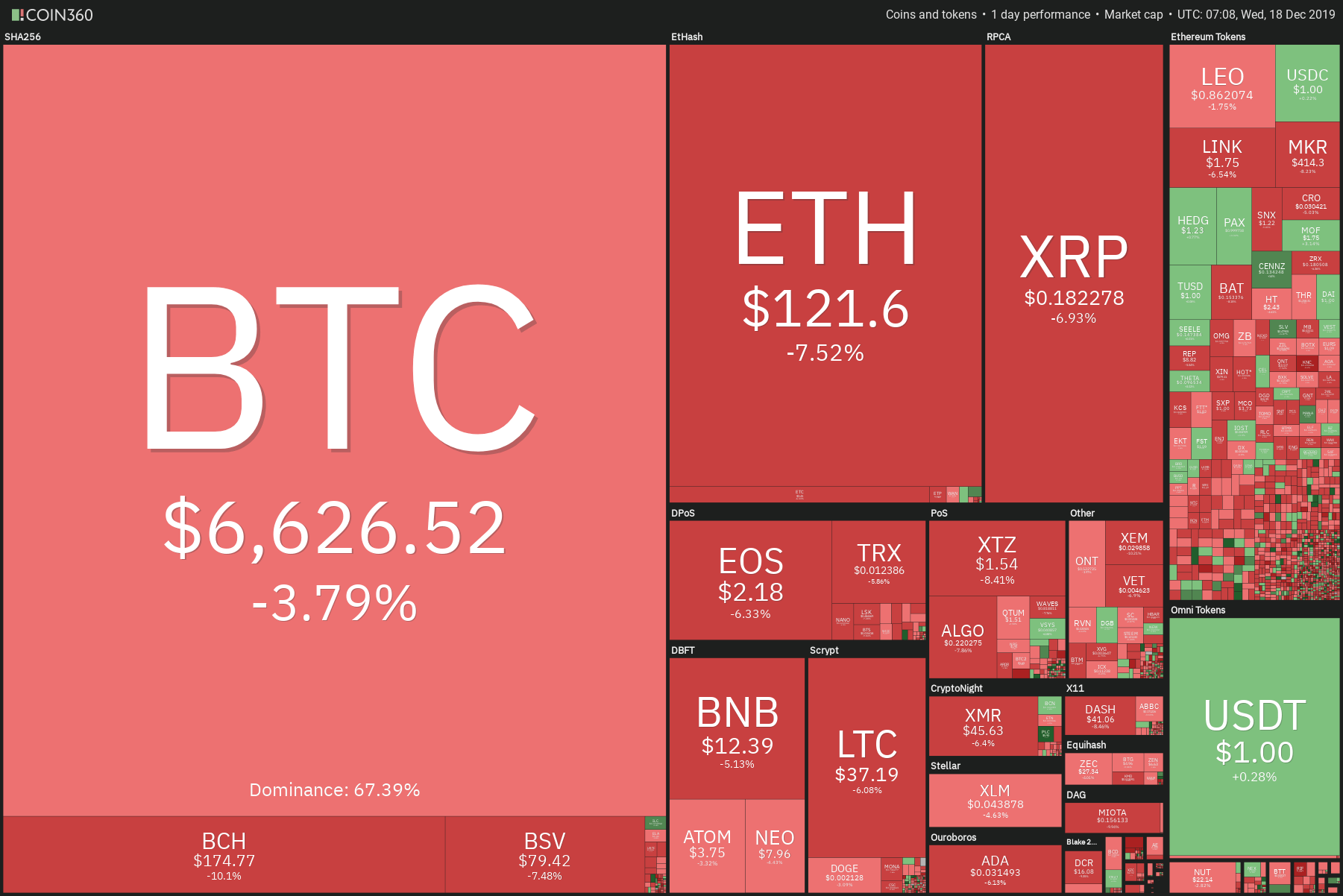

This Tuesday, the sales pressure did not weaken in the crypto sector. Bitcoin lost 3.6%, but those most affected by the selling pressure were Ethereum, which lost another 7.5%, Ripple (-6-27%), Bitcoin Cash (-9.9%) and Tezos (-9.5%).

On the Ethereum token sector, Link (-5.75%), MKR (-7.78%), ZRX (-6.2%), SNX (-10%), and BAT (-7.8%) were the ones who fell the most among the top capitalized. Surprisingly, CENNX gained +14.3%.

Fig 1 - 24H Crypto Heat Map

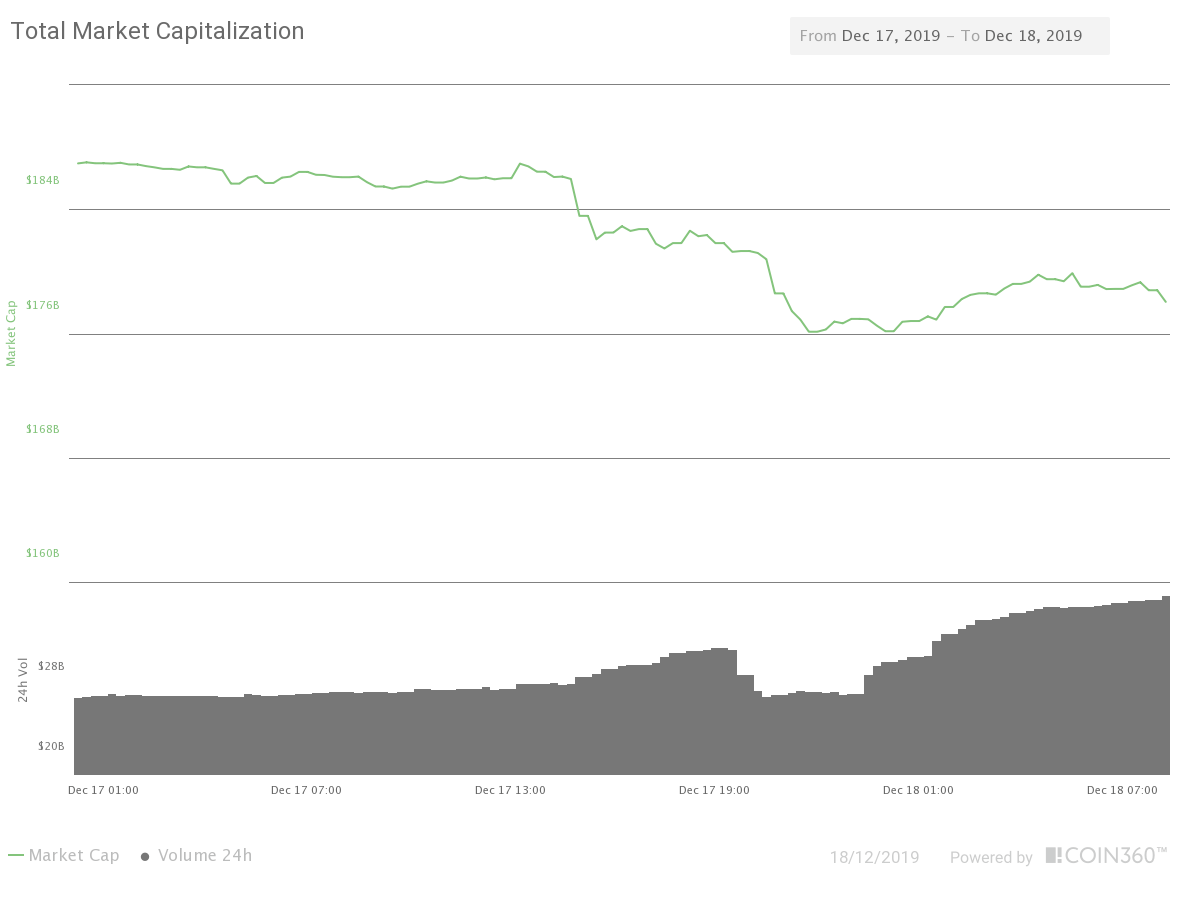

The market capitalization lost another 477% and now stands at $178 billion. Also, the 24H volume increased by 35.5% to $38 billion, and the dominance of Bitcoin moved slightly up to 66.6%.

Fig 2 - 24H Crypto Market Cap and Traded Volume

Hot News

The ECB has built a proof of concept to explore a partially anonymous central bank digital currency, trying to merge privacy with compliance. The concept would use anonymity vouchers allowing users to be anonymous on low-value transactions.

On a tweet post, Justin Sun announced the Shielded transaction beta-test for TRON. According to his tweet, shielded transactions would hide sender and receiver’s addresses, transaction input and output, and the amount transacted using zk-SNARK (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge).

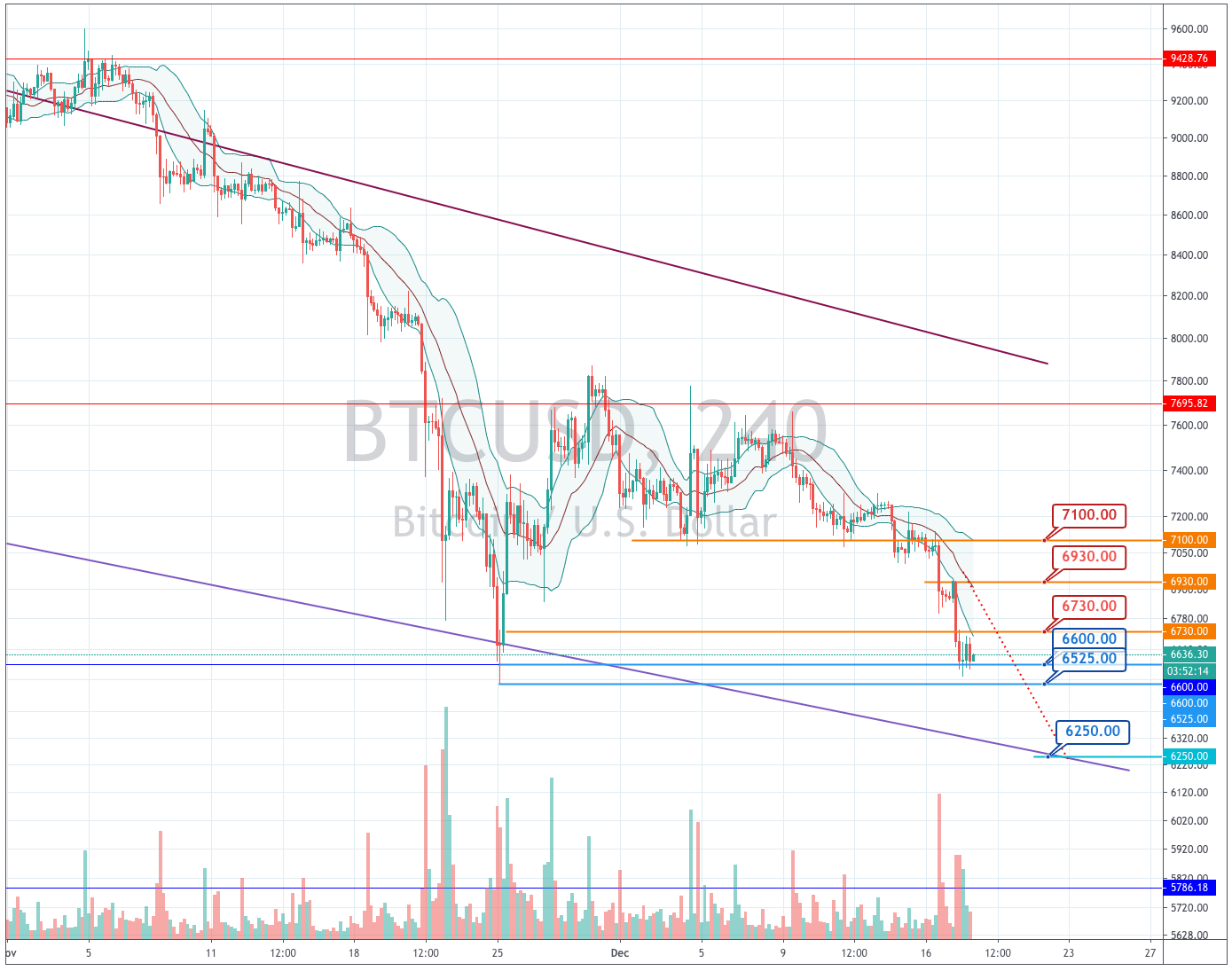

Technical Analysis - Bitcoin

Chart 1- Bitcoin 4H Chart

Bitcoin is suffering another wave of selling pressure, with its price well under the -1SD line and close to touch the $6525 low mace on Nov 25. Currently, the price action is having a pause near $6,600, but, so far, there is no reaction by the buyers. If we give credit to the channel trendlines, BTCUSD seems headed towards the $6,250 area. For a reversal, we would need to see a strong close above $6,930.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

6,600 |

6,700 |

6,850 |

|

6,525 |

7,100 |

|

|

6,400 |

7,220 |

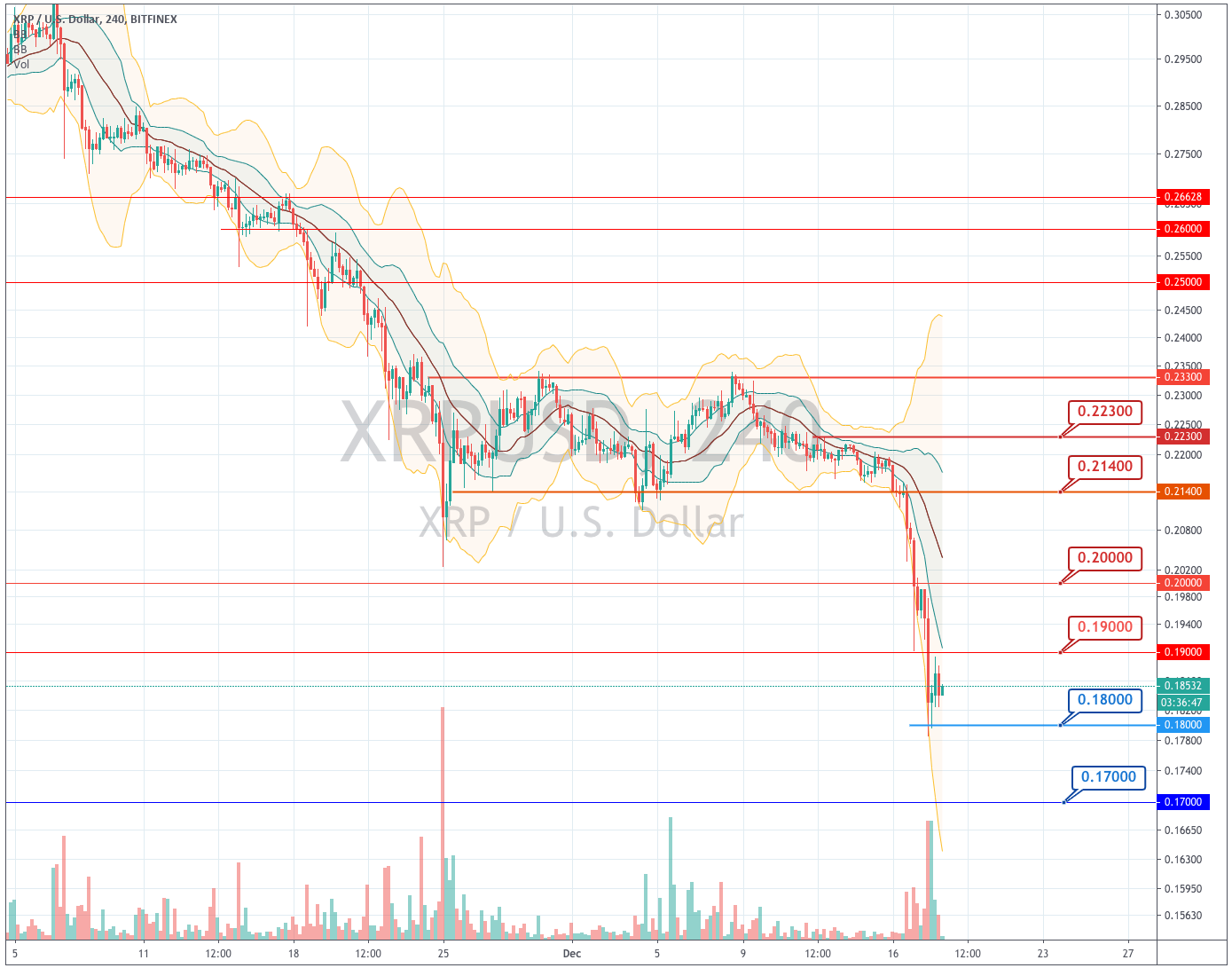

Ripple

Chart 2 - Ripple 4H Chart

Ripple has fallen 16% in the last 72 hours, moving from over $0.22 to $0.185. The bearish momentum has not decreased, and its pricehas followed the path marked by its -3SD line. In the last hours, there has been a consolidation of the price, held over the $0.18 level, which seems to act as support. Given the overextension of the movement, it is probable that this support will hold. A bounce from $0.18 to test the $0.20 level is also likely.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.18 |

0.19 |

0.2 |

|

0.173 |

0.214 |

|

|

0.165 |

0.223 |

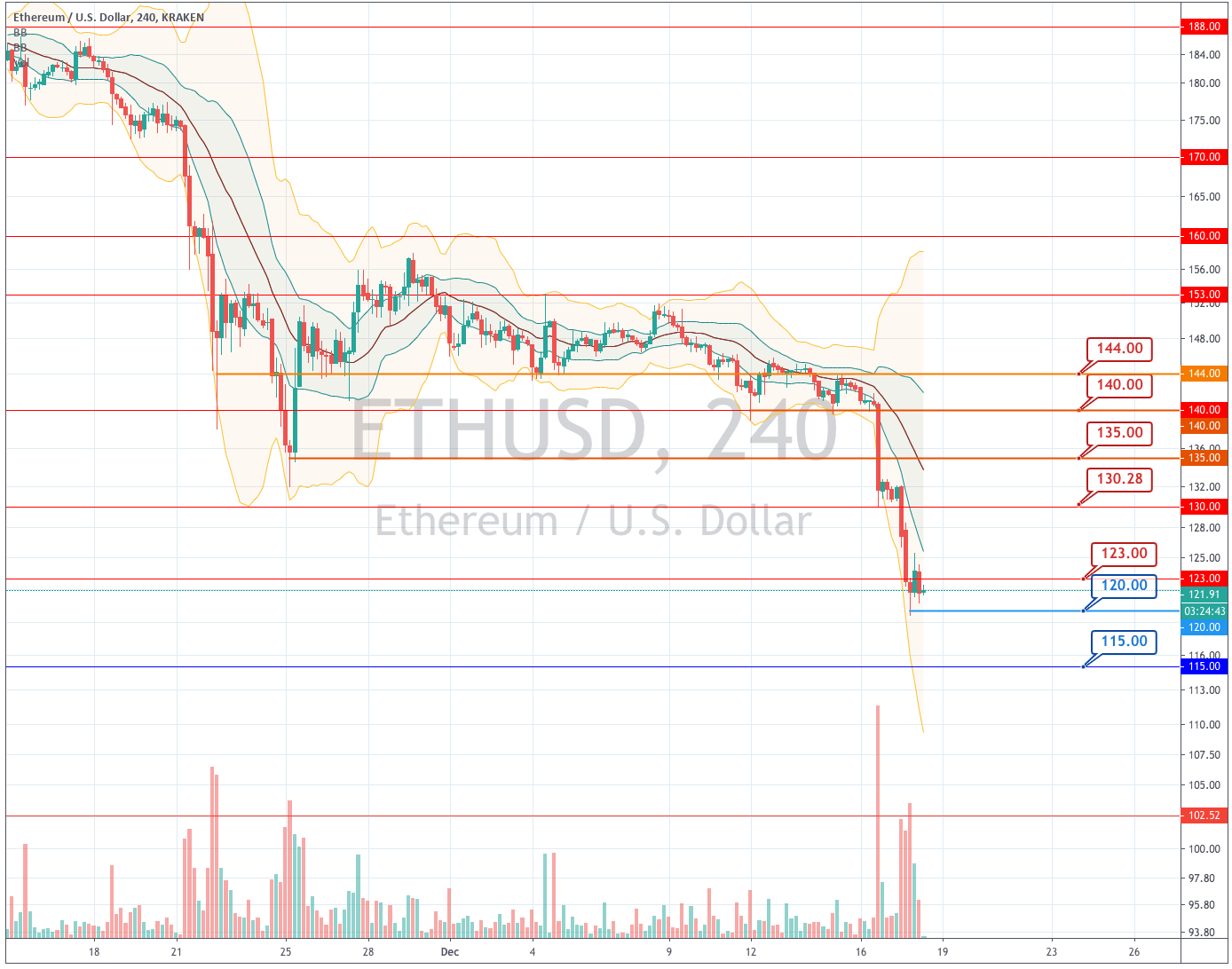

Ethereum

Chart 3- Ethereum 4H Chart

Ethereum also lost 15% in the last 72 hours, moving from $144 to the current $122. The price is currently consolidating above the $120 support level and trying to move away from the oversold region. A bounce towards the $130 level is possible, but the current situation is very bearish and unstable for buyers to risk a counter-trend play.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

120 |

124.6 |

130 |

|

115 |

135 |

|

|

110 |

140 |

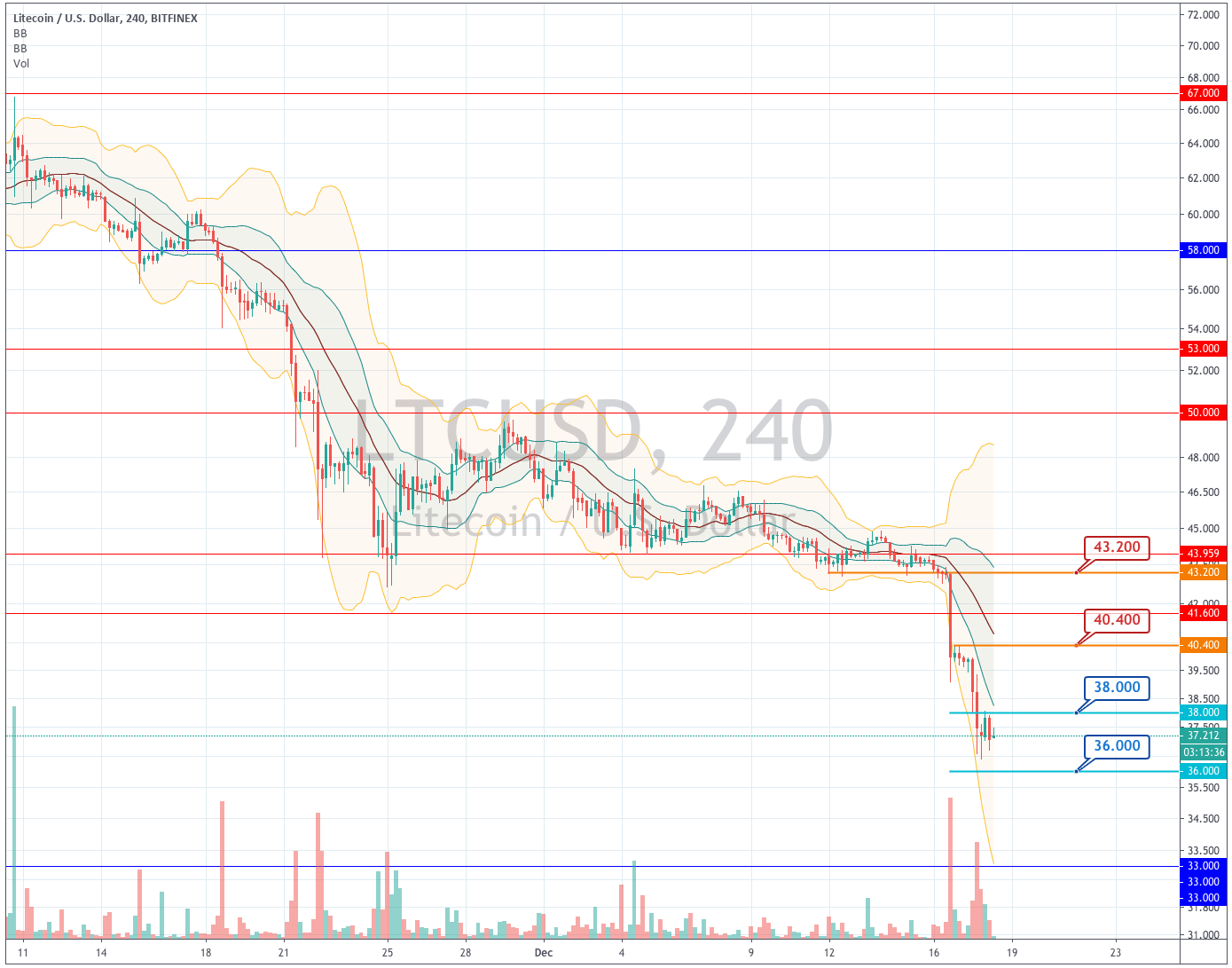

Litecoin

Chart 4 - Litecoin 4H Chart

Litecoin fell as heavily as the rest of the crypto sector, its price moving following the channel between the -1SD and -3SD lines. The bearishness of the market seems to push it further down. The $36 support was not touched yet, and the price appears to be consolidating around $37. If the $36 is pierced, the potential target is $33.

|

SUPPORT |

PIVOT POINT |

RESISTANCES |

|

36 |

38 |

40.4 |

|

34.5 |

42 |

|

|

33 |

43.5 |

Try Secure Leveraged Trading with EagleFX!

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?