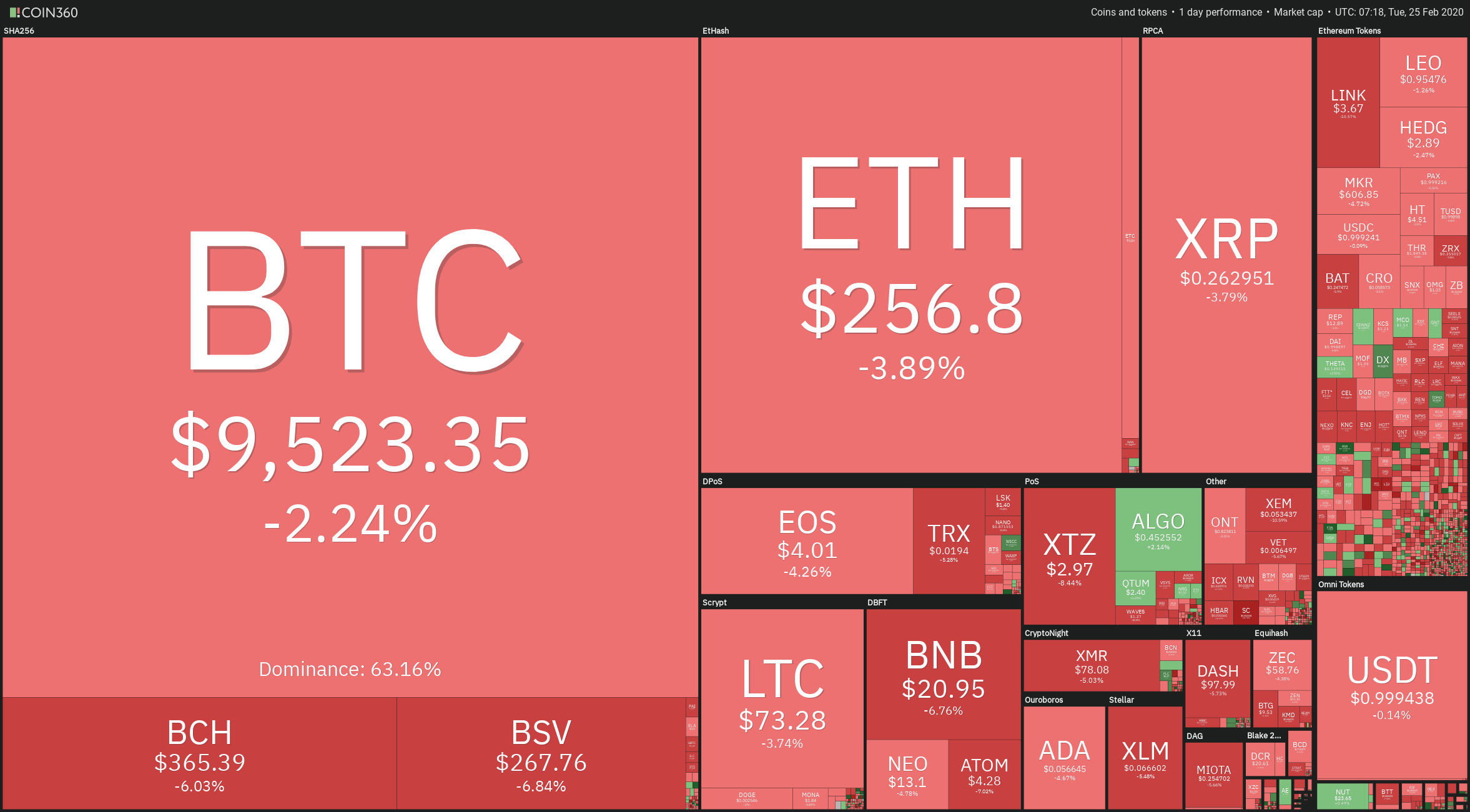

On the second day of price action dominated by sellers, the bearish momentum has been maintained or increased in some cryptocurrencies. The worst performers among the top cryptos are Bitcoin Cash(-5.84%), Binance Coin (-5.86%), Bitcoin SV (-6.64%), ATOM(-7.21%) and Tezos (8.56%). Among this selling sentiment, ALGO(+1.94%) keeps moving up. The Ethereum-based tokens are mostly in the red, with LINK dropping over 10 percent, also falling hard BAT(-5.82%), and ZRX(-7.56%). But others, such as CENNZ( +4.3%), TOMO(+5.5%), and DX(+7.93%), move against the main tide.

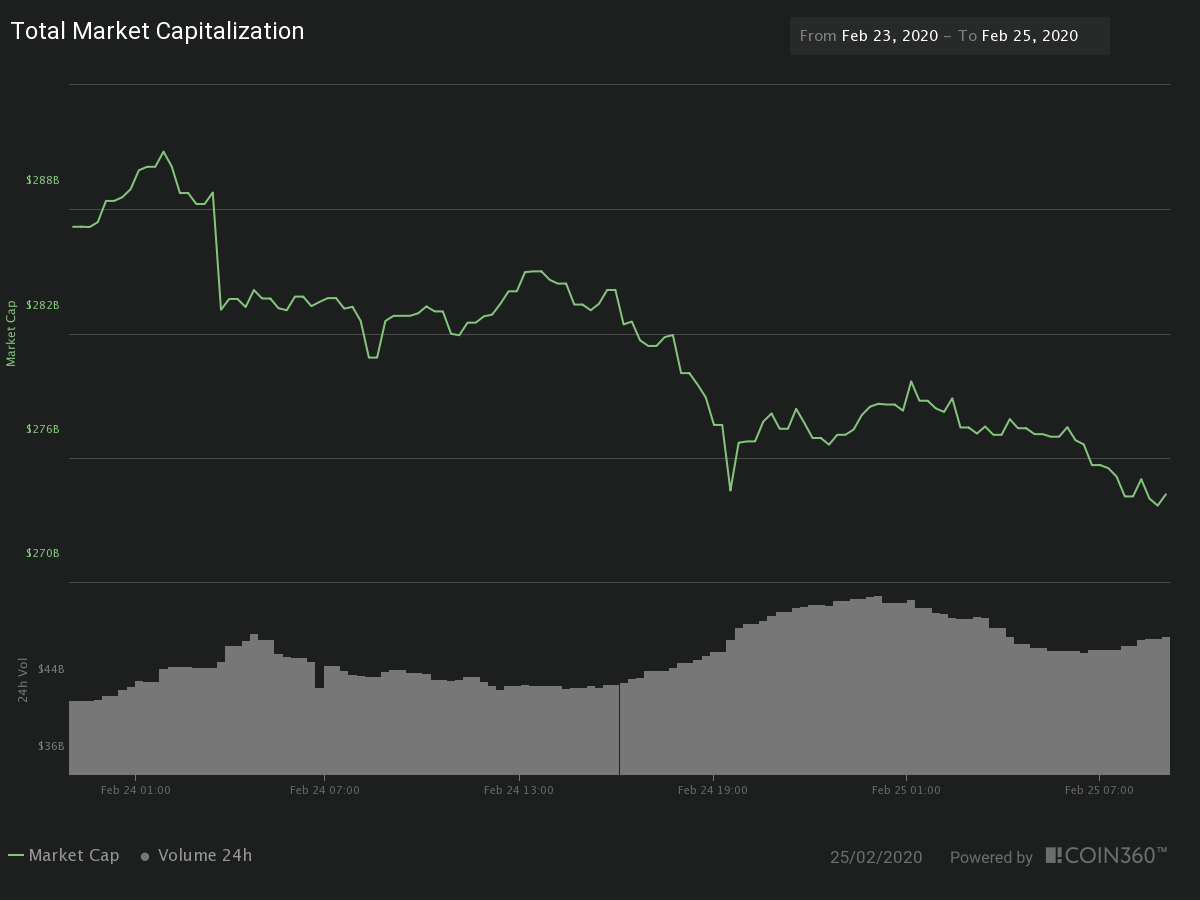

The market cap of the crypto sector has dropped by 5.15 percent, to $274.966 billion, on a 24H volume of %50.142 billion (+9.5%). This drop has brought the Bitcoin dominance to $63.36%, as the overall market dropped harder than BTC.

Hot News

Warren Buffet said in an interview on CNBC that he will never own any cryptocurrency. "Cryptocurrencies basically have no value, and they don't produce anything," said, adding, "I don't have any cryptocurrency, and I never will." Maybe he forgot the BTC and TRX wallets Justin Sun gave him as a gift in a Samsung phone. Buffet, oddly said he might create a "Warren currency" to be released after his death.

Chief Cashier of the Bank of England, Sarah John, has stated his support for an official central bank cryptocurrency before tech behemoths dominate the digital currency sector. "It is absolutely right that central banks think about whether public sector or private sector would be best to provide a digital currency going forward."

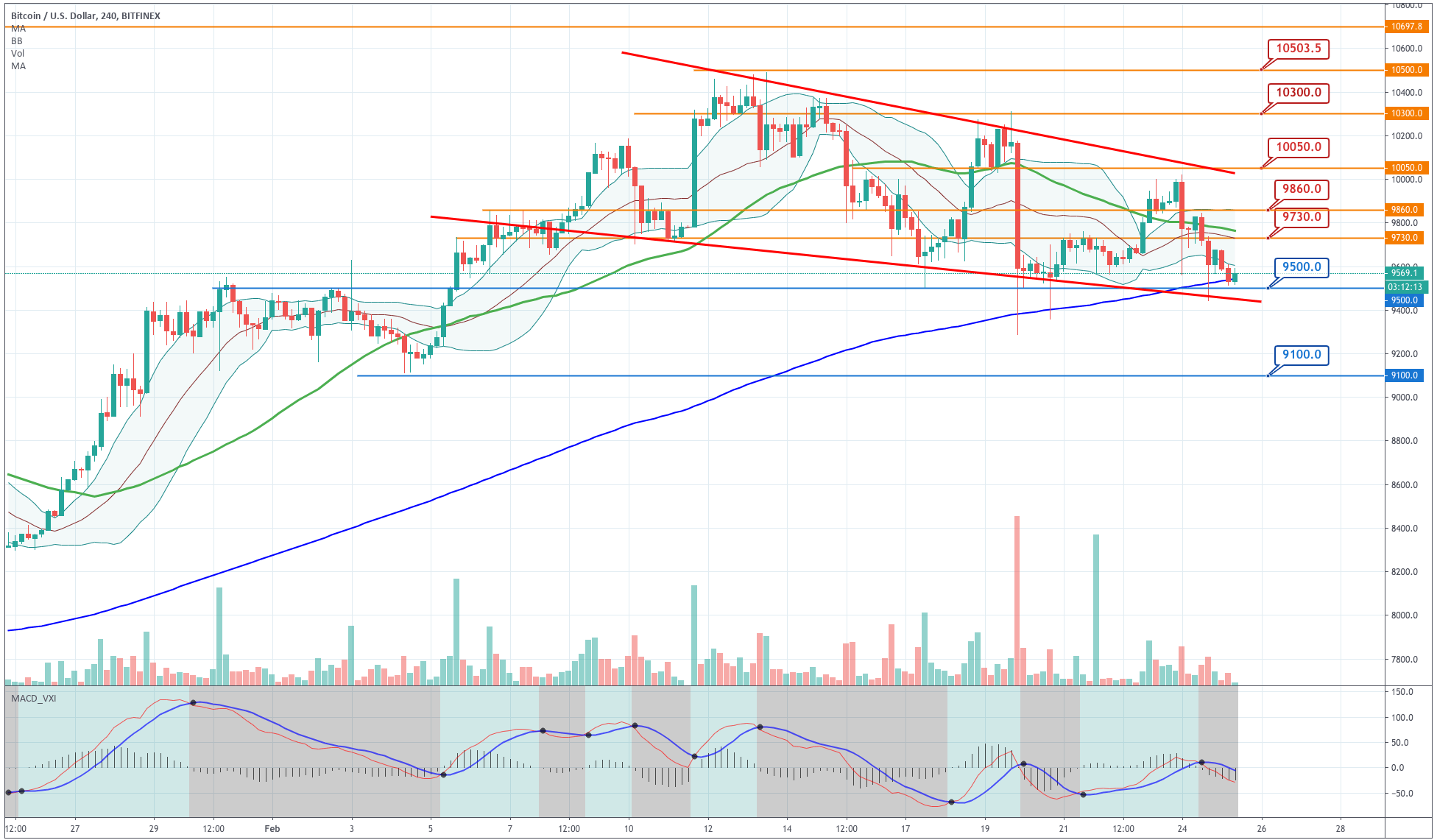

Technical Analysis: Bitcoin

Bitcoin's price is near the bottom edge of the descending wedge. The overall sector is bearish, and that has been reflected on BTC, which is moving below the -1SD Bollinger line, and touching its 200-period SMA line, and the MACD lines widening and pointing to the south. The situation is the price is reaching its $9,500 support. There we should observe how the price reacts in this area to see if the buyers come in or the weakness persists. That would give us clues about a potential reversal. The current bias points for more drops, with a likely visit to the $9,100 level.

|

Support |

Pivot Point |

Resistance |

|

9,500 |

9,730

|

9,860 |

|

9,100 |

10,050 |

|

|

8,800 |

10,300 |

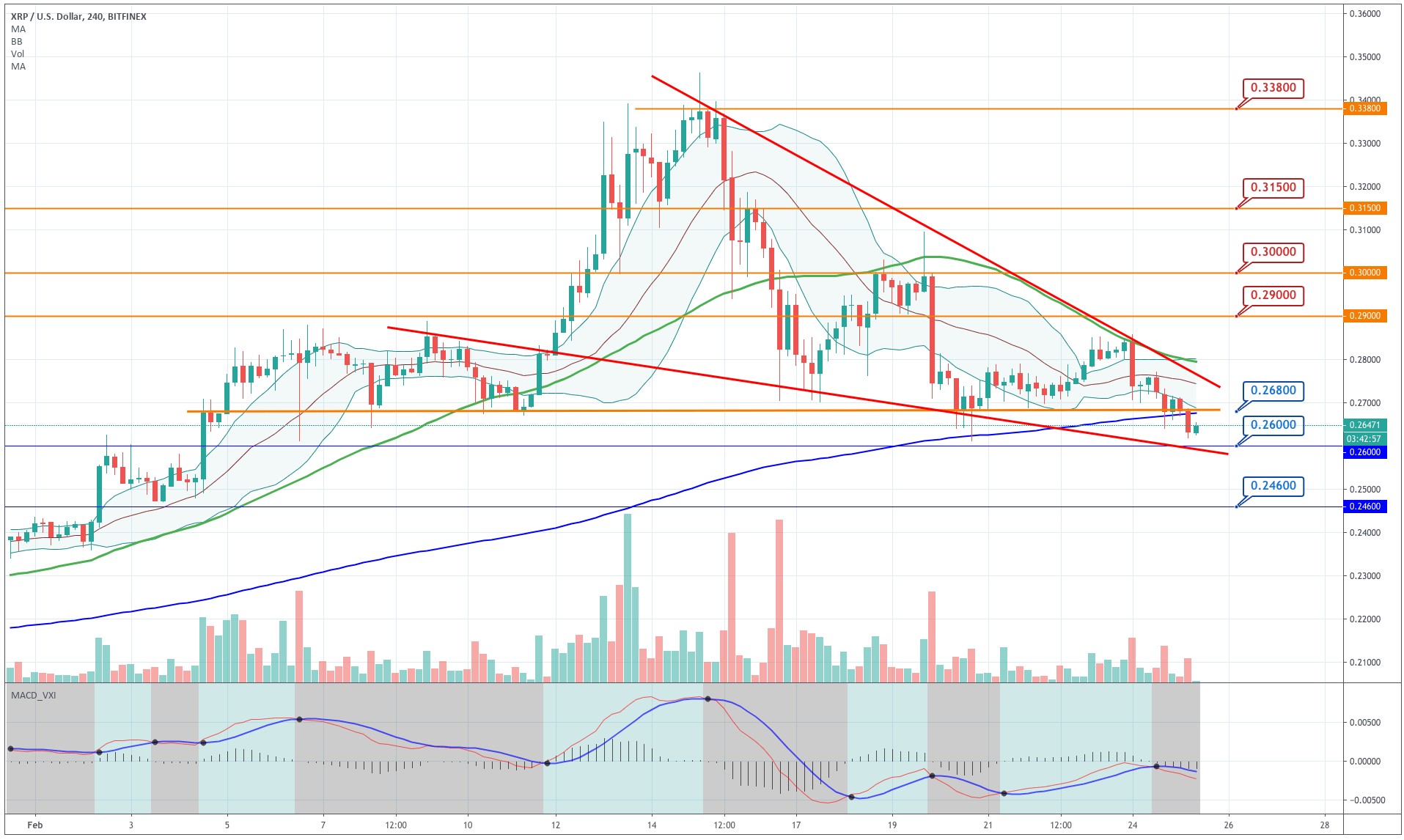

Ripple

Ripple continues moving bearishly. The price moves below its -1SD line, and the MACD is also bearish. The last candle has crossed the $0.268 support and the 200-period SMA, almost reaching the $0.26 level. The price action is moving in a descending wedge; thus, although short- term bearish, this is a consolidation structure, and the most likely it will resolve to the upside.

|

Support |

Pivot Point |

Resistance |

|

0.2610 |

0.2740

|

0.2800 |

|

0.2510 |

0.2900 |

|

|

0.2460 |

0.3000 |

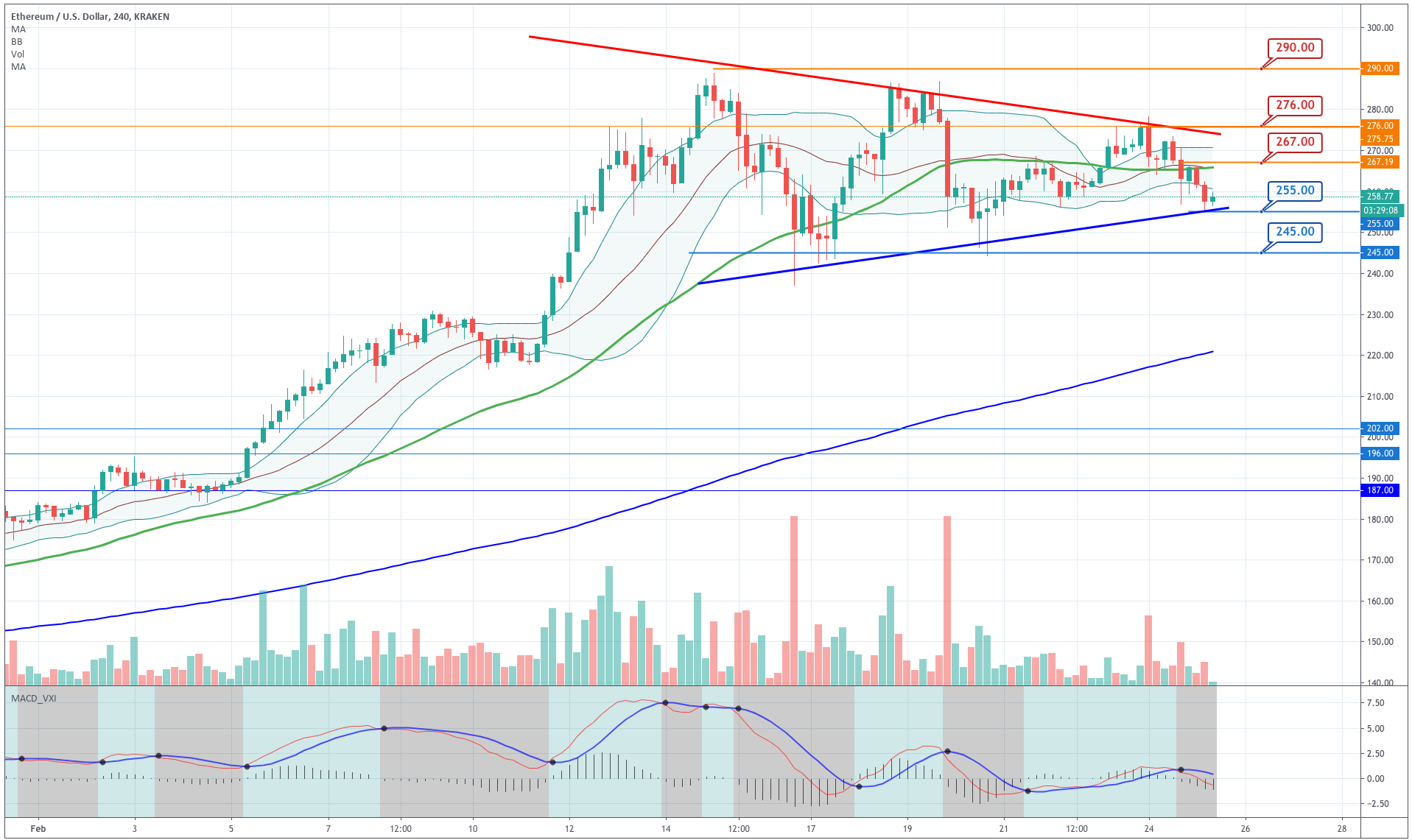

Ethereum

Ethereum has moved to the bottom of the wedge structure created by its past action. The last candle has pierced through the $260 support and touched the edge of the channel. We can see that this channel is horizontal and, although the price moves near the -1SD line, the likelihood of a reversal at this level is high. We still think this is a consolidation phase and that the underlying trend is still bullish.

|

Support |

Pivot Point |

Resistance |

|

255 |

267

|

276 |

|

245 |

290 |

|

|

234 |

300 |

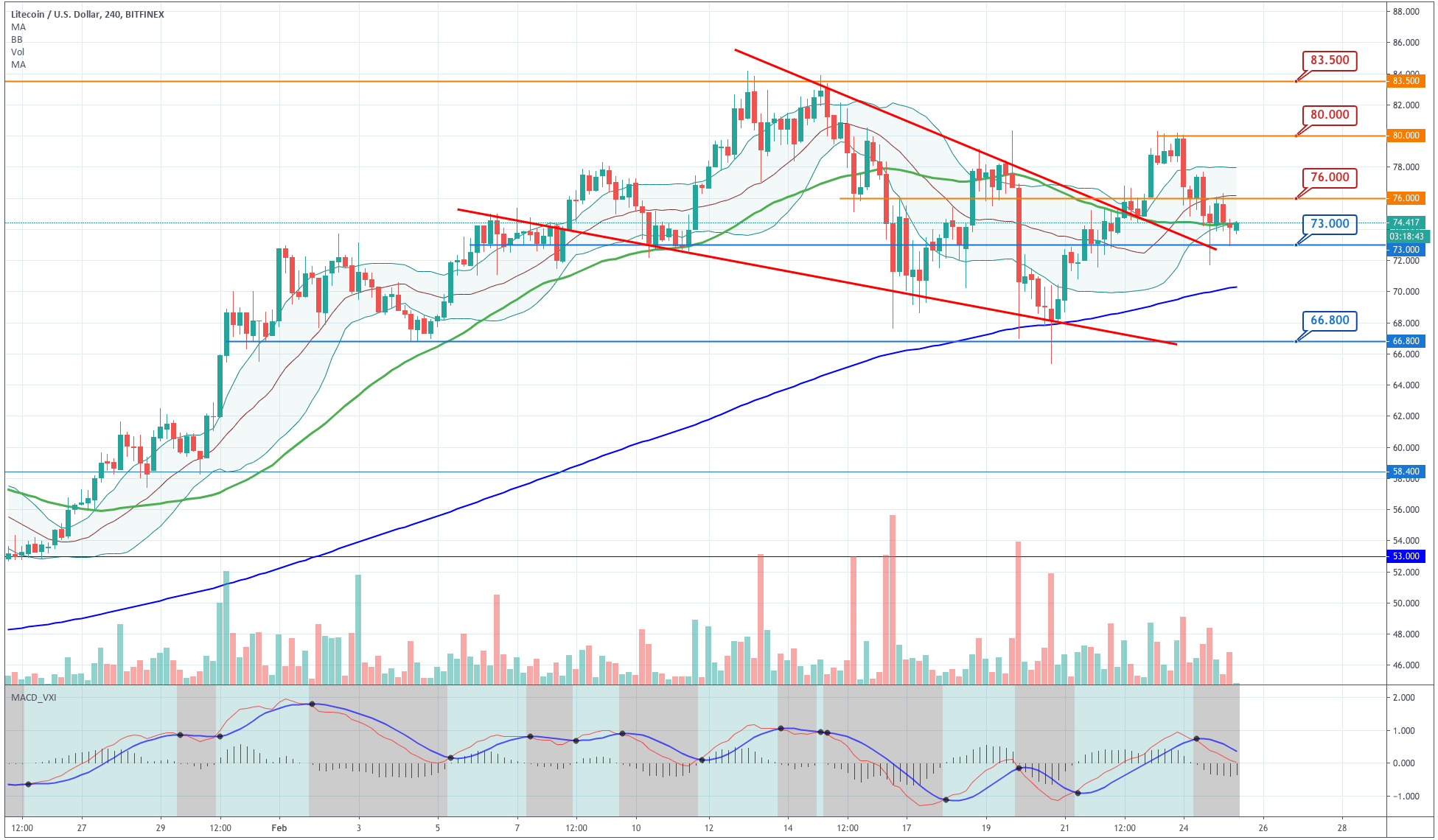

Litecoin

Litecoin continues retracing its last leg up, and now it is moving near its 50-period SMA while $73 has served as support. The last candle is a hammer, so we will be vigilant about the current price reaction. Currently, the price is moving near the -1SD line. A move above $76 with good volume would be an indication of a reversal. We should also take care of the $73 Support. A drop below could mean more declines towards the 200-period SMA level ($70).

|

Support |

Pivot Point |

Resistance |

|

73 |

76

|

80 |

|

70 |

83.5 |

|

|

67 |

87 |

Try Secure Leveraged Trading with EagleFX!

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

Ethereum dips slightly amid Renzo depeg, BlackRock spot ETH ETF amendment

Ethereum (ETH) suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH (ezETH) crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective (INJ) price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

US intensifies battle against crypto privacy protocols following crackdown on Samourai Wallet

CEO Keonne Rodriguez and CTO William Lonergan of Samourai Wallet were arrested by the US Department of Justice (DoJ) on Wednesday and charged with $100 million in money laundering on a count and illegal money transmitting on another count. This move could see privacy-focused cryptocurrencies take a dip.

Near Protocol Price Prediction: NEAR fulfills targets but a 10% correction may be on the horizon

Near Protocol price has completed a 55% mean reversal from the bottom of the market range at $4.27. Amid growing bearish activity, NEAR could drop 10% to the $6.00 psychological level before a potential recovery. A break and close above $7.95 would invalidate the downleg thesis.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?