- Last-minute rallies push Top 3 back to the upside.

- Ether continues to lead the market, setting the pace for the upward trend.

- XRP falls behind again because of Ripple Ltd-linked rumours.

The cryptocurrency board turns green again without giving the eyes time to get used to the red. At the moment, the current climb is still within the planned lateral downward scenario so that this green could be short-lived on the screens.

The BTC/USD pair is moving back above $10000 but is unable to break the resistance in the short term.

Ether continues to do better than Bitcoin, as do Litecoin, EOS or XTZ.

XRP is still surrounded by negative rumours, in this case, the controversy comes from the possible mass sale of XRP by David Schwartz, one of the founders of Ripple Ltd, and now CTO of XLM.

News is coming from the US about a new layer of regulation in the cryptography industry. Steve Mnuchin, US Secretary of the Treasury, stated that his department is working on a new package of measures to increase transparency and security in the cryptography industry.

US President Donald Trump has expressed his desire for the secret service to work again with the Treasury Department. The goal of this movement is to prosecute the illegal use of crypto-currency to launder capital and illicit business.

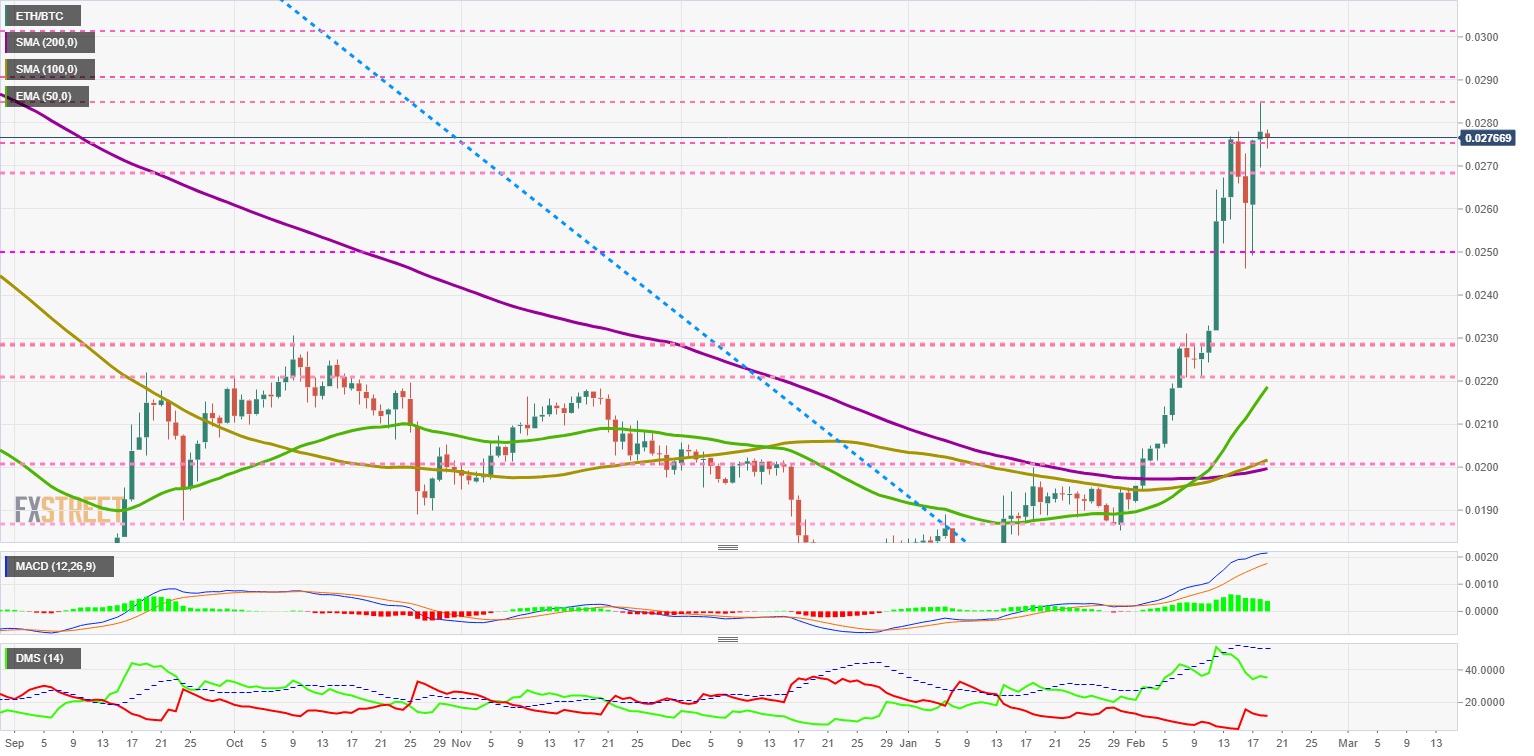

ETH/BTC Daily Chart

ETH/BTC finished yesterday's trading session at a new relative high of 0.0285 after breaking through the price congestion resistance at 0.0275.

Ether continues to be favored by the market and continues to set the overall market momentum.

Above the current price, the first resistance level is at 0.0285, then the second at 0.029 and the third one at 0.030.

Below the current price, the first support level is at 0.027, then the second at 0.025 and the third one at 0.023.

The MACD on the daily chart is losing some of its upward momentum, but the distance between the lines is still intact. This setup is conducive to increased volatility, both upward and downward.

The DMI on the daily chart shows a slight improvement from the beginning of the week. The bears, on the other hand, are getting worse, but are still within striking distance of taking ETH/BTC’s leadership.

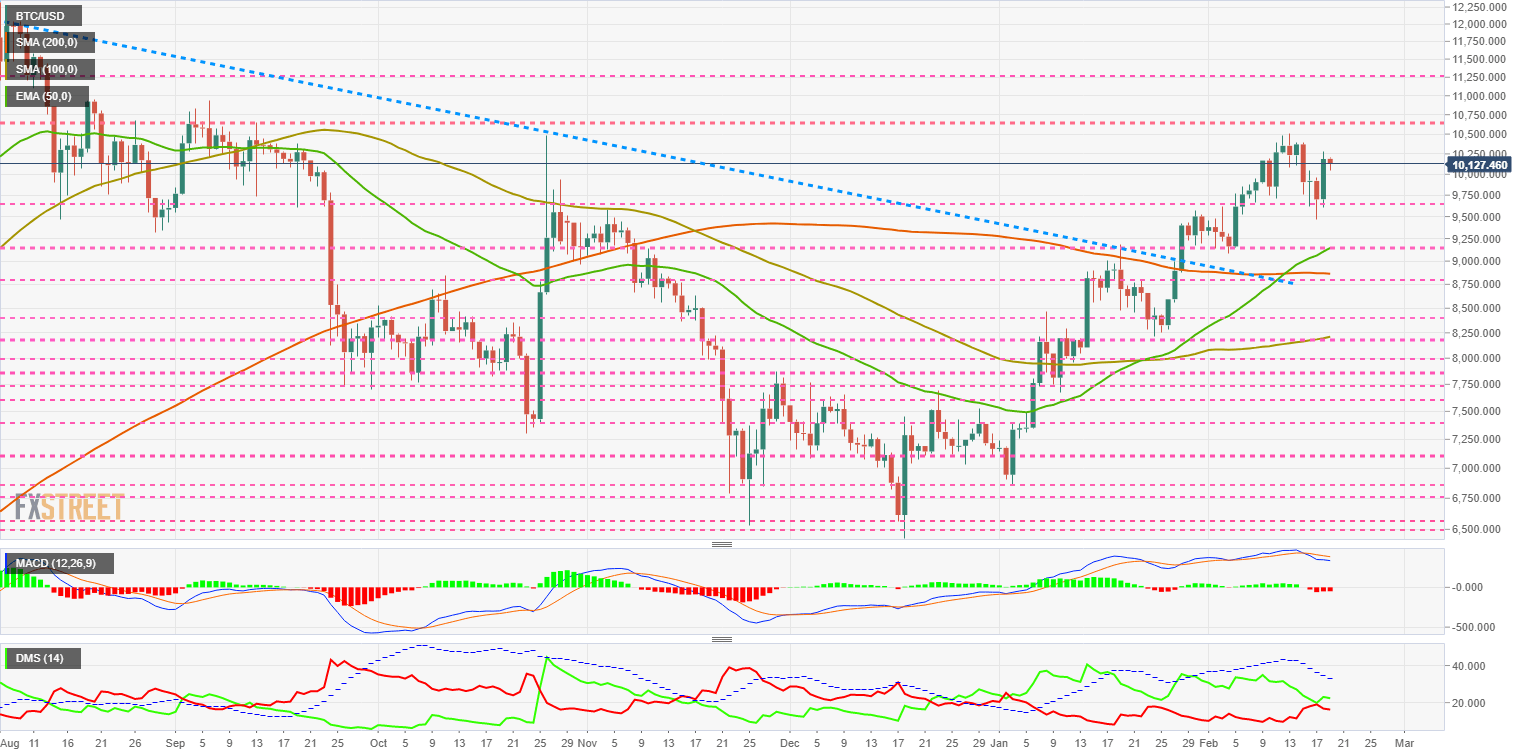

BTC/USD Daily Chart

The BTC/USD pair is trading above the psychological level of $10000 and is currently trading at the price level of $10140. The $9700 support level worked perfectly.

Above the current price, the first resistance level is at $10700, then the second at $11250 and the third one at $13980.

Below the current price, the first support level is at $9700, then the second at $9200 and the third one at $8750.

The MACD on the daily chart points to the downside, but with a slight slope and line spacing.

The DMI on the daily chart shows the bulls saving the first face of the bear. The low level it has reached after the bounce promises more meetings between the two sides of the market.

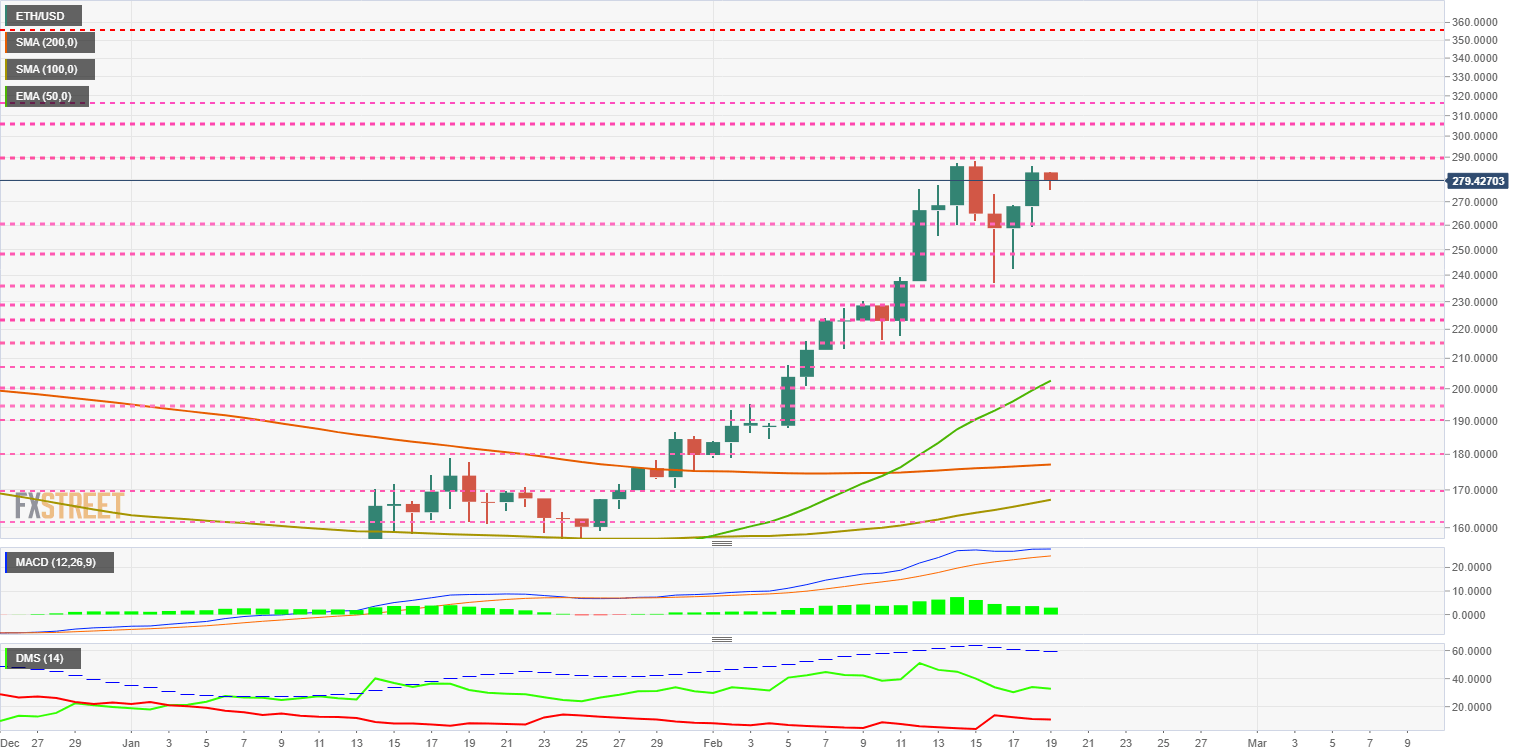

ETH/USD Daily Chart

ETH/USD is currently trading at the $279.5 price level after yesterday's high of $286. The price level to overcome to enter a new bullish phase is the $290 level.

Above the current price, the first resistance level is at $290, then the second at $308 and the third one at $318.

Below the current price, the first support level is at $260, then the second at $250 and the third one at $238.

The MACD on the daily chart shows an improvement in the profile from the beginning of the week, although it does not change the previous bearish lateral bias.

The MACD on the daily chart shows an improvement in the profile from the beginning of the week, although it does not change the previous bearish lateral bias.

The DMI on the daily chart shows bulls retaining the lead over the bears. The selling-side will likely attempt to capture the leadership of the pair.

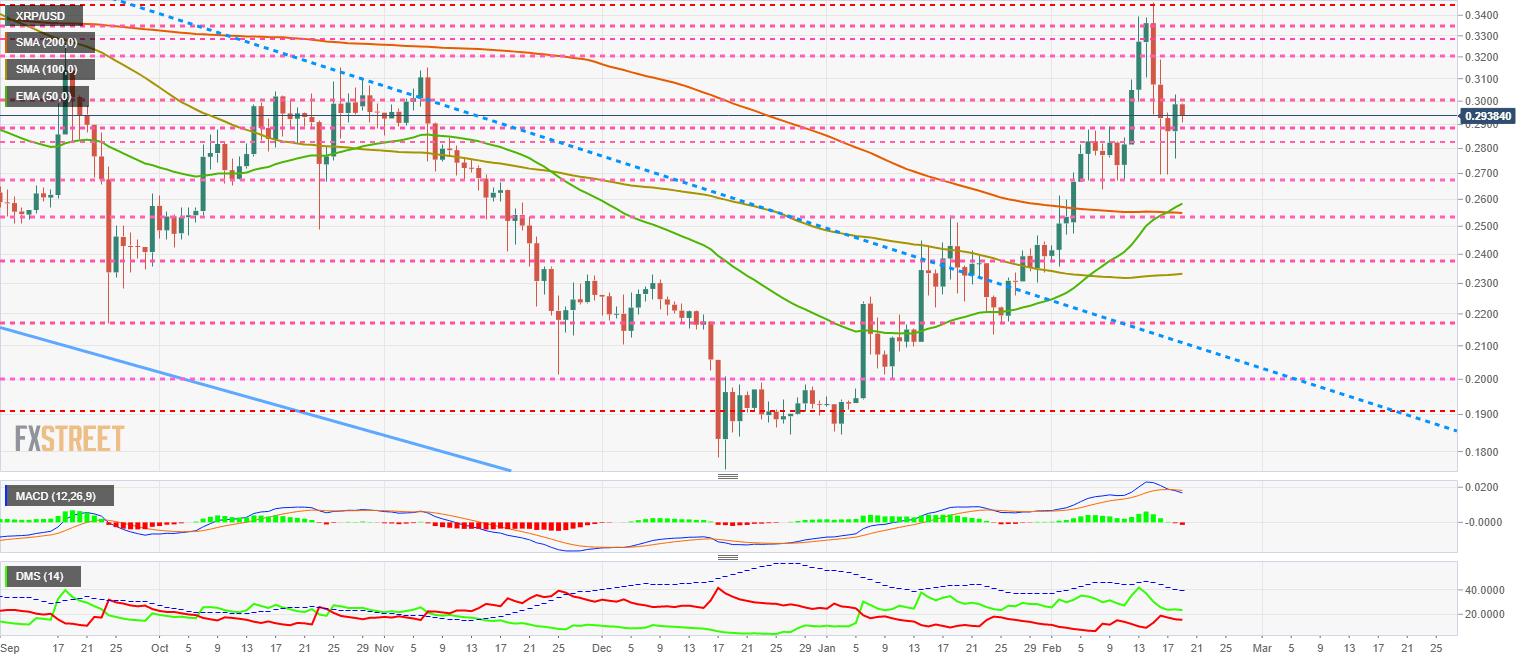

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the price level of 0.2938, in a second attempt to overcome the $0.30 level lost over the weekend.

XRP is again in the spotlight because there is speculation about the announcement made by Ripple Ltd co-founder David Schwartz to sell his large XRP stock.

Above the current price, the first resistance level is at $0.30, then the second at $0.32 and the third one at $0.33.

Below the current price, the first support level is at $0.29, then the second at $0.282 and the third one at $0.27.

The MACD on the daily chart completes the bearish cross, and the very likely development coincides with that of BTC/USD.

The DMI on the daily chart shows bulls with a slight advantage over the bears. A meeting between the two sides of the market will likely take place before the end of this week.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?