- Ripple price path of least resistance is to the upside, but $.5485 is a significant hurdle towards $0.60.

- XRP/USD is up over 2% on the day, the price is still bullish above $0.52.

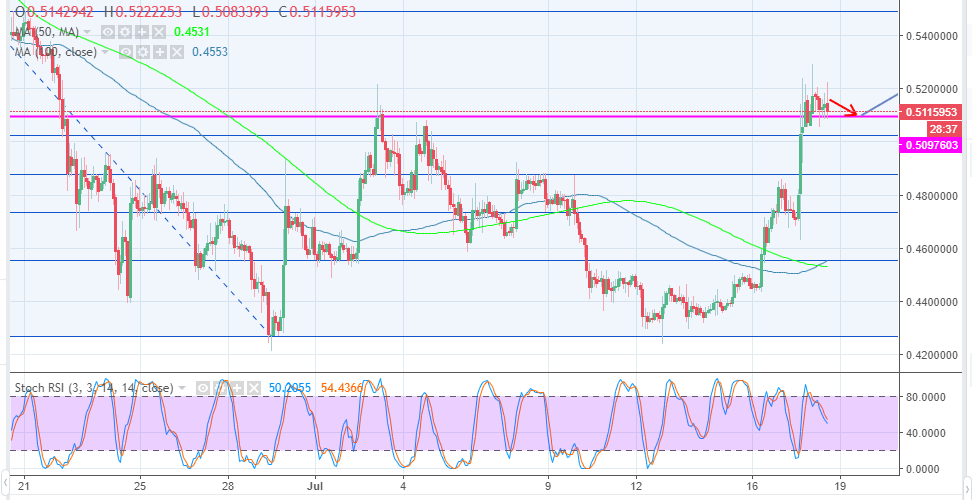

Ripple is correcting higher today, besides the charts are showing a more than 2% rise in value on the day. XRP/USD appears to be consolidating above $0.50 while the upside has stalled below the intraday cap at $0.520. The week’s trading has been fruitful for Ripple which had been limited below $0.45 since the declines that occurred at the beginning of last week.

Aside from the bullish spike on Monday this week, there was another surge on Tuesday. Ripple had run into resistance at $0.48 and lower reactions found support at the 38.2% Fib level close to $0.470. A bullish engulfing candle ensued taking the price right above the medium-term resistance at $0.50. As mentioned the Bulls lost momentum short of $0.520 but the downside daily movements have been supported above $0.505.

Moreover, at the time of covering, indicators show bullish signals and the price is likely to break above the immediate resistance at $0.52 before the close of the trading session on Wednesday. On the upside, it is vital that Ripple breaks the short-term resistance in order to get ready for another roll towards $0.6. But before that, the upper supply zone at $0.5485 is a key breakout and a major hurdle.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Why crypto may see a recovery right before or shortly after Bitcoin halving

Cryptocurrency market is bleeding, with Bitcoin price leading altcoins south in a broader market crash. The elevated risk levels have bulls sitting on their hands, but analysts from Santiment say this bleed may only be cauterized right before or shortly after the halving.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network (MANTA) price was not spared from the broader market crash instigated by a weakness in the Bitcoin (BTC) market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network (OMNI) lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.