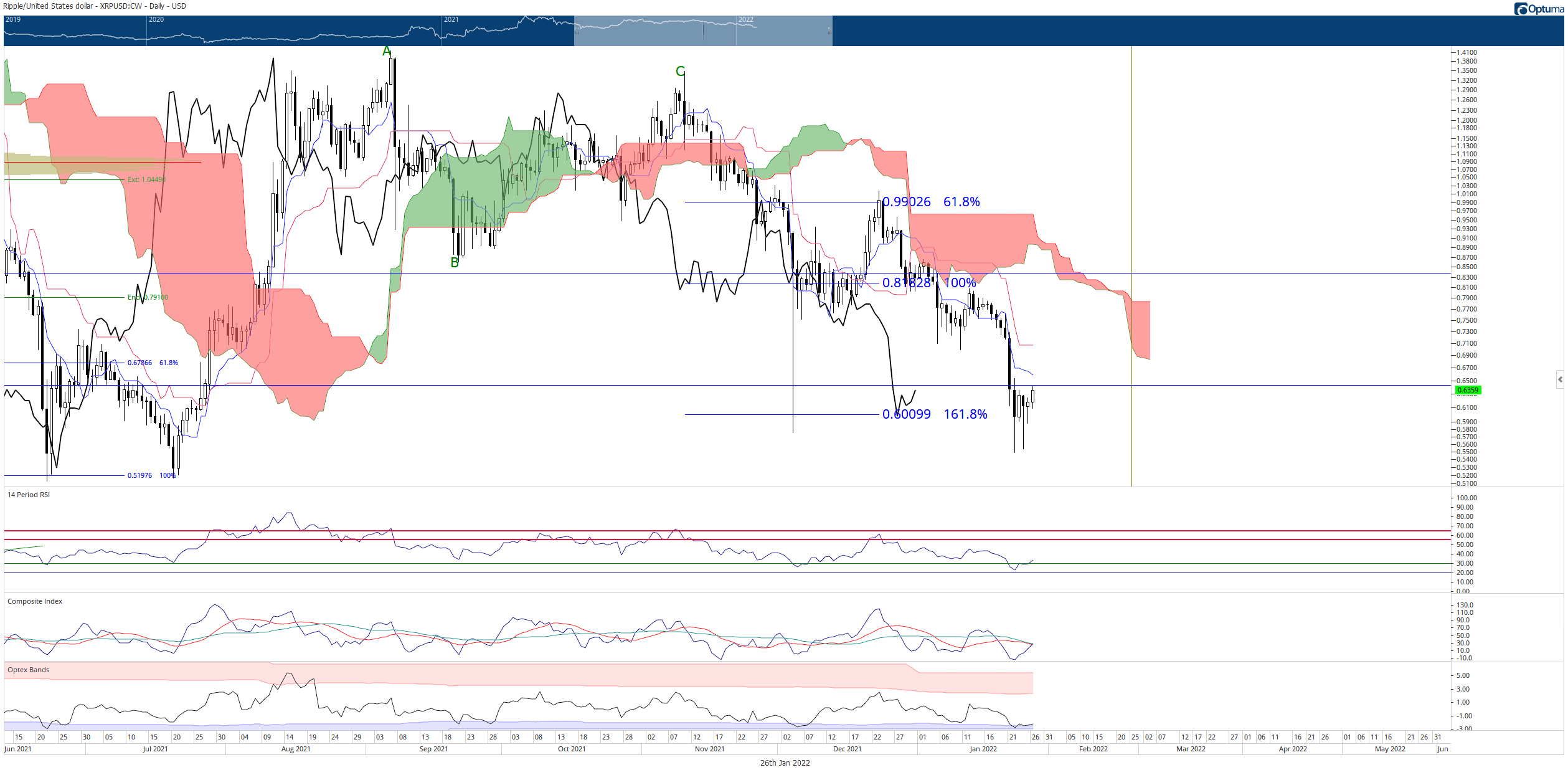

XRP price to return to $1

XRP price action has found a strong support level near the 50% Fibonacci retracement at $0.64 and the 161.8% Fibonacci retracement at $0.60. This support comes in as XRP has developed highly oversold conditions in the Relative Strength Index, Composite Index, and Optex Bands oscillators.

Perhaps the most critical warning signal that a new bull run could be imminent is the 180-day (180 to 198 days) Gann Cycle of the Inner Year. The 180-day is the second most powerful Inner Year Cycle. Gann wrote that the 180-day cycle has a high probability of establishing necessary support or resistance levels. Additionally, he also warned that reversals often happen at this time cycle.

XRP/USD Daily Ichimoku Kinko Hyo Chart

Bulls should look for a return to test the $1.00 value area if XRP price can close above the 50% Fibonacci retracement at $0.64. Downside pressure remains but is likely limited to the 61.8% Fibonacci retracement and psychological price level at $0.50.

RELATED CONTENT

Binance Coin price bound for 15% upswing as bulls make a comeback

Binance Coin sees bulls trading away from the monthly S2 support level at $335 tested twice and bulls jumping on the buying volume to get involved in the price action. Backed by the green ascending trendline, a bullish entry makes sense as the Relative Strength Index (RSI) has just exited oversold territory. As such, sellers do not have much incentive to stay further in their short positions as further gains look limited for now. BNB price thus offers a solid entry point, and bulls are now ready to break above $389, the weekly high and short-term cap that has kept BNB price limited to the upside this week. As bears are being pushed against that level, expect their stops to be run once bulls break above it, which will trigger a massive demand for buying volume and squeeze price action even higher. The monthly S1 does not hold much historical reference, so $452 makes the most sense with the 200-day Simple Moving Average just above as a cap, that needs to be broken to start speaking of an uptrend.Read more

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?