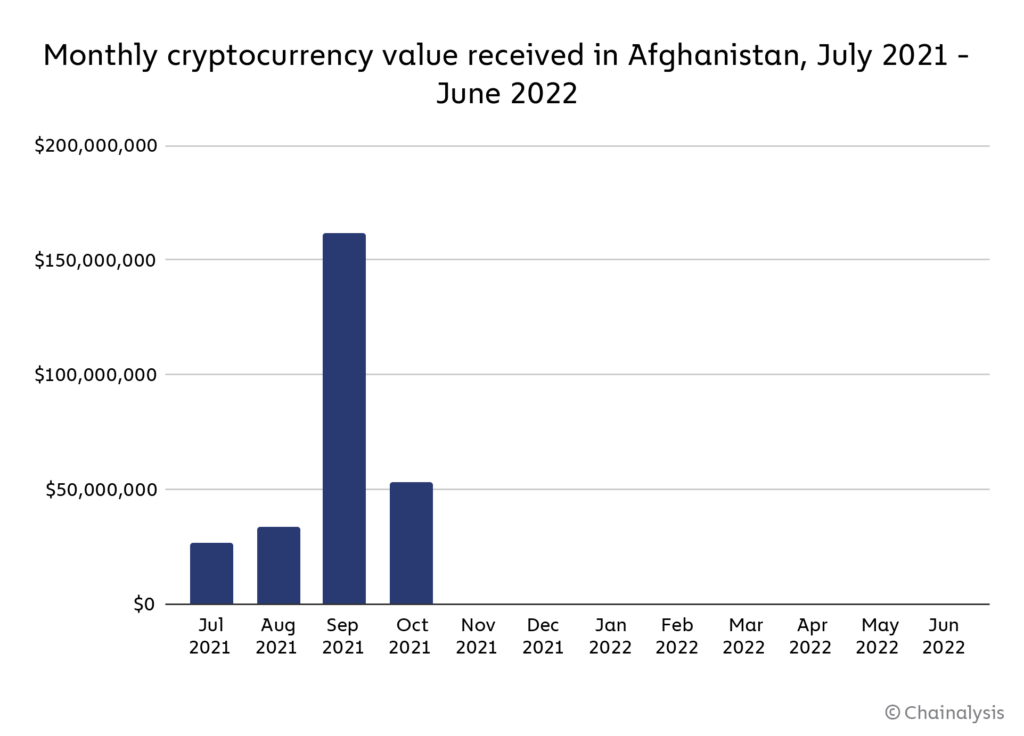

Crypto value received in Afghanistan surged in the wake of the Taliban seizing power in August 2021, but crypto markets have flat lined under the regime.

The Taliban’s takeover of Afghanistan has had a “massive chilling effect” on the local cryptocurrency market, bringing it to an effective “standstill,” according to a recent report.

Blockchain analytics firm Chainalysis in an Oct. 5 report stated the Middle East and North Africa (MENA) region saw the largest crypto market growth in 2022 but noted that Afghani crypto dealers had three options: “flee the country, cease operations, or risk arrest.”

The report states after the Taliban seized power in August 2021, crypto value received in August and September that year spiked to a peak of over $150 million, then fell sharply the following month.

Before the takeover, Afghani citizens would on average receive $68 million per month in crypto value mainly used for remittances. That figure has now dropped to less than $80,000 post takeover.

Graph from Chainalysis 2022 Geography of Cryptocurrency Report. Source: Chainalysis

Afghanistan was 20th place in Chainalysis’ 2021 crypto adoption index released in October 2021, but now is at the bottom of the list following the Taliban takeover.

The reinstated Ministry for the Propagation of Virtue and the Prevention of Vice in charge of implementing Islamic law in the country is the reason for the change. Chainalysis explains the agency equated cryptocurrency to gambling declaring it haram — forbidden under Islamic law.

A large portion of the activity still undertaken in the country comes from money laundering from illicit sources such as bribes or drugs, an anonymous source cited to Chainalysis.

The individual added only a “small portion” is “young people who have a few hundred bucks” to day-trade digital assets.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

HBAR price jumps 75% as BlackRock tokenizes Money Market Fund on Hedera

Archax, Ownera and The HBAR Foundation have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera. Last year Hedera Council member abrdn’s successfully tokenized its MMFs on Hedera.

Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Bitcoin (BTC) price remains range-bound, holding above the $63,000 level, while its upside is capped below $68,000, going against or delaying the assumption that the fourth halving would be a 'sell-the-news' outcome.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce reliance on the US dollar after plans for a stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?