- Tuur Demeester, the Founding partner at Adamant Capital, calculated that the Bitcoin market share of MtGox is more than the gold reserves of the Swiss Central Bank.

- MtGox is currently planning to execute the “Gox Rising” project to ensure that victims of the Mt. Gox hack are paid a fair share of what has become more than a billion in assets.

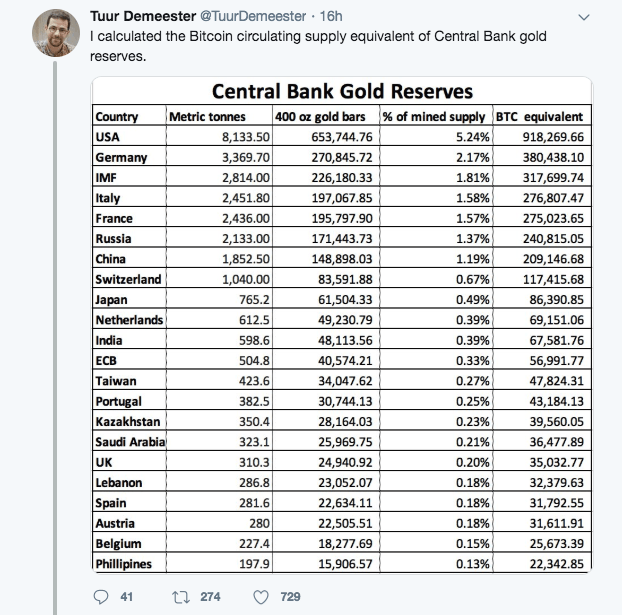

Tuur Demeester, the Founding partner at Adamant Capital, has calculated the Bitcoin circulating supply in equivalence of Central banks’ gold reserves and shared the following data:

Demeester explains:

“The current value of Dutch Central Bank gold is about $25 billion, so in order to buy 69k BTC (the mined Bitcoin equivalent of the Dutch gold reserve) it would only need to sell 1% of its gold, i.e. 492 gold bars.”

After that, Demeester made a pretty interesting comparison:

“Allows for fun comparisons, e.g.: The MtGox Trustee currently controls 137,891 BTC, which is bigger in terms of market share than the gold reserves of the Swiss central bank.”

As reported earlier by FXStreet, crypto billionaire Brock Pierce, plans to revive MtGox. His immediate priority is the “Gox Rising” project which seeks “to ensure that victims of the Mt. Gox hack are paid a fair share of what has become more than a billion in assets.”

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Uniswap nears $3 billion in daily trading volume despite Wells notice and fee hike

Uniswap's (UNI) price witnessed a double-fold crash in the past week after it received a Wells notice from the SEC and later due to the general crypto market crash over the weekend. In the past week, UNI has decreased more than 38%.

Arbitrum Price Prediction: 10% losses likely for holders ahead of $107 million worth of cliff token unlocks

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply.

Ethereum recovers from dip as Hong Kong ETH ETF approval sparks whale buying spree

Ethereum's (ETH) price slightly improved on Monday after Hong Kong approved applications for a spot Bitcoin and Ethereum ETF. Whales have also been accumulating ETH after the market dip over the weekend.

Bitcoin price delays pre-halving rally as US and China battle for BTC supremacy ahead of halving

Bitcoin has failed to showcase an enticing pre-halving rally. As the event remains less than a week out, traders and investors remain at the edge of their seats, with thoughts on whether the impact of the fourth cycle will be different than what has been seen before.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.