- FairFX, RationalFX and Exchange4Free are from the United Kingdom, UniPay is from Georgia while MoneyMatch is from Malaysia.

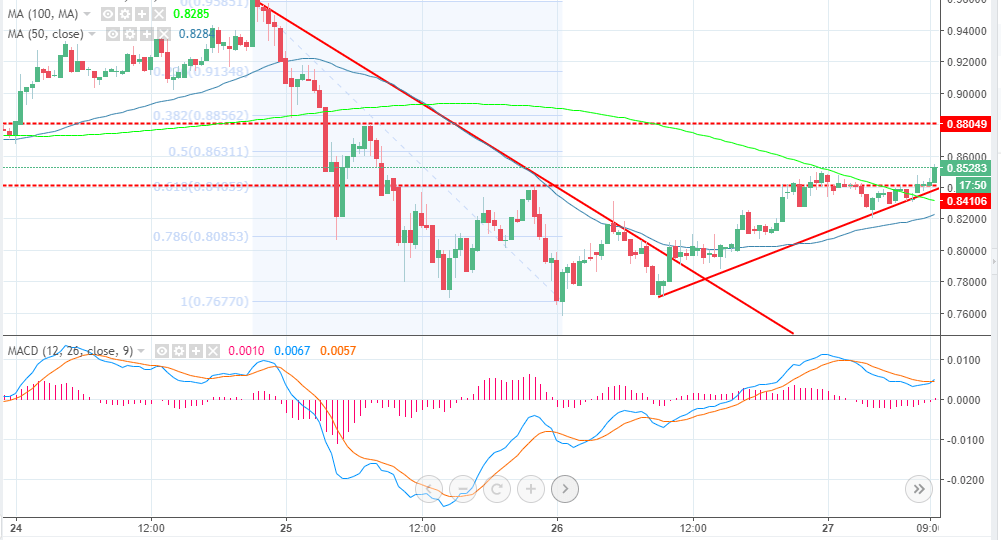

- Ripple price short-term support is at $0.84, although $0.80 is the highlighted major support area.

Ripple is up 6.67% in the last 24 hours on Friday ushering in bullish momentum after it had corrected lower for a few days. XRP/USD traded highs of $0.95 before embarking on a downward movement where it traded below $0.78. Ripple yesterday released its report for the first quarter of 2018. The Report shows that the company’s market share increased, however, its price dropped by 73% from its all-time high of $1.91 to lows of $0.51.

In other news, Ripple has recently signed new partnerships with companies from Asia and Europe. Some these companies include FairFX, RationalFX and Exchange4Free are from the United Kingdom; UniPay is from Georgia while MoneyMatch is from Malaysia. The CEO of RationalFX, Chris Humphrey was reported saying:

“This is an exciting new partnership for RationalFX, and we look forward to passing on the benefits of xVIA to our clients across the globe.”

Ripple’s xVia’s API gives banks and other payment institutions the opportunity to carry out money transfers in a transparent and less costly manner. Commenting on xVia’s API, the senior vice president of product at Ripple Asheesh Birla said:

"By tapping our global network with xVia, our customers now access new markets quicker and cost efficiently. All of these customers run into the same problem: building bespoke connections to banks and networks all over the world. It’s expensive and time consuming. xVia enables them to grow their overall market share by reaching new customers in new markets, easier than ever before.”

Ripple price technical analysis

Ripple price recently broke above the bearish trend on the 30’ timeframe chart, at the same time it is exchanging hands above the intraday high recorded during the trading on Thursday $26. The moving averages are pointing towards a growing bullish momentum that could break above $0.9. Similarly, the MACD is moving further into the positive levels to signal that the buyers have the upper hand. There is a short-term support formed at $0.84, although $0.80 is the highlighted major support area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle (PENDLE) price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin (BTC) price.

Ethereum shows signs of a potential rally as suspected Justin Sun wallet buys heavily

Ethereum's (ETH) recent price movement hints at a potential rally despite ETH ETPs recording outflows. The recent price improvement follows the fourth Bitcoin halving and a suspected Justin Sun wallet purchasing large numbers of ETH.

Floki poised for growth after listing on Revolut

Floki's (FLOKI) team announced in an X post on Monday that the meme coin would be listed on the popular neobank and Fintech platform Revolut. Floki could rise further following key partnerships to boost retail usage.

Jupiter DEX second Launchpad vote concludes, JUP price rises 5%

Jupiter, a Solana-based decentralized exchange (DEX) has completed the second launchpad (LFG) vote to identify the two projects that will debut on its platform. On March 30, the aggregator network had unveiled its Core Working Group (CWG) budget proposal voting.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?