- Ethereum price continues to consolidate after recording a new all-time high but is preparing to take off.

- There are three major reasons why ETH supply is quickly decreasing, which could propel prices higher.

- The governing technical pattern suggests that Ethereum is aiming to tag $6,300 next.

Ethereum price has been consolidating after the second-largest cryptocurrency registered a new all-time high on November 10. Although ETH has been moving sideways, a few factors suggest that the token may be preparing for a massive take-off.

Ethereum circulating supply depleting at rapid pace

Here are a few factors that are currently limiting the overall circulating supply of Ethereum, which could continue to drive ETH price higher to target bigger aspirations.

Over the past few years, Ethereum became the major player in terms of smart contract development on its network. A large majority of Ether is placed in smart contracts on the network, with nearly 27% of its supply, reaching $143 billion or nearly 32,000,000 ETH. Of the 27% of coins placed in smart contracts, 77% are locked in decentralized finance (DeFi).

ETH in smart contracts

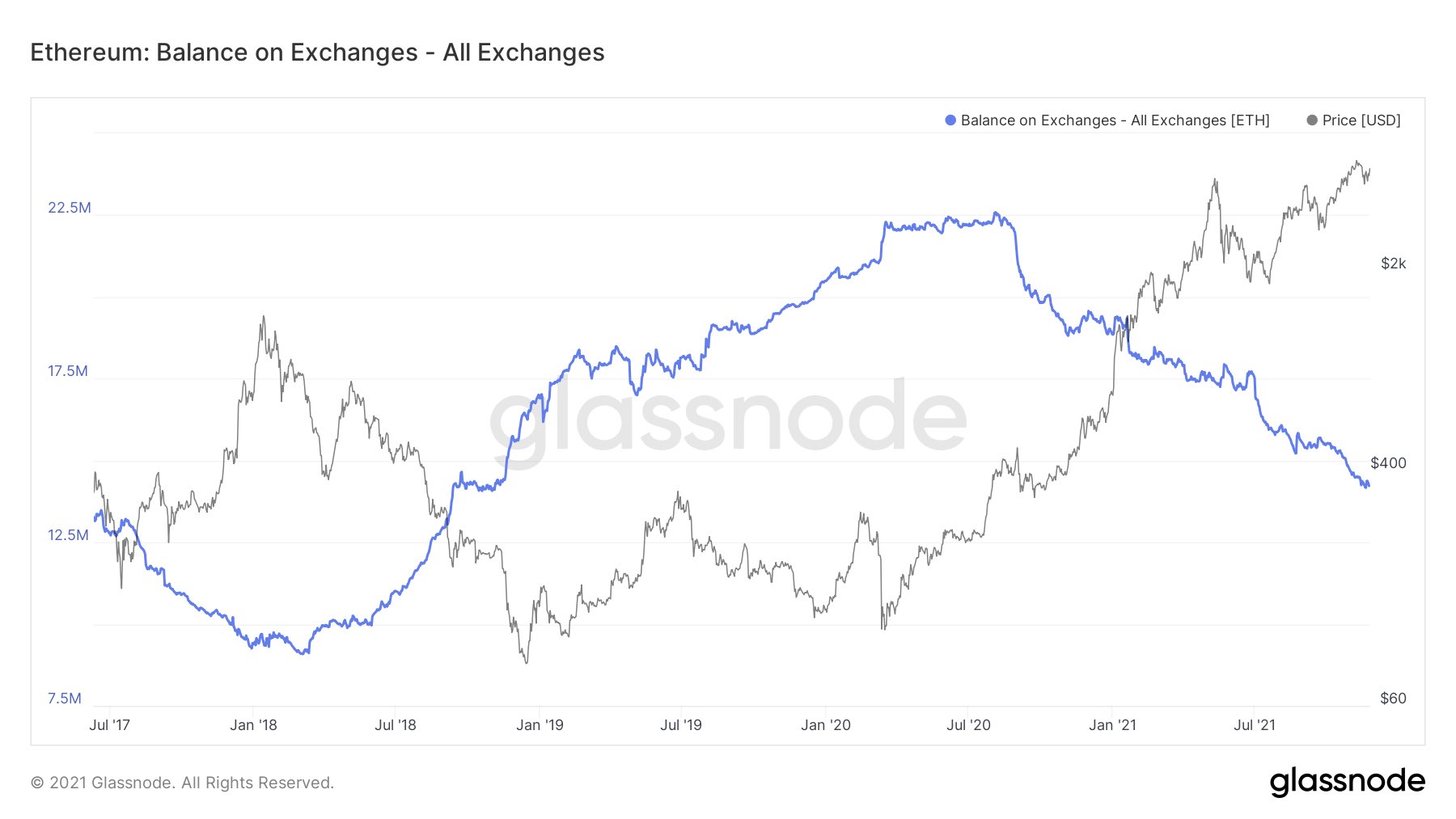

The supply of Ether on exchanges is nearly reaching a three-year low, a trend that started in late 2020. Only 12% of the total supply of Ethereum is on exchanges, down from 17.3% at the start of the year. The low balance on exchanges suggests that investors are not planning to sell, which could dry liquidity and volatility for ETH.

ETH on exchanges

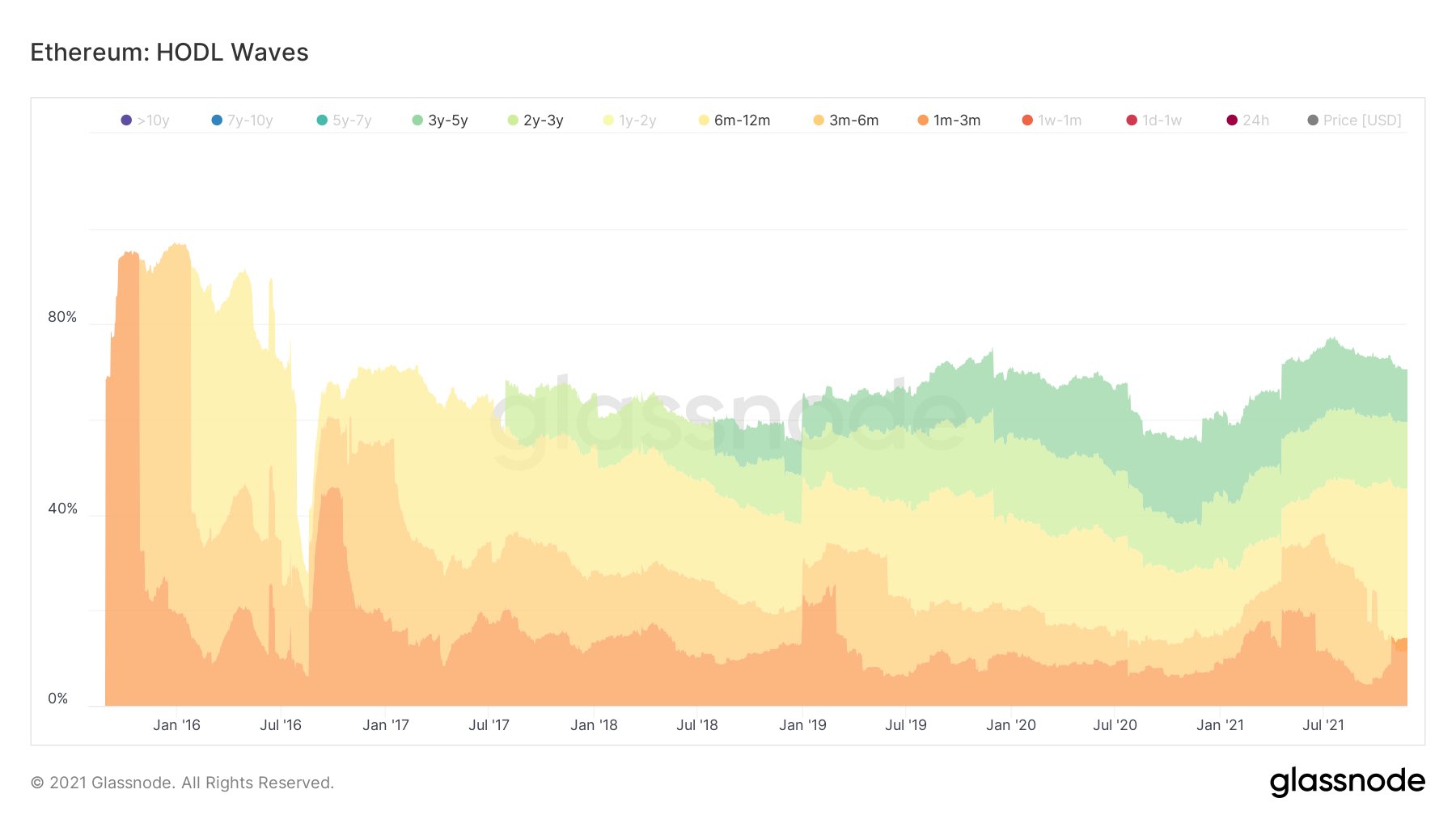

The actual circulating supply of Ethereum is fairly lower than commonly believed. Over 50% of the total supply of Ethereum has not been moved in over a year. Only 20% of ETH supply has been recorded as active since October 1.

ETH HODL waves

EIP-1550, which introduced a fee-burning mechanism removed over 1 million ETH in circulation in just three months after it was initiated, resulting in nearly 1% of the total supply burnt.

Ethereum price set sights on $6,300

Both the underlying fundamentals and technicals of Ethereum point to a bullish future. Ethereum price presented a cup-and-handle pattern, with a measured move of a 58% upswing toward $6,340 from the neckline of the governing technical pattern.

While ETH sliced above the neckline at $3,971 on October 20, the token has faced challenges with reaching the optimistic target. As long as Ethereum price stays above the neckline, the bullish forecast remains on the radar.

Investors should note that Ethereum price recently reclaimed the 21-day Simple Moving Average (SMA) at $4,373 as support, adding fuel to a potential recovery. The next obstacle for ETH to overcome is at the November 16 high at $4,553, then at the November 15 high at $4,757 before attempting to reach its record high at $4,880.

ETH/USDT daily chart

If a spike in sell orders occurs, Ethereum price will discover immediate support at the 21-day SMA at $4,373, then at the 50-day SMA at $4,279. Additional foothold will emerge at the 78.6% Fibonacci retracement level at $4,211, then at the November 23 low at $4,050.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?