- Chain has since its inception in 2014 raised at least $40 million all in private capital.

- Stellar is still languishing in selling pressure in spite of the partnership news.

Stellar recently announced the acquisition of a blockchain startup referred to as Chain in cash has been successfully completed. Rumors surrounding the acquisition have existed for a few months but the deal has finally gone through.

Chain has since its inception in 2014 raised at least $40 million all in private capital. The startup is said to have collaborated with global leaders such a Visa, Nasdaq and Citigroup. The company was formed with the purpose of developing “cryptographic ledger systems that make financial services smarter, more secure, and more connected.”

The blockchain startup made the acquisition public on August 10, although the deal was signed on September 5. The new Stellar Venture, Interstellar will be in the leadership of the Chain CEO, Adam Ludwin who commented on the buyout saying:

“All of the clients that we have now have effectively shifted from using a traditional database model to using a tokens model, issuing assets on a local environment. By partnering with Stellar you can fire an asset to another institution.”

He further said that the new venture was going to keep most of the employees that worked at Chain. The details of the deal did not, however, indicate the exact amount of the deal but the CEO told CryptoDaily that it significantly exceeded $40 million.

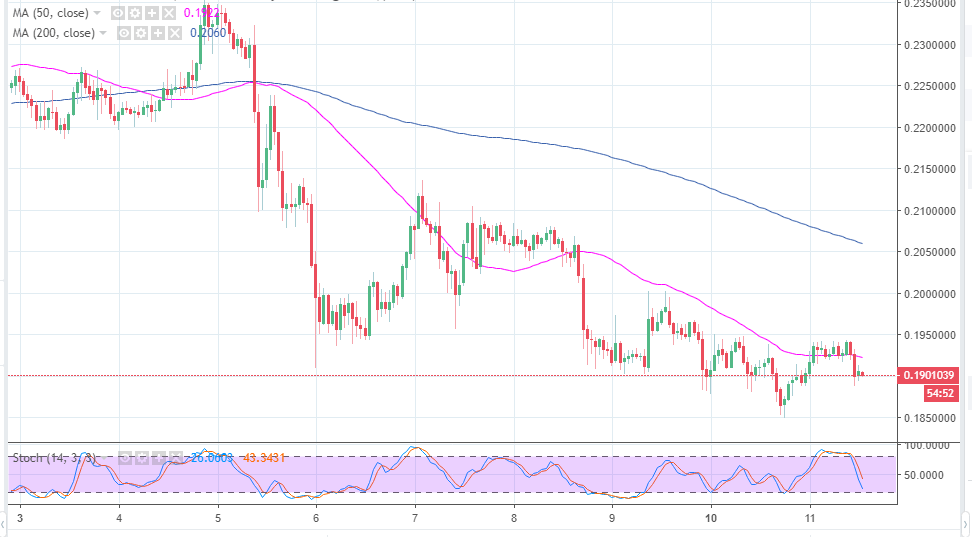

Stellar price technical picture

Stellar has ignored the above strategic news, although there was a slight pullback from the primary support at $0.185. The upside was immediately limited at $0.19, besides the 50 simple moving average is hindering movement at $0.1920. XMR/USD is trading at $0.190 while the path of least resistance is to the south. There must be a break above $0.20 in the near-term to allow the buyers to form a path to the supply zone at $0.21.

XMR hourly chart

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum dips slightly amid Renzo depeg, BlackRock spot ETH ETF amendment

Ethereum (ETH) suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH (ezETH) crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective (INJ) price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

US intensifies battle against crypto privacy protocols following crackdown on Samourai Wallet

CEO Keonne Rodriguez and CTO William Lonergan of Samourai Wallet were arrested by the US Department of Justice (DoJ) on Wednesday and charged with $100 million in money laundering on a count and illegal money transmitting on another count. This move could see privacy-focused cryptocurrencies take a dip.

Near Protocol Price Prediction: NEAR fulfills targets but a 10% correction may be on the horizon

Near Protocol price has completed a 55% mean reversal from the bottom of the market range at $4.27. Amid growing bearish activity, NEAR could drop 10% to the $6.00 psychological level before a potential recovery. A break and close above $7.95 would invalidate the downleg thesis.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?