- The current levels give room for an attempt at consolidation and upward reaction.

- Terminal patterns of the bearish phase are activated which can bring more volatility and the momentary extension of the minimum levels.

- The current potential benefit has some advantage over the risk if the protection stops are properly managed.

The perfect storm that hits the equity, commodity & bond markets overshadows the crypto board. You don't see much news about the collapse of Bitcoin or Ether when the NYSE has "burned" trillions of dollars in a few days.

The prices of the leading crypto assets have depreciated considerably, and the current doubt is whether the correction will spread downwards or whether the worst is over.

The top 3 components are building technical floors in the critical areas that have already proven to be sound in the past.

The proximity of the major supports offers relatively close stops, although we are always well aware of the risks that ALL markets have at present. Buying assets in free fall is the maximum expression of the "risk/benefit" concept.

The main reason why I believe that the crypto market is not dead is the consistency that the ETH/BTC pair is showing, which despite losing 30% is still within an entirely standard consolidation structure.

In previous sell-offs, we have seen how the capital flow to Bitcoin was massive, with substantial devaluations in the Altcoin segment. The ETH/BTC pair does not show this kind of capital flow behaviour on this occasion.

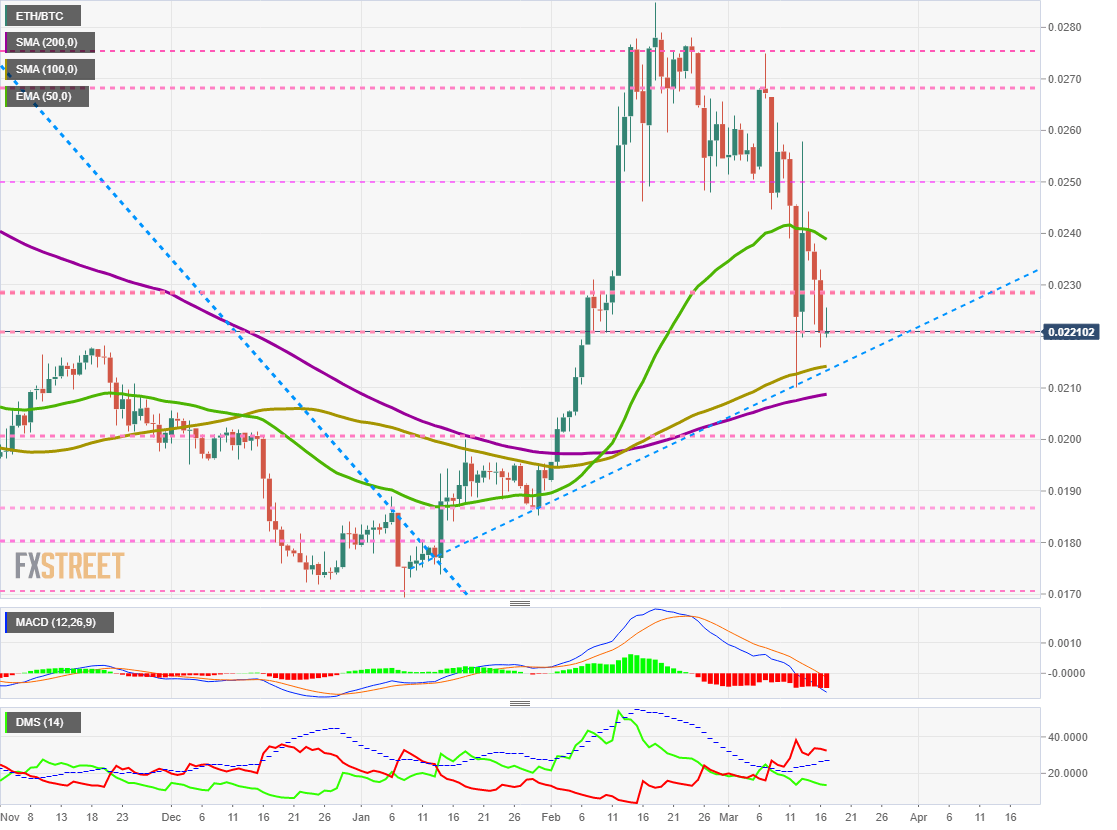

ETH/BTC Daily Chart

The ETH/BTC pair is currently trading at the price level of 0.0221 and it is having trouble finding some support at the base level of consolidation. The trend line from the January lows is at 0.0215, the same level as the SMA100 and SMA200.

Above the current price, the first resistance level is at 0.023, then the second at 0.025 and the third one at 0.0268.

Below the current price, the first support level is at 0.02200, then the second at 0.0213 and the third one at 0.0209.

The MACD on the daily chart continues to show a bearish continuity profile similar to that of the last few days. There is no sign of a possible change in the price direction.

The DMI on the daily chart shows that the bears are losing strength but not threatening their leadership. The bulls are not reacting to the upward movement but are maintaining an acceptable level of activity.

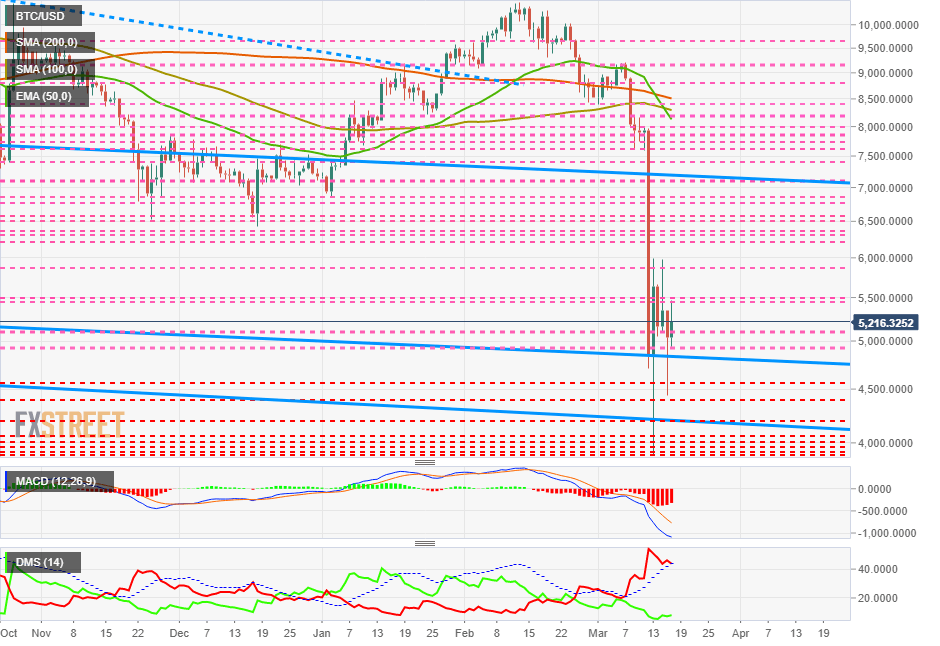

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the price level of $5216 and is attempting to punch up a double resistance due to price congestion at $5500. The stop level is below $4800.

Above the current price, the first resistance level is at $5500, then the second at $5900 and the third one at $6200.

Below the current price, the first support level is at $5100, then the second at $4950 and the third at $4800.

The MACD on the daily chart shows changes, with a decrease in the bearish profile suggesting a possible improvement in the price in the coming days.

The DMI on the daily chart shows bears about to break the ADX line, which would trigger a bullish reversal pattern in the medium term. The bulls are improving a bit, but not enough to risk the current control on the bearish side.

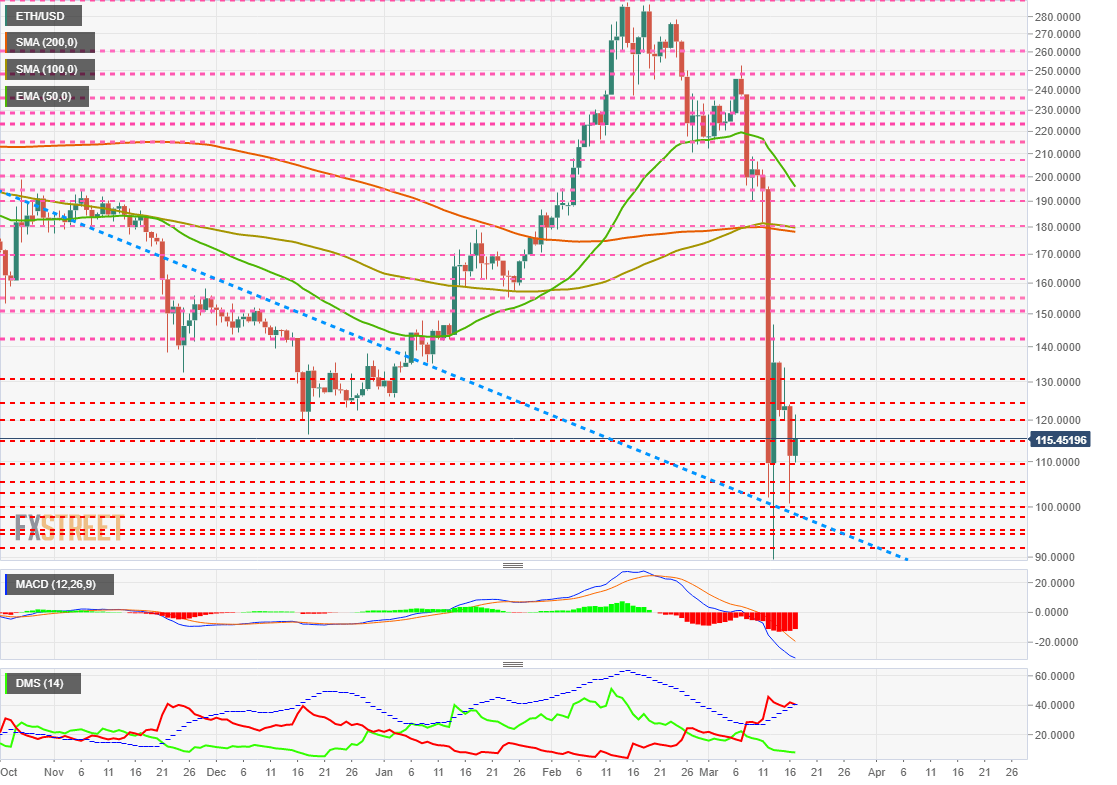

ETH/USD Daily Chart

The ETH/USD pair is currently trading at the $115.26 price level and shows the difficulty in overcoming the price's congestion resistance at $120.

Above the current price, the first level of resistance is at $120, then the second at $125 and the third one at $130.

Below the current price, the first support level is at $115, then the second at $110 and the third one at $108.

The MACD on the daily chart shows a slight improvement and manages to lower the bearish profile of the last few days.

The MACD on the daily chart shows a slight improvement and manages to lower the bearish profile of the last few days.

The DMI on the daily chart shows bears about to drill down the ADX line, which would trigger a terminal pattern of the downtrend.

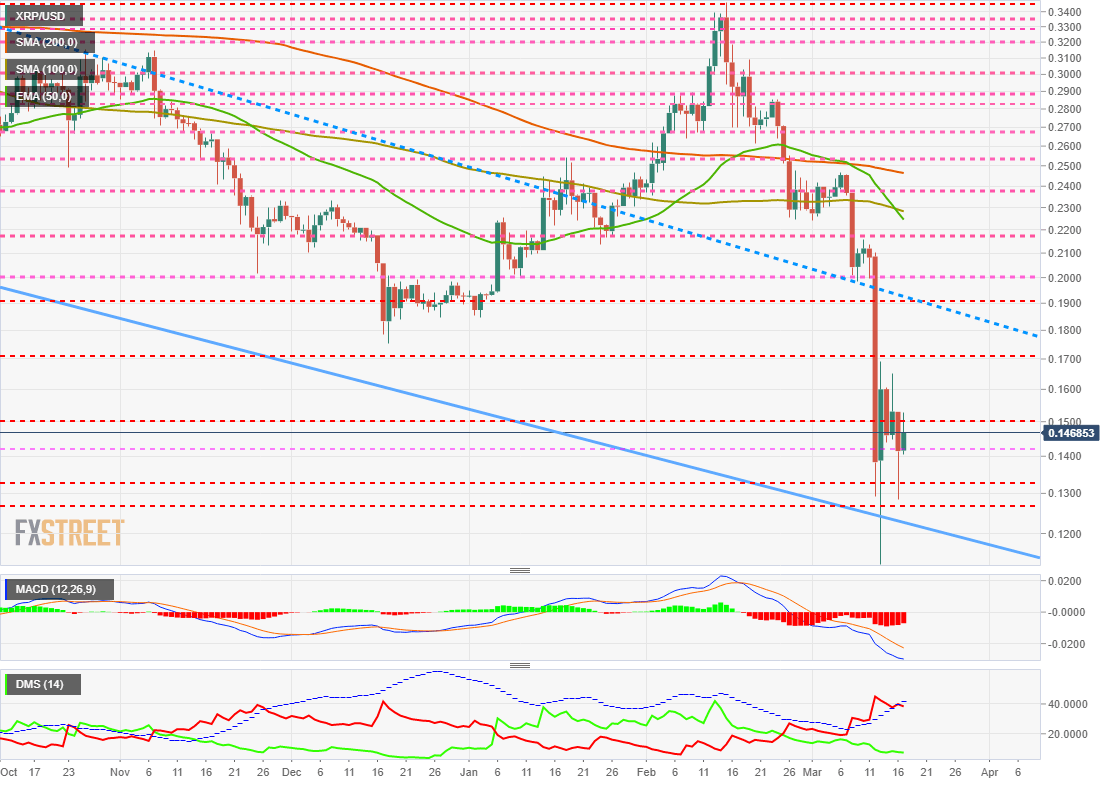

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the price level of $0.1468 but is unable to overcome the price congestion resistance at $0.152.

Above the current level, the first resistance level is at $0.152, then the second at $0.17 and the third one at $0.185.

Below the current price, the first support level is at $0.142, then the second at $0.17 and the third one at $0.19.

The MACD on the daily chart shows an improvement in the previous bearish profile. This change indicates that there could be a change in direction in the medium term.

The DMI on the daily chart shows that the bears have already drilled down the ADX line, a part that triggers the terminal phase of the current downward movement.

Entering the terminal phase of any movement may involve increased volatility and even extended price levels. It is necessary to be cautious should be exercised when trading this type of pattern due to its high risk.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Google, Apple could remove Binance from their app store on Philippines SEC request

The Philippines SEC has requested Google and Apple to remove applications controlled by Binance from their App stores. The exchange’s Philippines-based users are finding the exchange inaccessible to remove their funds.

XRP rallies as Ripple slams SEC for penalties, asks regulator to establish likelihood of future violations

Ripple filed its response to the SEC lawsuit on Monday, arguing that XRP institutional sales before and after the court ruling show no disregard for the law. The firm asks for a civil penalty of no more than $10 million against the $2 billion requested by the SEC.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin (BTC) price.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?