In brief

-

The prices of BTC rebounded to $9600 area on the rumors of PayPal launching cryptocurrency services.

-

Market volatility is expected to increase ahead of major BTC options contracts expirations.

-

Data shows that the BTC's current valuation still has room to grow, suggesting prices still have an upside.

Market overview

Sentiment in the cryptocurrency markets improved on Tuesday Asia, as the prices of BTC reclaimed the USD9600 levels in the early part of the session. The rebound came after reports saying Paypal has been considering launching digital currency services surfaced, and created public postings seeking crypto engineers.

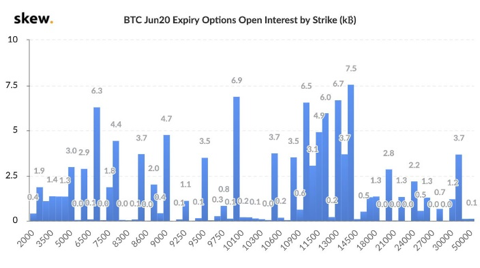

Market volatility is expected to increase this week despite the Paypal rumors. That's because traders will face major June BTC options contracts expirations. Data from Skew shows that among the options contracts that will expire this week, most of the open interest was concentrated on strike price at around 14000, while 10000 and 10500 also received plenty of focus.

It's worth noting that the spot markets tend to be more volatile ahead and during major options expirations, that's because when traders purchased an options contract, they have the right to buy or sell the underlying asset at an agreed-upon price, and these activities may fuel the volatility in the spot markets.

Figure 1: BTC June expiry options OI by strike (Source: Skew)

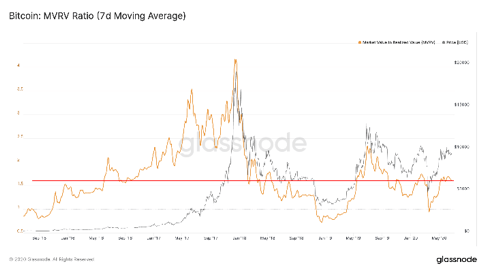

Figure 2: Bitcoin MVRV ratio (7d-MA) (Source: Glassnode)

Valuation could be another pillar that able to support a continuation rebound of BTC. Data from Glassnode shows that BTC's MVRV ratio remained at relatively low levels despite the prices rebounded.

The Market Value to Realized Value ratio indicates whether BTC has been trading above or below its fair value relative to its realized price. When the ratio is at 1, it means BTC could be undervalued, when the ratio is at 3.7, that could mean BTC prices could be overvalued. With the current MVRV ratio of around 1.6, the BTC prices' upside could remain relatively large, even as market prices have been inching closer to the 10000 levels.

Elsewhere, DGB, ONT, and BCD were among the top gainers in the altcoin space, while HYC and ORBS gave up about 6 to 9 percent value in the session.

Price Analysis

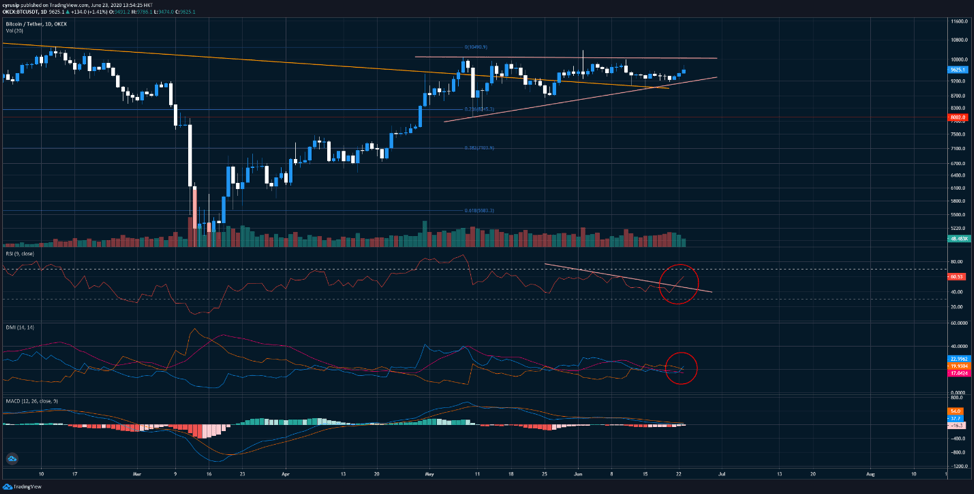

BTCUSDT – Not yet a trend reversal?

-

Momentum has turned positive on BTCUSDT as the pair found the lower support remained valid in the lower part of the triangle pattern.

-

This upside momentum has also reflected in the RSI and the DMI. The RSI has made a breakthrough from the recent trend, while the +DI has advanced above the -DI and the ADX. Both indicators signaled a positive shift has been taking place.

-

Although the MACD remained in red, however, the difference between the two lines has been narrowing.

-

Although the sentiment has taken a positive shift, it's hard to call Tuesday's price actions the beginning of a trend reversal. That's because the pair is still trading within the triangle pattern, and a breakout is needed to confirm a real trend reversal.

-

If the positive sentiment remains intact, the pair may retest the 9800 to 10000 area, which is still a significant resistance.

-

The support at 9200 could be the lower area to watch, if seen, that could increase the likelihood of retesting the one-year resistance-turned-support trendline near 8850.

Figure 3: BTCUSDT daily chart (Source: OKEx; Tradingview)

ETHUSDT – Shooting Star in the making?

-

ETHUSDT has a similar momentum breakthrough that we see in BTCUSDT; however, we haven't seen enough buying power near the Tuesday high at around 246. With such a situation, the pair may easily produce a daily Shooting Star pattern, which considered a bearish candlestick pattern with a long upper shadow.

-

The pair has almost reached the upper Bollinger band, which could consider as an initial sign of being overbought, despite the RSI remained below 70.

-

The trade volume didn't increase significantly alongside with the price. This divergence could also strengthen the case of having a short-term correction.

-

The 227 to 251 range that we highlighted in our last publication remained valid, and that could still be the reference for this week.

Figure 4: ETHUSDT daily chart (Source: OKEx; Tradingview)

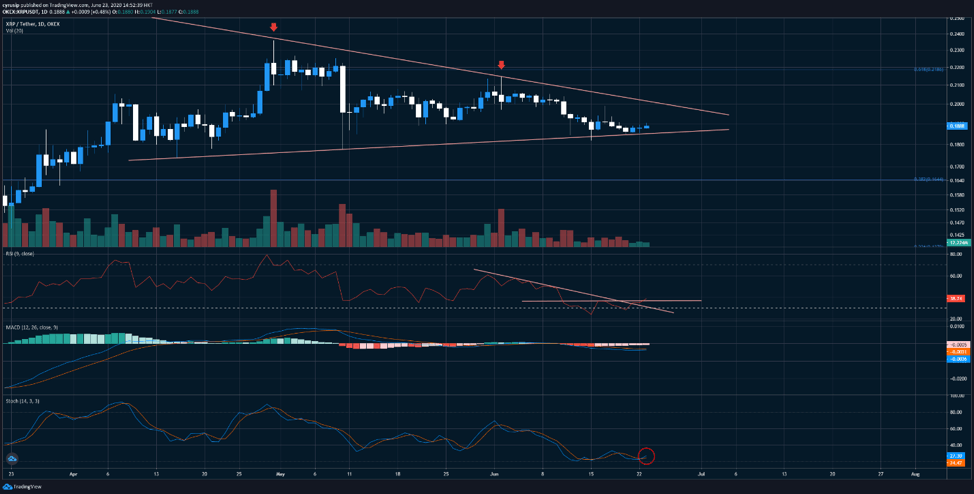

XRPUSDT – A short-term rebound is due?

-

In our last Technical Tuesday publication, we mentioned that XRP bears remained in control last week, and XRPUSDT has touched the triangle's lower support as expected.

-

Initial signs show that the bulls may start to come back. With the stochastic produced a bullish crossover and the RSI also seem to begin to produce a breakout on the upside. Both indicate that the bulls seem started to come back but very slowly.

-

However, even a short-term rebound materialized, upper resistance of the triangle near 0.198 remained valid. Again, a trend reversal can't be confirmed at this point.

Figure 5: XRPUSDT daily chart (Source: OKEx; Tradingview)

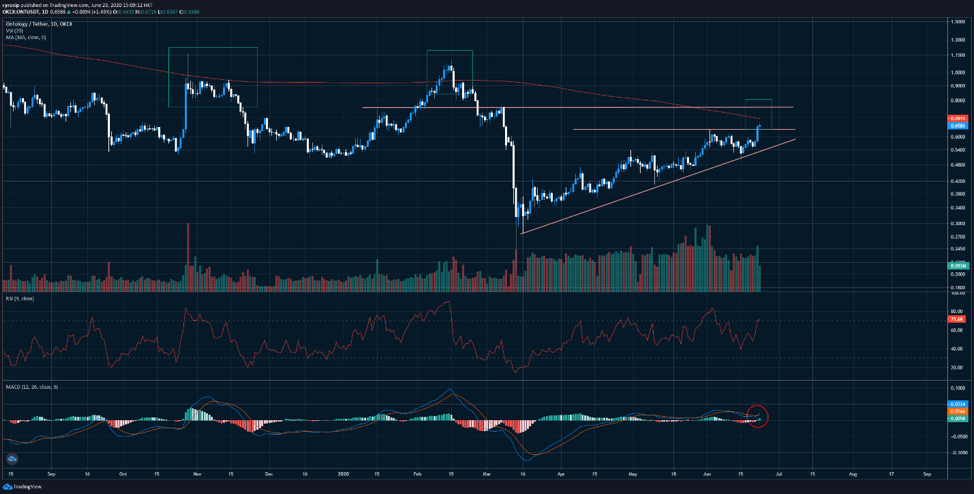

ONTUSDT – Getting overbought?

-

ONTUSDT has been one of the top-performing altcoins on the OKEx trading platform on Tuesday, traded 5 percent higher during the session.

-

The pair has initially produced a breakout on the upside from the recent triangle pattern, and that upside momentum can also be seen on the MACD.

-

However, as the pair traded higher, it inched closer to the 365-day moving average, which seems to be a strong resistance levels.

-

0.7 could be the first area to watch. If the support at that levels are confirmed, it could set a stage for 0.76 area. 0.63 could be the lower level to watch from here.

Figure 6: ONTUSDT daily chart (Source: OKEx; Tradingview)

This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?