- Coinbase Custody secures $7 billion in assets after Xapo’s acquisition.

- Institutional investors are finally behind Bitcoin other cryptocurrencies.

- Ripple is flashing bright ‘BUY’ signals after grinding to oversold levels.

The cryptocurrency market is trying its luck on recovery following the recent Bitcoin triggered selloff. However, the cryptocurrencies live rates still display a saddening picture of red. On the brighter side, the market has a certain liking for weekends. Therefore, most investors are looking forward to a higher close at the of the weekend sessions.

In other news, Coinbase announced the completion of the deal to acquire Xapo’s custody businesses. Xapo is a trusted custody provider for Bitcoin other cryptocurrencies. The acquisition has seen Coinbase control about $7 billion of assets under its custody arm.

Following the announcement, the CEO of Coinbase Brian Armstrong released some catalytic figures likely to push Bitcoin price to higher levels. Armstrong says that Coinbase custody is recording a whopping $200-400 million every week in new cryptoassets deposits. According to him, institutional investors are finally behind Bitcoin other cryptocurrencies which further validates the market.

“Whether institutions were going to adopt crypto or not was an open question about 12 months ago. I think it's safe to say we now know the answer. We're seeing $200-400M a week in new crypto deposits come in from institutional customers.”

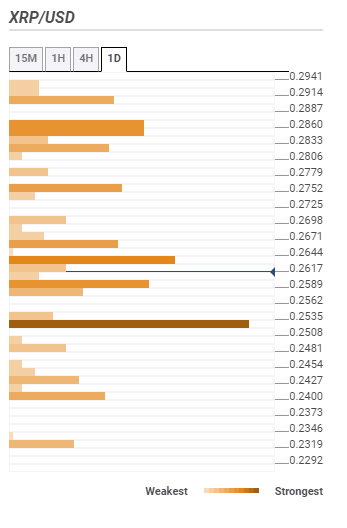

Consequently, an analyst Naeem Aslam says that Ripple is flashing bright ‘BUY’ signals after grinding to oversold levels. He advices investor to buy at the current market value.

“I personally think that #Ripple's $XRP is way OVERSOLD and it could be a good BUY at the current price,” Aslam wrote on Twitter.

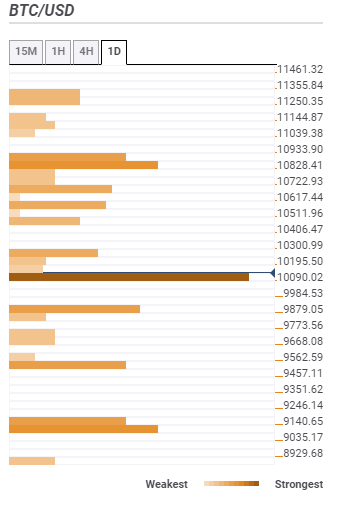

Bitcoin toughest hurdle is behind us: Eyes set on $11,000

Bitcoin is likely reacting to the above mentioned Coinbase custody news with a comeback above $10,000. The resistance level that has been limiting correction upwards at $10,090 has turned into a massive support area. Therefore, dips into this level will most likely bounce paving the way for an explosive move towards $11,000.

The cluster of indicators at the support area include SMA 10 1-hour, SMA 200 15-mins, SMA 50 15-mins, SMA 100 15-mins, SMA 50 1-hour, and the Previous low 15-mins. In case the bears manage to force their way through $10,090 support, the cushion is likely to be found at $9,879, $9,562 and $9,140.

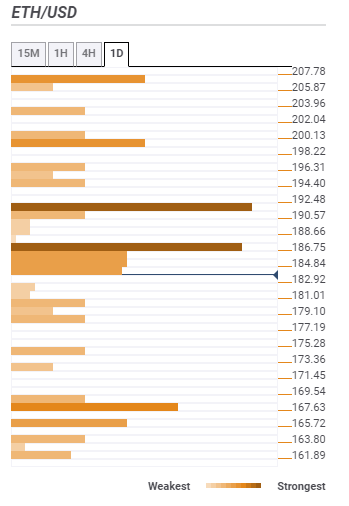

Ethereum lethargic momentum above $180 needs a catalyst to $200

Ethereum bears are not leaving any stoned unturned. The plunge from consolidation levels above $200 was devastating if not demoralizing. The support at $170 was strong enough to stop the painful downtrend. However, recovery has been slow and mundane.

The confluence tool places the initial resistance at $186 (sellers’ congestion zone). Forming the confluence at this zone is the Previous High 4-hour, Pivot Point 1-week S2 and 23.6% Fib daily. A breakout above this resistance will come face to face with the resistance at $192. Meeting here is the Previous Month Low and the Bollinger Band 1-day lower. The crypto needs a catalyst to project above the resistance at $200.

If the support at $182 fails to hold, we are likely to see the price plunge below $170 and even explore the levels close to $150. The tool shows $167 as tentative support. However, Ethereum has a big shortage of support areas.

Ripple stuck in oversold levels; what’s next?

Ripple is still staring into an avalanche of resistance pressure despite the correction above the stubborn level at $0.2535. At press time, the range resistance between $0.2589 and $0.2644 limits movement either side. The SMA 5 4-h, SMA 100 15-mins and Bollinger Band 1-hour middle, SMA 10 4-h and 23.6% Fib 1-day and Fib 38.2% 1-day form the confluence.

Recovery above beyond $0.30 will not come without a fight due to the multiple resistance zones outlined by the confluence. Traders should keep in mind the possible struggle at $0.2752, $0.2860 and $0.2914.

On the flipside, the resistance turned support at $0.2535 is in line to protect XRP from declines. Below this level, $0.2400 is the only viable support area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?