- The cryptocurrency exchange industry presents interesting initiatives that may be key for the next trip to the moon.

- Altcoins reach key resistance but fail after lack of reaction from Bitcoin.

- Loss of momentum at wide ranges can cause significant intraday shifts.

The crypto board is painted red at the end of the week after yesterday's attempt at a new bullish breakout move. The flow of capital that is pivoting towards the Altcoin, especially the Ether, is hampering the upward development of prices.

Today news highlights several initiatives to bring tokens that clone Bitcoin to the ERC20 or Ethereum network. An exciting move that will allow the flow between the two segments, Bitcoin vs Altcoins, to share network, speed and costs.

The Ethereum network is taking an increasingly important role and with it the interest in the native token, the Ether. An example of this is the data left by the futures market.

The volume of futures trading on Ether exceeds $4.5 billion for the first time since June 2017. Three weeks ago, the amount was $750 million, according to Skew Markets.

The International Organization of Securities Commissions (IOSCO) has called on global regulators to act more decisively to ensure the safety of crypto exchange users and greater oversight of potential fraudulent uses.

Another initiative released today lead by a group of veteran professionals from NASDAQ, Morgan Stanley, VISA and MasterCard. Apinify is the name of a project that brings together world-class talent, intending to offer a unified pricing service for the Crypto market. The implementation of this technology would be a definite step towards bringing the crypto market out of the current atomization.

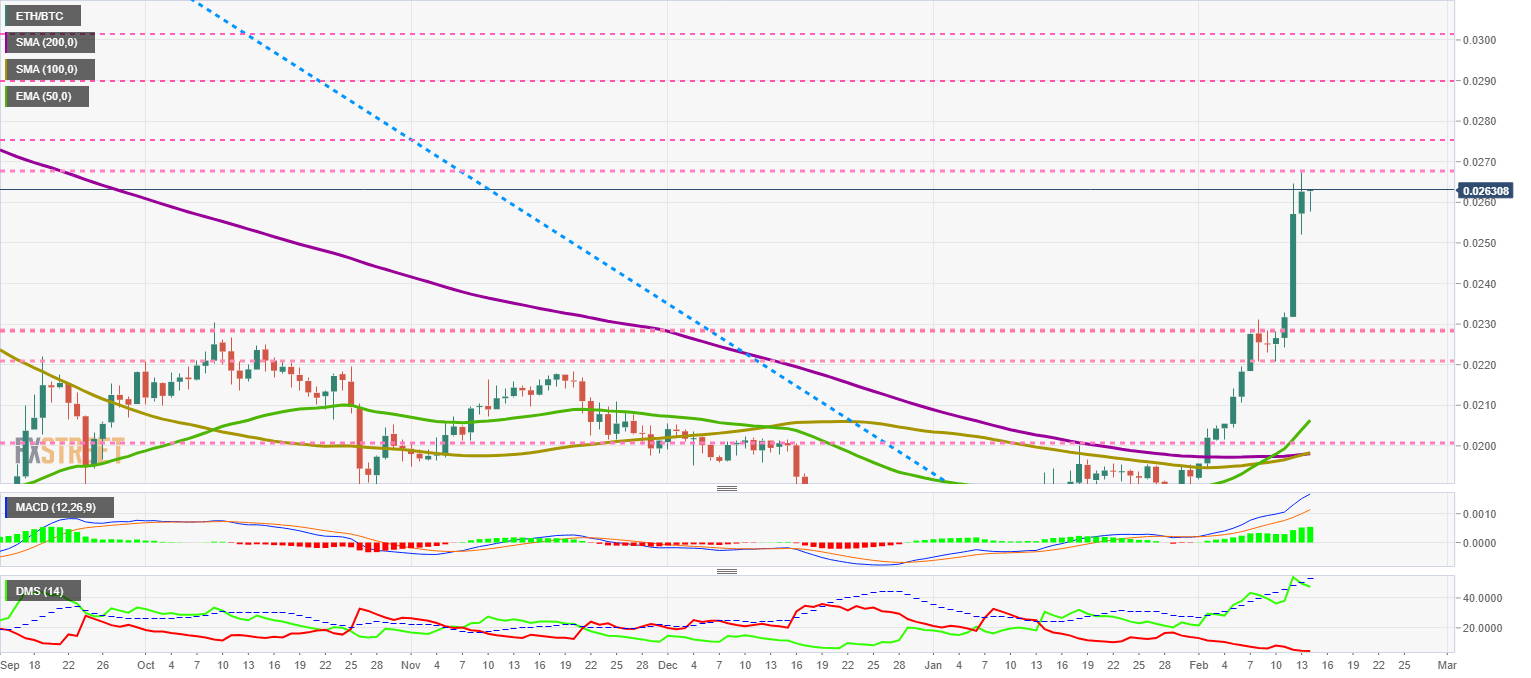

ETH/BTC Daily Chart

The ETH/BTC pair is trading at the price level of 0.02629 and shows the difficulty in rising above the price level of 0.0268. ETH/BTC is in a wide range that promises increased volatility if the upward momentum loses momentum.

Above the current price, the first resistance level is at 0.0268, then the second at 0.0275 and the third one at 0.029.

Below the current price, the first support level is at 0.023, then the second at 0.022 and the third one at 0.020.

The MACD on the daily chart shows a slight upward slope which, given the current height of the indicator's moving averages, could trigger a consolidation pattern in the current range.

The MACD on the daily chart shows a slight upward slope which, given the current height of the indicator's moving averages, could trigger a consolidation pattern in the current range.

The DMI on the daily chart shows bulls unable to stay above the ADX line, which is otherwise normal given the height reached by this indicator. Bears continue to be at multi-month lows, an extreme that could trigger sales by the effect of a return to normal levels.

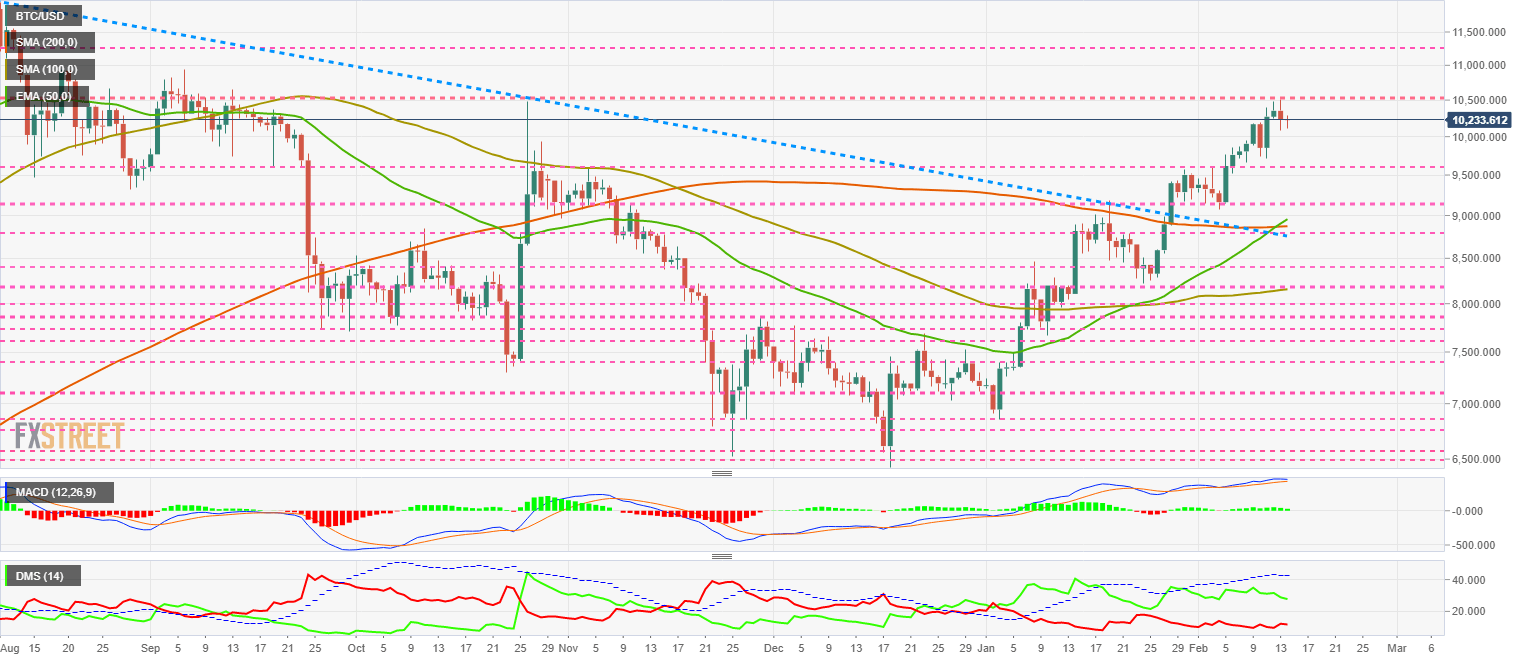

BTC/USD Daily Chart

BTC/USD is trading at the $10233 price level and shows weakness over two consecutive days. The shift of positions into the Altcoin segment takes strength away from the Bitcoin and keeps it too close to the bullish breakout level of $8750.

Above the current price, the first resistance level is at $10500, then the second at $11250 and the third one at $14000.

Below the current price, the first support level is at $9650, then the second at $9150 and the third one at $8,800.

The MACD on the daily chart points to a soft downward cross, which could lead to a bearish sideways scenario in the near term.

The MACD on the daily chart points to a soft downward cross, which could lead to a bearish sideways scenario in the near term.

The DMI on the daily chart shows bulls losing the uptrend, while bears are not reacting to the price weakness.

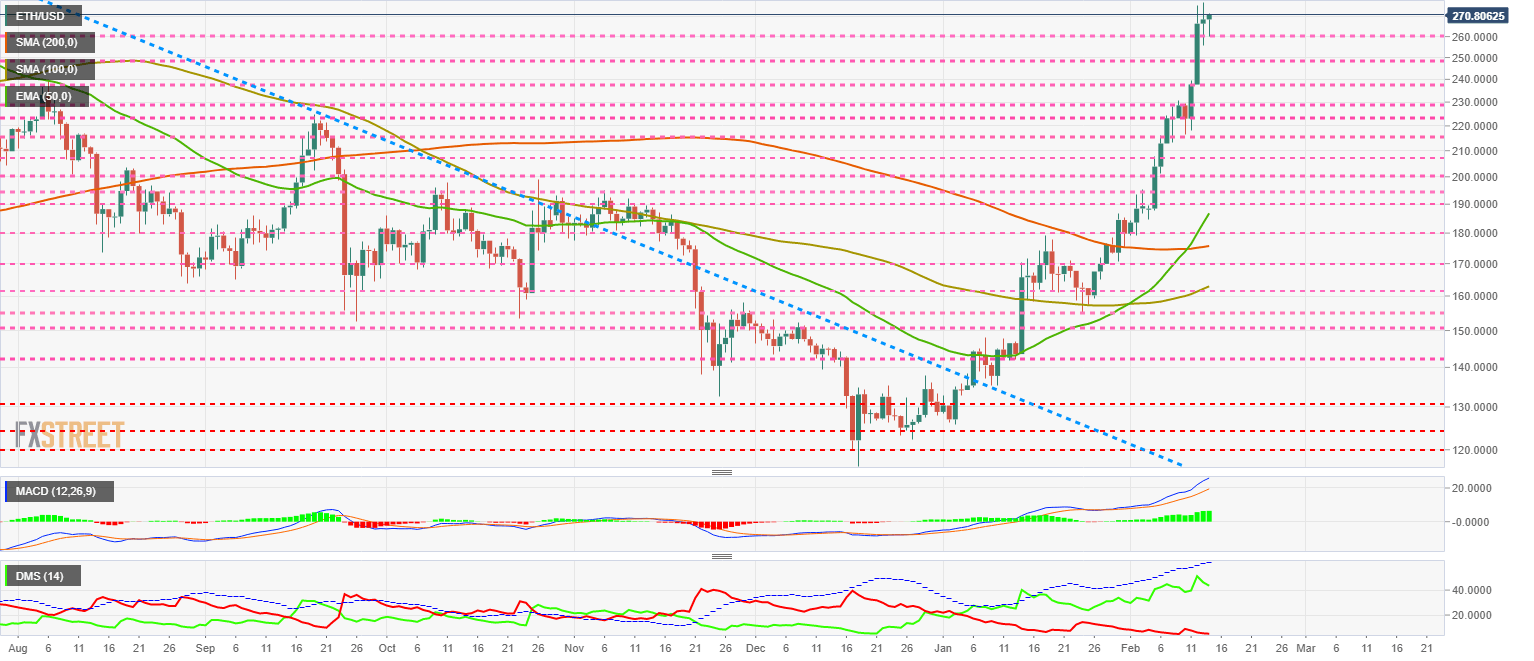

ETH/USD Daily Chart

ETH/USD is currently trading at $270.8 after peaking at $277 yesterday and ending the day with a Doji that weakens the technical structure.

Above the current price, the first resistance level is at $290, then the second at $305 and the third one at $315.

Below the current price, the first support level is at $260, then the second at $250 and the third one at $238.

The MACD on the daily chart maintains the bullish profile and does not yet confirm the weakness that the Doji is transmitting on the daily chart.

The MACD on the daily chart maintains the bullish profile and does not yet confirm the weakness that the Doji is transmitting on the daily chart.

The DMI on the daily chart shows that the bulls are still in the bullish trend. The bears hold on to their multi-month lows levels and are not showing any interest in disputing the leadership on the buying side.

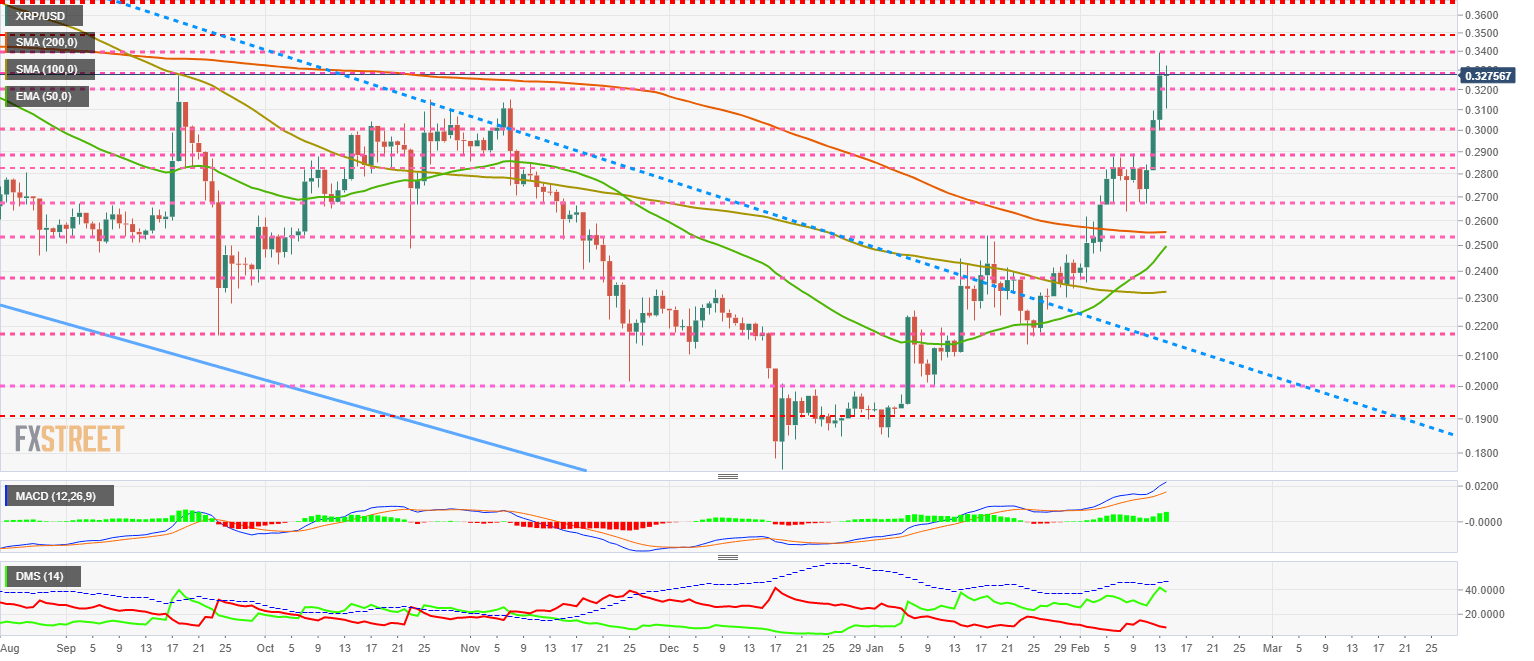

XRP/USD Daily Chart

XRP/USD is currently trading at the price level of $0.3275 after a login where it has moved below $0.30.

Above the current price, the first resistance level is at $0.33, then the second at $0.34 and the third one at $0.35.

Below the current price, the first support level is at $0.32, then the second at $0.30 and the third one at $0.29.

Below the current price, the first support level is at $0.32, the second at $0.30 and the third at $0.29. The MACD on the daily chart maintains the previous bullish profile without affecting the first hour's sales.

Below the current price, the first support level is at $0.32, the second at $0.30 and the third at $0.29. The MACD on the daily chart maintains the previous bullish profile without affecting the first hour's sales.

The DMI on the daily chart shows how the bulls failed to cross the ADX line higher, showing weakness on the buy-side. The bears are not reacting to the bullish move and are giving up their claim to the leadership of the XRP/USD pair.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?