- ETH/USD drops below $95.00; no follow through.

- Ethereum\d Lublin announces ConsenSys restructuring.

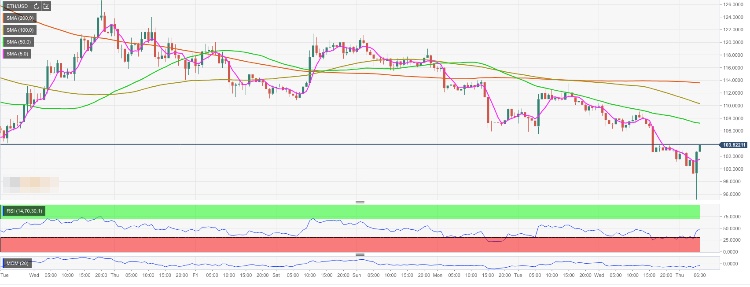

Ethereum dropped to $95.17 during early Asian hours before recovering to $103.82 by the time of writing. The third largest coin by market value has lost 4.6% in recent 24 hours; however, an upside correction is gaining traction as the price managed to clear a local resistance at $102.40/50 created by SMA5 and SMA50 (15-min).

Ethereum's technical picture

From the short-term perspective, ETH/USD is still capped by $110.00 with SMA100 (1-hour) settled right above this area. An additional hurdle is created by 61.8% Fibo retracement level (daily) and SMA 50 (1-hour) at $107.00/20, and Once this area is cleared, the price may continue growing towards Tuesday's high at $113.52.

On the downside, the first support is created by former resistance at $102.20/00. It is followed by a strong barrier on approach to $101.00, reinforced by Bollinger Band 15 min Lower and Bollinger Band 4 hour Lower. If it is cleared, the sell-off will continue towards psychological $100 and to the Asian low at $95.17

Ethereum cofounder and ConsenSys CEO Joseph Lubin announced plans to restructure ConsenSys in the view of the recent slump on the cryptocurrency market that saw Ethereum collapse by more than 50% in November and pushed ETH to the third place in the rating of digital assets.

According to Lubin, ConsenSys, and ethereum-based development studio enter a new phase with a focus on efficiency and accountability. The company will exclude all underperforming ConsenSys projects, while the department responsible for venture investment will have functions similar to startup accelerator.

ETH/USD, 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?